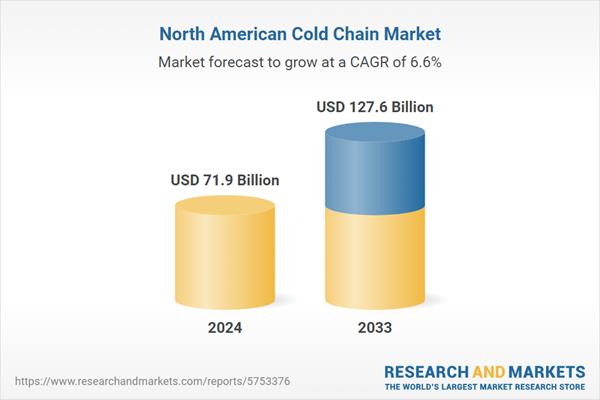

The North America cold chain market size reached USD 71.9 Billion in 2024. Looking forward, the research expects the market to reach USD 127.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6.4% during 2025-2033. The increasing demand for temperature-controlled storage, stringent regulations and quality standards, advancements in refrigeration technology, growth of e-commerce, and the importance of maintaining food safety and quality in the meat and seafood industries, are among the key factors driving the market growth.

Cold chain refers to a system of maintaining a controlled temperature environment throughout the transportation, storage, and handling of temperature-sensitive products, such as food, pharmaceuticals, and vaccines, from their point of origin to the end-user. The primary objective of the cold chain is to preserve the quality, efficacy, and safety of these perishable goods. The cold chain typically involves a combination of refrigeration, freezing, and insulated packaging technologies, along with specialized equipment, such as refrigerated trucks, warehouses, and cold chain facilities.

It also requires strict adherence to temperature monitoring, documentation, and quality control procedures. By maintaining the required temperature range, the cold chain prevents the growth of microorganisms, slows down enzymatic and chemical reactions, and minimizes the degradation of sensitive products. This ensures that perishable items reach consumers or patients in optimal condition, with their potency, freshness, and nutritional value intact.

The increasing demand for temperature-controlled storage and transportation of perishable goods is a major driver. As the population grows and consumer preferences shift toward fresh and frozen food products, there is a higher need for maintaining the quality and safety of these items throughout the supply chain. Additionally, the expanding e-commerce sector contributes to the growth of the market. With the rise of online grocery shopping and direct-to-consumer deliveries, there is a need for efficient cold chain and last-mile temperature-controlled transportation to maintain the freshness of perishable items. Besides this, advancements in refrigeration and cold chain technologies are driving market growth.

Innovations, such as real-time temperature monitoring systems, GPS tracking, and improved insulation materials enhance the efficiency and reliability of the cold chain. These technologies enable better control and management of temperature-sensitive products, reducing losses and ensuring product quality. Moreover, growing consumer awareness about food safety and the increasing demand for organic and natural products also drive the cold chain market. Consumers are more conscious about the quality, safety, and traceability of the products they purchase, leading to an increased emphasis on maintaining a cold chain to deliver fresh and safe goods.

These advancements enable better control and management of temperature-sensitive products, reducing losses, ensuring product quality, and extending shelf life. Furthermore, the integration of data analytics and automation in cold chain processes allows for better optimization, risk mitigation, and proactive maintenance, enhancing overall operational efficiency and cost-effectiveness.

Refrigerated storage drives the North America cold chain market by providing essential infrastructure for the safe and efficient storage of perishable goods. With the increasing demand for fresh and frozen food products and the need for temperature-controlled storage of pharmaceuticals and vaccines, refrigerated storage facilities, such as warehouses and cold chain units, play a vital role.

These facilities ensure that products are stored at the required temperature ranges, preventing spoilage, maintaining quality, and extending shelf life. By offering a reliable and controlled environment for perishable goods, refrigerated storage enables businesses to meet consumer demands, comply with regulations, reduce product waste, and safeguard the integrity of temperature-sensitive items throughout the supply chain.

Chilled storage plays a significant role in propelling the North America cold chain market by meeting the specific temperature requirements of a wide range of perishable products. Chilled storage refers to the controlled storage of goods at temperatures above freezing but below room temperature. It caters to products that require cool and consistent temperatures, such as fruits, vegetables, dairy products, and beverages.

By providing an optimal environment for these items, chilled storage facilities ensure that their freshness, quality, and nutritional value are preserved. The demand for chilled storage is driven by the growing consumer preferences for fresh and healthy foods, the need for efficient inventory management, and the expanding e-commerce sector, which requires temperature-controlled storage for quick deliveries of perishable goods.

Meat and seafood play a crucial role in driving the North America cold chain market due to their specific temperature requirements and the high demand for these perishable products. The meat and seafood industries rely heavily on cold chain facilities to preserve product quality, extend shelf life, and ensure food safety. These facilities provide the necessary temperature-controlled environment to store, handle, and distribute fresh, frozen, and processed meat and seafood products. With consumers' growing demand for a wide variety of meat and seafood options, the need for efficient cold chain solutions has increased to maintain the freshness, flavor, and texture of these products throughout the supply chain, thus driving the growth of the cold chain market.

In order to maintain the quality and safety of these products, an efficient and robust cold chain infrastructure is essential. The region has invested significantly in cold storage facilities, refrigerated transportation, and advanced temperature control technologies, making it the leader in cold chain logistics. Additionally, the size and geographical diversity of the United States contribute to its dominance in the cold chain market. The country spans a vast area, with diverse climates and agricultural regions. This necessitates extensive cold chain networks to transport goods from farm to fork across long distances.

The United States has a well-established network of refrigerated warehouses, distribution centers, and transportation systems that cater to the diverse needs of the country's food supply chain. Moreover, the United States has stringent regulations and quality standards for food safety. The Food and Drug Administration (FDA) and other regulatory bodies impose strict guidelines on temperature control, storage, and handling of perishable goods, thus creating a high demand for cold chain services and technologies to comply with these regulations.

Besides this, key players are actively pursuing strategic partnerships and acquisitions to expand their market presence and enhance their service offerings. These partnerships may involve collaborations with logistics companies, e-commerce platforms, or food producers to create a comprehensive cold chain network and offer end-to-end solutions. Other than this, various companies in the cold chain market are prioritizing sustainability by implementing energy-efficient practices and utilizing eco-friendly refrigeration systems. This includes adopting renewable energy sources, optimizing insulation materials, and implementing waste reduction measures.

Cold chain refers to a system of maintaining a controlled temperature environment throughout the transportation, storage, and handling of temperature-sensitive products, such as food, pharmaceuticals, and vaccines, from their point of origin to the end-user. The primary objective of the cold chain is to preserve the quality, efficacy, and safety of these perishable goods. The cold chain typically involves a combination of refrigeration, freezing, and insulated packaging technologies, along with specialized equipment, such as refrigerated trucks, warehouses, and cold chain facilities.

It also requires strict adherence to temperature monitoring, documentation, and quality control procedures. By maintaining the required temperature range, the cold chain prevents the growth of microorganisms, slows down enzymatic and chemical reactions, and minimizes the degradation of sensitive products. This ensures that perishable items reach consumers or patients in optimal condition, with their potency, freshness, and nutritional value intact.

The increasing demand for temperature-controlled storage and transportation of perishable goods is a major driver. As the population grows and consumer preferences shift toward fresh and frozen food products, there is a higher need for maintaining the quality and safety of these items throughout the supply chain. Additionally, the expanding e-commerce sector contributes to the growth of the market. With the rise of online grocery shopping and direct-to-consumer deliveries, there is a need for efficient cold chain and last-mile temperature-controlled transportation to maintain the freshness of perishable items. Besides this, advancements in refrigeration and cold chain technologies are driving market growth.

Innovations, such as real-time temperature monitoring systems, GPS tracking, and improved insulation materials enhance the efficiency and reliability of the cold chain. These technologies enable better control and management of temperature-sensitive products, reducing losses and ensuring product quality. Moreover, growing consumer awareness about food safety and the increasing demand for organic and natural products also drive the cold chain market. Consumers are more conscious about the quality, safety, and traceability of the products they purchase, leading to an increased emphasis on maintaining a cold chain to deliver fresh and safe goods.

North America Cold Chain Market Trends/Drivers:

Increasing demand for temperature-controlled storage and transportation systems

The rising population and changing consumer preferences have escalated the demand for fresh and frozen food products. Consumers now expect access to a wide variety of perishable goods, including fruits, vegetables, meats, and dairy, regardless of the season. This has resulted in an increased need for efficient cold chain systems to maintain the quality, nutritional value, and safety of these products throughout the supply chain. Without proper temperature control, perishable items can spoil, resulting in significant financial losses for businesses and compromised consumer health.Stringent regulations and quality standards

Governments and regulatory bodies in North America have implemented strict regulations and quality standards to ensure the safety and efficacy of pharmaceuticals, vaccines, and food products. For example, the United States Food and Drug Administration (US FDA) and Health Canada have established guidelines and requirements for storing, handling, and transporting practices. Compliance with these regulations necessitates the adoption of advanced cold chain technologies and practices to maintain the integrity of temperature-sensitive products. Non-compliance can result in legal consequences, product recalls, and damage to a company's reputation.Advancements in refrigeration and cold chain technologies

The continuous advancements in refrigeration and cold chain technologies have significantly contributed to the market growth of the cold chain. Innovations, such as real-time temperature monitoring systems, GPS tracking, improved insulation materials, and more energy-efficient refrigeration units, have enhanced the efficiency, reliability, and visibility of the cold chain.These advancements enable better control and management of temperature-sensitive products, reducing losses, ensuring product quality, and extending shelf life. Furthermore, the integration of data analytics and automation in cold chain processes allows for better optimization, risk mitigation, and proactive maintenance, enhancing overall operational efficiency and cost-effectiveness.

North America Cold Chain Industry Segmentation:

The research provides an analysis of the key trends in each segment of the North America cold chain market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on service type, temperature and end user.Breakup by Service Type:

- Refrigerated Storage

- Refrigerated Transport

- Airways

- Roadways

- Seaways

- Railway.

Refrigerated storage represents the most widely used product type

The report has provided a detailed breakup and analysis of the market based on the service type. This includes refrigerated storage and refrigerated transport (airways, roadways, seaways, and railways). According to the report, refrigerated storage represented the largest segment.Refrigerated storage drives the North America cold chain market by providing essential infrastructure for the safe and efficient storage of perishable goods. With the increasing demand for fresh and frozen food products and the need for temperature-controlled storage of pharmaceuticals and vaccines, refrigerated storage facilities, such as warehouses and cold chain units, play a vital role.

These facilities ensure that products are stored at the required temperature ranges, preventing spoilage, maintaining quality, and extending shelf life. By offering a reliable and controlled environment for perishable goods, refrigerated storage enables businesses to meet consumer demands, comply with regulations, reduce product waste, and safeguard the integrity of temperature-sensitive items throughout the supply chain.

Breakup by Temperature:

- Chilled

- Froze.

Chilled holds the majority of the share in the market

A detailed breakup and analysis of the market based on the temperature has also been provided in the report. This includes chilled and frozen. According to the report, the chilled accounted for the largest market share.Chilled storage plays a significant role in propelling the North America cold chain market by meeting the specific temperature requirements of a wide range of perishable products. Chilled storage refers to the controlled storage of goods at temperatures above freezing but below room temperature. It caters to products that require cool and consistent temperatures, such as fruits, vegetables, dairy products, and beverages.

By providing an optimal environment for these items, chilled storage facilities ensure that their freshness, quality, and nutritional value are preserved. The demand for chilled storage is driven by the growing consumer preferences for fresh and healthy foods, the need for efficient inventory management, and the expanding e-commerce sector, which requires temperature-controlled storage for quick deliveries of perishable goods.

Breakup by End User:

- Meat and Seafood

- Fruits and Vegetables

- Bakery and Confectionery

- Dairy and Frozen Products

- Pharmaceuticals

- Other.

Meat and seafood represent the largest end user segment

A detailed breakup and analysis of the market has been provided based on end user. According to the report, meat and seafood accounted for the largest market share.Meat and seafood play a crucial role in driving the North America cold chain market due to their specific temperature requirements and the high demand for these perishable products. The meat and seafood industries rely heavily on cold chain facilities to preserve product quality, extend shelf life, and ensure food safety. These facilities provide the necessary temperature-controlled environment to store, handle, and distribute fresh, frozen, and processed meat and seafood products. With consumers' growing demand for a wide variety of meat and seafood options, the need for efficient cold chain solutions has increased to maintain the freshness, flavor, and texture of these products throughout the supply chain, thus driving the growth of the cold chain market.

Breakup by Country:

- United States

- Canad.

United States exhibits a clear dominance in the market

The United States has a highly developed and sophisticated food and beverage industry, producing a vast amount of perishable goods, including fresh fruits, vegetables, dairy products, meat, and seafood. According to the report, the United States represented the largest regional market.In order to maintain the quality and safety of these products, an efficient and robust cold chain infrastructure is essential. The region has invested significantly in cold storage facilities, refrigerated transportation, and advanced temperature control technologies, making it the leader in cold chain logistics. Additionally, the size and geographical diversity of the United States contribute to its dominance in the cold chain market. The country spans a vast area, with diverse climates and agricultural regions. This necessitates extensive cold chain networks to transport goods from farm to fork across long distances.

The United States has a well-established network of refrigerated warehouses, distribution centers, and transportation systems that cater to the diverse needs of the country's food supply chain. Moreover, the United States has stringent regulations and quality standards for food safety. The Food and Drug Administration (FDA) and other regulatory bodies impose strict guidelines on temperature control, storage, and handling of perishable goods, thus creating a high demand for cold chain services and technologies to comply with these regulations.

Competitive Landscape:

Numerous key players are expanding their existing cold chain facilities or establishing new ones to meet the increasing demand. This includes constructing larger warehouses, adding more temperature-controlled storage units, and investing in advanced technologies for efficient operations. Additionally, companies are investing in innovative technologies to enhance their cold chain capabilities. This includes implementing real-time monitoring systems, automation solutions, and advanced inventory management systems to improve efficiency, reduce energy consumption, and ensure better product tracking and traceability.Besides this, key players are actively pursuing strategic partnerships and acquisitions to expand their market presence and enhance their service offerings. These partnerships may involve collaborations with logistics companies, e-commerce platforms, or food producers to create a comprehensive cold chain network and offer end-to-end solutions. Other than this, various companies in the cold chain market are prioritizing sustainability by implementing energy-efficient practices and utilizing eco-friendly refrigeration systems. This includes adopting renewable energy sources, optimizing insulation materials, and implementing waste reduction measures.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major players include:

- Americold Logistics

- Lineage Logistics

- United States Cold Storage, Inc.

- VersaCold Logistics Services

- AGRO Merchants Group

- Interstate Warehousing Inc.

Key Questions Answered in This Report

- What was the size of the North America cold chain market in 2024?

- What is the expected growth rate of the North America cold chain market during 2025-2033?

- What has been the impact of COVID-19 on the North America cold chain market?

- What are the key factors driving the North America cold chain market?

- What is the breakup of the North America cold chain market based on the service type?

- What is the breakup of the North America cold chain market based on the temperature?

- What is the breakup of the North America cold chain market based on the end user?

- What are the key regions in the North America cold chain market?

- Who are the key players/companies in the North America cold chain market?

Table of Contents

1 Preface3 Executive Summary

2 Scope and Methodology

4 Introduction

5 North America Cold Chain Market

6 Market Breakup by Service Type

7 Market Breakup by Temperature

8 Market Breakup by End User

9 Market Breakup by Country

10 Competitive Landscape

11 Key Player Profiles

List of Figures

List of Tables

Companies Mentioned

- Americold Logistics

- Lineage Logistics

- United States Cold Storage Inc.

- VersaCold Logistics Services

- AGRO Merchants Group

- Interstate Warehousing Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 121 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 71.9 Billion |

| Forecasted Market Value ( USD | $ 127.6 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 6 |