Technological advancements in energy storage, advanced controllers, and distributed energy resource (DER) management systems are enhancing the operational efficiency, flexibility, and scalability of microgrids. However, high capital investment requirements, complex regulatory approvals, and interoperability challenges between diverse technologies can hinder adoption. In addition, limited awareness among end users in certain emerging markets and the difficulty quantifying long-term economic benefits remain key barriers. Overcoming these challenges through innovative financing models and standardized frameworks will be critical for sustained market expansion.

By power source, the fuel cell segment is expected to register the highest CAGR between 2025 and 2030.

The fuel cell segment of the microgrid market is projected to register the highest CAGR during the forecast period, owing to the rising demand for clean, efficient, and reliable distributed power solutions. Fuel cells are increasingly adopted for microgrid applications due to their ability to provide continuous, low-emission power generation, making them ideal for commercial, industrial, and institutional facilities aiming to meet decarbonization and sustainability goals. Their high efficiency, modular scalability, and capability to operate independently or in conjunction with renewable energy sources position them as a key technology for grid-connected and islanded microgrids.Advancements in hydrogen production, storage, and distribution infrastructure are improving the economic feasibility of fuel cell-based microgrids, while supportive policies and incentives are accelerating deployments, particularly in Asia Pacific, North America, and Europe. Key manufacturers focus on enhancing durability, lowering costs, and integrating fuel cells with advanced energy management systems to maximize performance. As energy transition initiatives gain momentum, fuel cells are expected to be pivotal in shaping next-generation microgrid architectures.

By power rating, the 1-5 MW segment is projected to account for the largest market share from 2025 to 2030.

The 1-5 MW segment of the microgrid market is expected to hold the largest market share from 2025 to 2030, supported by its optimal balance between capacity, scalability, and application versatility. Systems within this power range are ideally suited for commercial complexes, industrial facilities, healthcare institutions, educational campuses, and small communities, offering sufficient capacity to meet diverse energy demands while maintaining cost efficiency.Their ability to integrate multiple distributed energy resources, including solar PV, wind, combined heat and power (CHP), fuel cells, and energy storage, enables enhanced reliability, energy cost savings, and resilience against grid disruptions. The 1-5 MW range also meets the growing requirements of facilities aiming for partial grid independence, renewable integration, and peak load management without incurring the high capital costs associated with larger systems. Strong adoption is observed in Asia Pacific, North America, and Europe, driven by regulatory support, renewable energy targets, and advancements in control and automation technologies that optimize microgrid performance within this segment.

North America is projected to account for the second-largest market share from 2025 to 2030.

North America is projected to hold the second-largest share of the global microgrid market from 2025 to 2030, driven by increasing demand for resilient and reliable power systems, rising renewable energy integration, and supportive regulatory frameworks. The US and Canada are at the forefront of microgrid adoption, with strong investments from utilities, government agencies, and private enterprises to enhance energy security and reduce carbon emissions. The region’s vulnerability to extreme weather events, such as hurricanes and wildfires, has accelerated deployment in critical facilities, including hospitals, military bases, data centers, and community energy systems. Advancements in control software, energy storage, and hybrid power solutions further boost performance and cost efficiency.Key players such as Schneider Electric SE (France), General Electric Company (US), and Eaton (Ireland) are actively partnering with regional utilities and municipalities to implement scalable, grid-connected, and islandable microgrid solutions. With robust technological capabilities and supportive policies, North America remains a pivotal market for global microgrid expansion.

The break-up of the profile of primary participants in the microgrid market:

- By Company Type: Tier 1 - 50%, Tier 2 - 25%, Tier 3 - 25%

- By Designation: C-level Executives - 40%, Directors - 30%, Others - 30%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 20%, RoW - 15%

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the microgrid market with a significant global presence include Schneider Electric (France), Siemens (Germany), General Electric Company (US), Eaton (Ireland), ABB (Switzerland), and others.

Research Coverage

The report segments the microgrid market and forecasts its size by offering, connectivity, power rating, power source, end user, and region. It also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall microgrid market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.The report provides insights into the following pointers:

- Analysis of key drivers (increasing emphasis on decarbonization, growing need for reliable and uninterrupted power supply, surging deployment of microgrids for rural electrification, increasing cyberattacks on energy infrastructure, rising demand for electric vehicle (EV) charging infrastructure, increasing need for demand response and load management capabilities, economic and environmental advantages associated with use of microgrids), restraints (high installation and maintenance costs, complexities in grid interconnections, low economies of scale), opportunities (increasing number of microgrid projects across different industries and sectors, growing energy demand and adoption of renewable energy in Asia Pacific, rising interest of investors in energy-as-a-service (EaaS) business model to minimize cost, rising government support for microgrid projects, digitalization and smart grid integration), and challenges (lack of standardization and regulatory frameworks related to microgrid operations, technical challenges related to microgrids operating in island mode, complexities associated with standardizing scalability of microgrids, difficulties in planning and designing large-sized microgrids)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches, agreements, partnerships, acquisitions, and contracts in the microgrid market

- Market Development: Comprehensive information about lucrative markets - the report analyses the microgrid market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the microgrid market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product/service offerings of leading players, including Schneider Electric SE (France), Siemens (Germany), General Electric Company (US), Eaton (Ireland), ABB (Switzerland), Hitachi Energy Ltd (Switzerland), Honeywell International Inc. (US), Caterpillar (US), S&C Electric Company (US), and Tesla (US)

Table of Contents

Companies Mentioned

- Schneider Electric

- Siemens

- Ge Vernova

- Eaton

- Abb

- Hitachi Energy Ltd

- Honeywell International Inc.

- Caterpillar

- S&C Electric Company

- Tesla

- Homer Energy

- Emerson Electric Co.

- Pareto Energy

- Spirae LLC

- Kohler Co.

- Ameresco

- Saft

- Ferroamp Ab

- Canopy Power Pte Ltd.

- Powersecure, Inc.

- Polaris

- Anbaric Development Partners, LLC.

- Wärtsilä

- Aggreko

- Power Analytics

- Bloom Energy

- Engie

- Rolls-Royce plc

- Enel X S.R.L.

- Xendee Inc.

- Boxpower, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 338 |

| Published | September 2025 |

| Forecast Period | 2025 - 2030 |

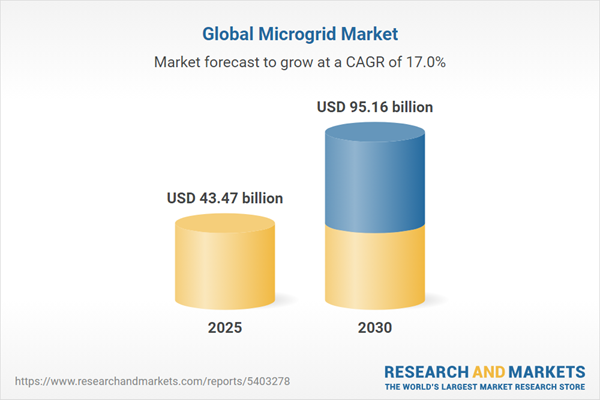

| Estimated Market Value ( USD | $ 43.47 billion |

| Forecasted Market Value ( USD | $ 95.16 billion |

| Compound Annual Growth Rate | 17.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |