Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Increased Awareness of Water and Wastewater Treatment & Development of the Biopharmaceutical Industries in India

The market for membrane separation technology will expand in the forecast period due to the increased awareness of wastewater treatment. The main factor fueling market development is the rising need for selective separation technology to fulfill water quality regulations. India, one of the most water-stressed nations in the world, will eventually run out of water. For instance, the wastewater treatment situation in Delhi appears to be improving on paper. Daily consumption of 3,420 MLD results in wastewater production of nearly 2600 MLD. 338 MLD are reused, and 1,600 MLD are treated from this.Additionally, the market for membrane separation technology would rise more quickly due to the development of the biopharmaceutical industry and the replacement of older technologies. For instance, India's pharmaceutical sector iis presently estimated at USD50,000 billion. With almost 200 nations receiving Indian pharmaceutical exports, India is a significant pharmaceutical exporter. The demand for membrane separation technology would grow due to increasing water consumption for industrial processes and the growing need for portable water due to population expansion.

Membrane separation technology is being used more often in various end-use sectors, including food, healthcare, and others, due to the government's growing awareness of stringent regulatory frameworks and environmental concerns. Amounts of USD 1,919.94 million have been given to States and UTs under the Swachh Bharat Mission (Urban) 2.0, which was started in October 2021, to manage wastewater and used water, including the establishment of STPs and FSTPs (fecal sludge treatment plants).

Adoption of RO Membrane in Industries & Rising Demand for Membrane Separation in the Food/Beverage Sector

The process' low energy needs and numerous product innovations would open favorable chances for the market's evolution for membrane separation technology. Furthermore, an increase in R&D efforts and rising demand for membrane separation technology in developing markets would open attractive potential prospects for the market.In the food and beverage processing sector, a higher rate of adoption of the membrane separation technique is anticipated. The market is expected to benefit from rising demand for reverse osmosis and ultrafiltration separation technologies for eliminating impurities from water, milk, and wine. Government laws on food safety and pollution prevention are also anticipated to support the market's expansion throughout the projected timeframe.

Due to the high levels of total dissolved solids (TDS), there is a rising need for RO (Reverse Osmosis) membranes in various Indian areas. As a result, the RO membranes sector will continue to dominate the market for membrane separation technology in India in the coming years. Rever osmosis is very effective when treating brackish, surface, and groundwater for both big and small flow applications. A few categories of companies that use RO water are pharmaceutical, boiler feed water, food and beverage, metal finishing, and semiconductor production.

Short Lifespan and High-Cost Restraining Market Growth

The primary limiting factor for membrane filtration is their short lifespan before membrane fouling occurs. They are also quite expensive for industry usage and hence these factors restrain the market growth in the forecast period.Market Segmentation

The India Membrane Separation Technology Market is segmented by technology, application, regional distribution and competitive landscape. Based on technology the market is segmented into Reverse Osmosis (RO), Microfiltration Ultrafiltration (MU), Nanofiltration and Others. Based on application the market is segmented into Water & Wastewater Treatment, Food & Beverage, Industry Processing, Medical & Pharmaceutical and Others.Market Players

Some of the major players in the India Membrane Separation Technology Market include Dow Chemical International Pvt Ltd, 3M India Ltd., Suez Water Technologies & Solutions (India) Private Limited, Toray Industries (India) Private Limited, Merck KGaA, Asahi Kasei India Pvt Ltd, Hydranautics, Pall India Pvt. Ltd, Pentair Water India Private Limited, Koch Separation Solutions India Pvt.Report Scope

In this report, India Membrane Separation Technology Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Membrane Separation Technology Market, by Technology:

- Reverse Osmosis (RO)

- Microfiltration Ultrafiltration (MU)

- Nanofiltration

- Others

India Membrane Separation Technology Market, by Application:

- Water & Wastewater Treatment

- Food & Beverage

- Industry Processing

- Medical & Pharmaceutical

- Others

India Membrane Separation Technology Market, by Region:

- North India

- West India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Membrane Separation Technology Market.Available Customizations

The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- DuPont

- 3M India Ltd.

- Suez Water Technologies & Solutions (India) Private Limited

- Toray Industries (India) Private Limited

- Merck KGaA

- Asahi Kasei India Pvt Ltd.

- Hydranautics

- Pall India Pvt. Ltd.

- Pentair Water India Private Limited

- Koch Separation Solutions India Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2023 |

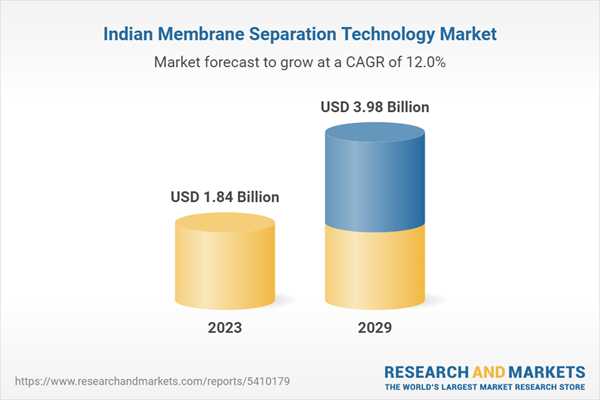

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.84 Billion |

| Forecasted Market Value ( USD | $ 3.98 Billion |

| Compound Annual Growth Rate | 11.9% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |