The dimethyl ether (DME) market is expanding due to an increasing demand for clean energy alternatives, stricter emission regulations, and advancements in sustainable production technologies. As concerns over air pollution and carbon footprint rise, industries are shifting to DME as a diesel substitute and LPG blending component, particularly in transportation, power generation, and heating applications. Its role in aerosol propellants, refrigerants, and chemical feedstocks further strengthens dimethyl ether market demand. Investments in renewable DME production from waste biomass and captured carbon sources align with sustainability goals, promoting broader adoption. However, infrastructure constraints and cost-intensive production pose challenges, driving ongoing technological innovations to improve efficiency and scalability.

The United States DME market is advancing as the country focuses on low-carbon fuel adoption and energy diversification. Government incentives encourage renewable DME projects, particularly in transportation, industrial heating, and power applications, thereby fueling the dimethyl ether market growth. For instance, in January 2025, the U.S. Department of Energy announced that nine organizations selected for the new REDI Consortium in Texas and Louisiana, designed to provide capacity-building and technical assistance to communities, maximizing benefits from clean energy investments and carbon reduction projects. The fuel’s ability to reduce diesel engine emissions and integrate with existing LPG infrastructure makes it an attractive solution for clean combustion technologies. While large-scale production is still developing, growing investments in pilot projects, commercial plants, and fuel standardization efforts are accelerating market readiness. Furthermore, continued policy support and private sector initiatives will shape future expansion and long-term adoption.

Dimethyl Ether Market Trends:

Rising focus on cleaner energy sources and fuels

The rising preference for cleaner energy sources and fuels across various industries across the globe is contributing to the growth of the dimethyl ether market size. In line with this, people are increasingly focusing on maintaining environmental sustainability. According to a recent survey, 78% of respondents believed sustainability is very important for the environment, while 55% were willing to pay a premium for products from sustainable brands. DME is a viable alternative due to its lower carbon footprint as compared to traditional fossil fuels. It produces fewer greenhouse gas (GHG) emissions when burned, contributing to improved air quality and reduced environmental impact. Besides this, several industries and consumers are preferring environmentally friendly alternatives, which is offering a favorable DME market outlook. Furthermore, governing agencies of various countries are rapidly adopting DME to align with sustainability goals.Increasing demand for aerosol propellants in various sectors

The rising adoption of aerosol propellants in the personal care and cosmetic industries is bolstering the growth of the market. In addition, people are increasingly preferring various aerosol products, such as deodorants, hair sprays, and foaming cleansers, as DME is commonly used as a propellant. DME is a preferred choice for these applications, as it is effective in creating fine and consistent sprays, along with its odorless and colorless properties. Apart from this, the rising demand for various personal care products due to the increasing awareness about maintaining personal hygiene among individuals is supporting the growth of the market. As per the publisher, the global beauty and personal care products market reached USD 529.5 Billion in 2024 and is expected to grow at a CAGR of 4.2% during 2025-2033. Additionally, the pharmaceutical and food industries also employ DME as a propellant in certain products, further reinforcing key dimethyl ether market trends in end-use diversification and consumer-driven applications.Wide availability of renewable feedstocks

The wide availability of renewable feedstocks around the world is strengthening the growth of the market. In addition, biomass, agricultural waste, and even municipal solid waste can be converted into DME through various processes that assist in reducing reliance on finite fossil fuel resources. Besides this, various industries are seeking solutions that benefit in reducing their environmental footprint and diversifying their energy sources. The production of DME from renewable feedstocks aligns with the popularity of maintaining sustainability in the environment. For instance, according to the International Energy Agency (IEA), global renewable energy consumption in the heat, power, and transport industries is projected to increase by approximately 60% during 2024-2030. In line with this, the usage of renewable feedstocks also provides a degree of energy security, as it is less susceptible to price fluctuations commonly associated with conventional fossil fuels. These factors are expected to positively influence the dimethyl ether market size as demand grows for low-carbon, renewable fuel alternatives across industrial and energy sectors.Dimethyl Ether Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global dimethyl ether market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on raw material, application, and end-use industry.Analysis by Raw Material:

- Methanol

- Coal

- Natural Gas

- Bio-Based

- Others

Analysis by Application:

- Fuel

- Aerosol Propellent

- LPG Blending

- Chemical Feedstock

- Others

Analysis by End-Use Industry:

- Oil and Gas

- Automotive

- Power Generation

- Cosmetics

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Dimethyl Ether Market Analysis

In 2024, United States accounted for 86.20% of the market share in North America. The United States dimethyl ether (DME) market is primarily driven by the growing demand for clean energy alternatives, advancements in production technologies, and increasing applications across industries. As a clean-burning alternative to conventional fuels, DME is gaining popularity as a potential replacement for liquefied petroleum gas (LPG) and diesel in the residential, industrial, and transportation sectors, driven by the need for sustainable energy solutions and reduced greenhouse gas emissions. According to the United States Energy Information Administration (EIA), in 2025, CO2 emissions related to energy are expected to grow by 1% in the country. The focus on environmental sustainability, combined with rising concerns over air pollution, has increased the adoption of DME, as it produces low particulate emissions and no black carbon when used as a fuel. Additionally, advancements in DME production technologies, such as methanol-to-DME processes and biomass conversion, have made production more cost-effective and scalable, further supporting market growth. The expanding use of DME as a propellant in aerosol products, as well as in the chemical and pharmaceutical industries, also contributes to the demand. Government policies and incentives encouraging the development of renewable energy sources and alternative fuels further fuel market growth. As infrastructure for DME distribution and use continues to expand, the market is expected to grow rapidly.North America Dimethyl Ether Market Analysis

The North America dimethyl ether (DME) market is driven by the transition to low-carbon fuels and increasing regulatory support for clean energy solutions. The U.S. is leading efforts in renewable DME production, utilizing biogas and waste feedstocks to reduce emissions. For instance, in January 2025, researchers at Washington University in St. Louis received a USD 2.1 Million grant from the U.S. Department of Energy to develop an energy-efficient process for converting waste gases like CO2 and methane into dimethyl ether using localized electrified heating. Demand is growing in aerosol propellants, LPG blending, and industrial applications, with expanding interest in diesel replacement for transportation. Moreover, government incentives encourage adoption, though infrastructure challenges and production costs remain key hurdles. Furthermore, industry stakeholders are investing in pilot projects and technological advancements to enhance efficiency and scalability, positioning North America as a center for innovation in sustainable fuel alternatives.Europe Dimethyl Ether Market Analysis

The Europe dimethyl ether (DME) market is growing, fueled by the increasing demand for cleaner, alternative fuels, advancements in production technologies, and stringent environmental regulations. As Europe intensifies its focus on reducing greenhouse gas emissions and transitioning to sustainable energy solutions, DME is emerging as a viable substitute for traditional fuels such as LPG and diesel. According to reports, in Q2 2024, GHG emissions in the European Union decreased by 2.6% in comparison to the same period in 2023. DME’s low carbon emissions, absence of black carbon, and minimal particulate matter make it an attractive choice for the transportation, residential, and industrial sectors in Europe, where environmental sustainability is a high priority. Additionally, the European Union’s strong commitment to renewable energy targets, outlined in the European Green Deal, further supports the adoption of DME as part of a broader strategy to decarbonize the energy and transportation sectors. The market also benefits from Europe’s strong infrastructure for alternative fuel distribution, which supports its adoption across various sectors. As the demand for renewable energy sources intensifies, the potential of DME as a sustainable fuel is further boosting its appeal. The increasing adoption of DME as a feedstock in the production of chemicals and as a propellant in aerosol products also supports market growth.Asia Pacific Dimethyl Ether Market Analysis

The Asia Pacific dimethyl ether (DME) market is expanding due to a rising demand for cleaner, alternative fuels, the region’s rapid industrialization, and increasing environmental concerns. For instance, as per the Press Information Bureau (PIB), the Index of Industrial Production (IIP) in India recorded a 5.2% growth in November 2024, highlighting the continual industrialization in the country. Moreover, as countries such as China, India, and Japan focus on reducing air pollution and greenhouse gas emissions, DME is gaining popularity as a sustainable fuel alternative for transportation, residential, and industrial sectors. For example, India accounts for 8% of global carbon emissions, as per recent industry reports. DME’s potential to replace liquefied petroleum gas (LPG) and diesel, offering lower emissions and improved air quality, aligns with the region’s growing commitment to cleaner energy solutions. Additionally, government policies in several Asia Pacific countries promoting renewable energy and cleaner fuels are also contributing to industry expansion, solidifying the position of DME as a key player in the region’s energy transition.Latin America Dimethyl Ether Market Analysis

The Latin America dimethyl ether (DME) market significantly benefits from the region's increasing industrialization and the need for cleaner, alternative fuels. For instance, between May and June 2024, industrial manufacturing in Brazil recorded a growth of 4.1%. Moreover, the role of DME in reducing dependency on imported fossil fuels is becoming vital for energy security in Latin America. As countries such as Brazil invest in renewable energy sources and seek alternatives to traditional petroleum products, DME presents an appealing solution due to its versatility and environmental benefits. As per the International Energy Agency (IEA), renewable energy sources accounted for 87.5% of power generation in Brazil in 2022. Besides this, the market also benefits from the region's significant biomass resources, allowing for cost-effective and sustainable DME production.Middle East and Africa Dimethyl Ether Market Analysis

The Middle East and Africa dimethyl ether (DME) market is being increasingly propelled by a rising focus on alternative and cleaner energy solutions, the region's growing industrial and transportation needs, and the focus on environmental sustainability. Several Middle Eastern countries are investing in renewable energy and clean technologies to reduce reliance on fossil fuels, boosting DME adoption. According to a report published by the publisher, the Middle East renewable energy market is projected to grow at a CAGR of 13.53% during 2024-2032. Additionally, as infrastructure development improves and the region embraces technological advancements in DME production, such as using waste and biomass feedstocks, DME is becoming more accessible and cost-competitive. The increasing demand for DME in the petrochemical and aerosol industries further fuels market growth.Competitive Landscape:

The global dimethyl ether (DME) market is highly competitive, with key players focusing on capacity expansions, technological advancements, and sustainable production. Market dominance is driven by large-scale production capabilities and well-established supply chains. Additionally, the rising demand for clean fuel alternatives is accelerating investments in bio-based DME, with several companies pioneering renewable options. For instance, in December 2023, Mitsubishi Gas Chemical Company (MGC) announced that it had received ISCC PLUS certification for bio-methanol and dimethyl ether (DME) produced at its Niigata Plant. However, Asian manufacturers maintain a lead in cost-efficient production, while North America and Europe prioritize regulatory compliance and sustainability. Furthermore, strategic collaborations, including joint ventures and research partnerships, are playing a critical role in shaping market growth. In conclusion, competition continues to intensify as industries seek low-emission fuel solutions to meet global environmental targets.The report provides a comprehensive analysis of the competitive landscape in the dimethyl ether market with detailed profiles of all major companies, including:

- Akzo Nobel N.V.

- Cornerstone Chemical Company B.V.

- Chinese Energy Holdings Limited

- ENN Energy Holdings Limited

- Grillo-Werke AG

- Korea Gas Corporation

- Mitsubishi Corporation

- Oberon Fuels

- Royal Dutch Shell PLC

- The Chemours Company LLC

- Zagros Petrochemical Company

Key Questions Answered in This Report

1. How big is the dimethyl ether market?2. What is the future outlook of dimethyl ether market?

3. What are the key factors driving the dimethyl ether market?

4. Which region accounts for the largest dimethyl ether market share?

5. Which are the leading companies in the global dimethyl ether market?

Table of Contents

Companies Mentioned

- Akzo Nobel N.V.

- Cornerstone Chemical Company B.V.

- Chinese Energy Holdings Limited

- ENN Energy Holdings Limited

- Grillo-Werke AG

- Korea Gas Corporation

- Mitsubishi Corporation

- Oberon Fuels

- Royal Dutch Shell plc

- The Chemours Company LLC

- Zagros Petrochemical Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2025 |

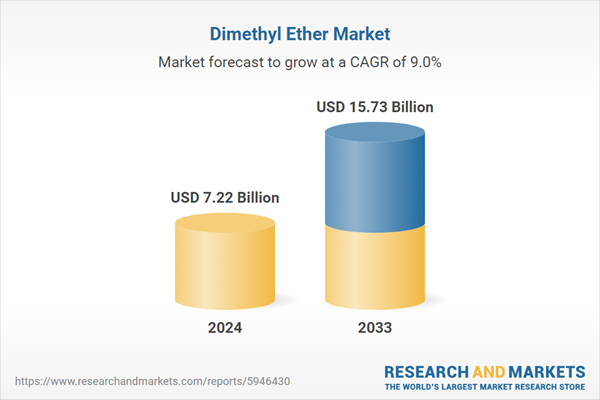

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 7.22 Billion |

| Forecasted Market Value ( USD | $ 15.73 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |