Speak directly to the analyst to clarify any post sales queries you may have.

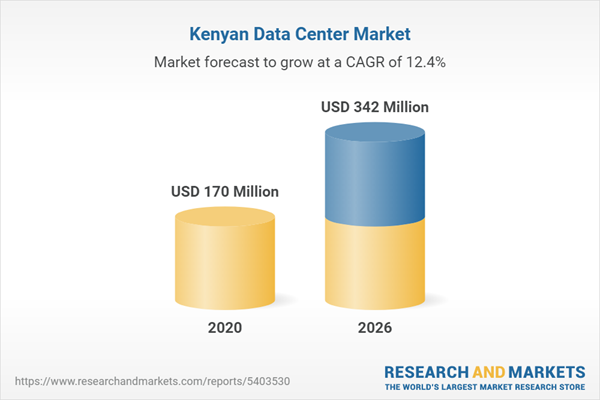

Kenya data center market to grow at a CAGR of 12.36% during 2021-2026.

The data center market in Kenya includes around six unique third-party data center service providers operating around nine facilities. Kenya is one of Africa's primary data center hubs and is considered the gateway to the East African region. Nairobi, the capital city, is a favorable location for data center development. In Kenya, Unaitas Sacco, a financial firm, selected Eastra Solutions for installation and commissioning services to Unaitas Data Center. Atos is investing in the development of a new data center facility in Kenya with around USD 260 million investment at the Mwale Medical and Technology City (MMTC) in Butere, Kakamega County.

KENYA DATA CENTER MARKET INSIGHTS

- Kenya is witnessing the growing adoption of digital services such as cloud, big data, and IoT driving the demand for data centers in the region.

- Most facilities in Kenya are based in Nairobi. In the coming years, the market is expected to witness data center investments in other cities, with Mombasa becoming a popular hub.

- In Kenya, on-premise data centers aid digitalization and witness enterprises shifting to cloud and colocation facilities during the forecast period.

- In 2020, Wholesale colocation contributed around 5% to the market share, and around 95% was from retail colocation in Kenya.

- In terms of server infrastructure, the demand for ODM servers among the large service operators is increasing the growth of the Kenya data center.

- Colocation service providers witnessed a strong uptake for their data center spaces by existing customers owing to the growth of COVID-19-induced demand.

- The country has the presence of several local facility operators. Global operators are entering the space by acquiring local operators or via partnerships.

- Investments in submarine cables in the market have increased over the past few years. The major investors include telecommunication providers and hyperscale operators working to create strong fiber connectivity and connections across the country.

The report considers the present scenario of the Kenya data center market and its market dynamics for the forecast period 2021−2026. It covers a detailed overview of several growth enablers, restraints, and trends in the market. The study includes the demand and supply aspects of the market.

KEY HIGHLIGHTS OF THE REPORT

- The growth in the physical security market depends majorly on the increasing number of new facility constructions in the Kenya data center market.

- In Kenya, there are four facilities certified by Uptime Institute as Tier III standard facilities.

- Nairobi is the home of around six existing facilities under operation. IXAfrica and Teraco Data Environments invest around four upcoming facilities in future years.

- In 2020, Huawei was involved in developing Konza smart city and data center phase 1 and phase 2 with around USD 30 million investment.

- In 2020, AWS data center partnered with Kenya’s Safaricom in East Africa, to facilitate cloud computing services that provide easy access to technologies such as big data, Internet of Things (IoT), machine learning, and artificial intelligence.

KENYA DATA CENTER MARKET VENDOR LANDSCAPE

icolo.io (Digital Realty), IXAfrica, PAIX, Teraco Data Environments, and Wingu are some of the key investors in the Kenya data center. Huawei Technologies is among the leading vendors in the modular data center space with multiple efficient and reliable deployments. All the vendors have taken precautionary measures to reduce disruptions in their supply chain operations. The most commonly adopted servers in the industry include rack and blade servers from Cisco Systems, HPE, Dell Technologies, IBM, and Lenovo.

IT Infrastructure Providers

- Arista Networks

- Atos

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies

- IBM

- Lenovo

- NetApp

Construction Contractors & Sub-Contractors

- Chess Enterprises

- Copy Cat Group

- Eastra Solutions

- Egypro

- Future-tech

- HubTech

- Kinetic Controls

- Norkun Intakes

- Remax Consult

- Tetra Tech

- Westwood Management

Support Infrastructure Providers

- ABB

- Carrier

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- Fuji Electric

- Legrand

- Rolls-Royce Power Systems

- Rittal

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Key Investors

- icolo.io (Digital Realty)

- IXAfrica

- PAIX Data Centres

- Teraco Data Environments

- Wingu

REPORT COVERAGE:

This report analyzes the Kenya data center market share and elaborative analysis of the existing and upcoming facilities, datacenter investments in terms of IT, electrical, mechanical infrastructure, general construction, tier standards, and geography. It discusses market sizing and investment estimation for different segments. The segmentation includes:

EXISTING VS. UPCOMING DATA CENTERS

- Existing Facilities in the region (Area and Power Capacity)

- Nairobi

- Other Cities

- List of Upcoming Facilities in the region (Area and Power Capacity)

KENYA DATA CENTER INVESTMENT COVERAGE

Infrastructure Type

- IT Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

IT Infrastructure

- Server

- Storage Systems

- Network Infrastructure

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches and Switchgears

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Rack Cabinets

- Other Mechanical Infrastructure

Cooling Systems

- CRAC & CRAH Units

- Chillers

- Cooling Towers, Condensers, and Dry Coolers

- Economizers & Evaporative Coolers

- Other Cooling Units

General Construction

- Building Development

- Installation and Commissioning Services

- Building & Engineering Design

- Physical Security

- DCIM

Tier Segments

- Tier I & Tier II

- Tier III

- Tier IV

Geography

- Nairobi

- Other Cities

KEY QUESTIONS ANSWERED:

1. What is the expected CAGR for the Kenya Data Center Market for the forecast period?

2. What are the investment opportunities in the industry?

3. What are the latest trends in Kenya Data Center Market?

4. What are some existing and upcoming Data Centers in Kenya?

5. Who are the key participants for Data Center Market in Kenya?

Table of Contents

Companies Mentioned

- Arista Networks

- Atos

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies

- IBM

- Lenovo

- NetApp

- Chess Enterprises

- Copy Cat Group

- Eastra Solutions

- Egypro

- Future-tech

- HubTech

- Kinetic Controls

- Norkun Intakes

- Remax Consult

- Tetra Tech

- Westwood Management

- ABB

- Carrier

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- Fuji Electric

- Legrand

- Rolls-Royce Power Systems

- Rittal

- Schneider Electric

- Siemens

- STULZ

- Vertiv

- icolo.io (Digital Realty)

- IXAfrica

- PAIX Data Centres

- Teraco Data Environments

- Wingu

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 92 |

| Published | August 2021 |

| Forecast Period | 2020 - 2026 |

| Estimated Market Value ( USD | $ 170 Million |

| Forecasted Market Value ( USD | $ 342 Million |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Kenya |

| No. of Companies Mentioned | 39 |