Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As vehicles age, the demand for replacement tires intensifies, particularly in urban centers where road wear accelerates tire degradation. Increasing consumer preference for routine maintenance and periodic vehicle servicing is further driving tire replacements. Growth in miles driven per year across various segments, from personal vehicles to commercial fleets, is directly contributing to higher tire wear rates.

This trend, combined with the rising presence of ride-hailing and last-mile delivery services, is creating a consistent replacement cycle that sustains demand. Manufacturers are responding by expanding product lines catering to different terrains, load capacities, and performance needs. For instance, Mexican tire plants currently operate at 80% capacity, with 35-40% of their production exported to the U.S. Following the commissioning of new facilities, this export volume could increase to 40 million tires annually.

Market Drivers

Aging Vehicle Fleet Leading to Higher Tire Replacement Cycles

As vehicles remain in operation for longer durations, the natural wear and tear on tires increases significantly, leading to a steady demand for replacement. In Mexico, a large portion of the existing vehicle fleet includes older models that require more frequent tire servicing or replacement. This phenomenon boosts the tire replacement market since aging vehicles often demand better maintenance to remain roadworthy. Older vehicles not only have deteriorated suspension and alignment systems, which accelerate tire wear, but also are more susceptible to road-induced damage.With a rise in vehicle inspection awareness, consumers are more proactive in replacing worn-out tires to maintain driving safety and comfort. Moreover, used vehicles entering the market from international and domestic sources further expand the pool of older automobiles. Tire retailers are capitalizing on this opportunity by offering packages focused on budget-conscious consumers and tailored solutions for aging vehicles. The consistent growth in older vehicle populations directly translates into sustained demand for replacement tires.

Key Market Challenges

Price Sensitivity Among Consumers

The market is heavily influenced by consumer price sensitivity, which limits the growth potential of premium and performance tire segments. Many vehicle owners prioritize upfront cost savings over long-term durability or fuel efficiency, leading to the selection of budget or entry-level tires. This behavior discourages innovation and reduces the incentive for manufacturers to invest in advanced technologies or eco-friendly designs.Price sensitivity also affects inventory planning and product variety at the retail level, where distributors may avoid stocking high-end tires due to slow turnover. The challenge is especially pronounced in economically constrained segments, where tire purchases are often postponed or made only after critical wear. While financing and promotional offers can partially mitigate this issue, they are not always accessible or attractive to the broader market. Addressing price sensitivity without compromising quality requires strategic pricing models, consumer education on cost-per-kilometer value, and loyalty-driven marketing.

Key Market Trends

Rise of Tier-2 and Tier-3 Tire Brands in Market Share

There is a noticeable increase in market penetration by Tier-2 and Tier-3 tire brands that offer value-driven propositions. These brands are gaining traction due to their competitive pricing, expanding product portfolios, and improved distribution strategies. While once perceived as inferior alternatives, many of these brands are now leveraging better manufacturing technologies and global quality certifications to shift consumer perception. Their growing presence is driven by partnerships with local distributors and the ability to adapt rapidly to market demand for affordable yet dependable tire options.These brands often focus on segments overlooked by premium manufacturers, such as light commercial vehicles or two-wheelers used in rural logistics. As consumers become more budget-conscious but still expect reasonable performance and safety, the middle-tier brand segment is becoming increasingly crowded and competitive. Some players in this tier also offer extended warranties or mileage-based replacement programs, further strengthening customer confidence. This trend is redefining traditional brand hierarchies and compelling major players to revisit their pricing and marketing strategies.

Key Market Players

- Bridgestone de Mexico SA de CV

- Industrias Michelin, S.Ade C.V.

- Hankook Tire de Mexico, S.A de C.V.

- Goodyear Servicios Comerciales, S.de R.L. de C.V.

- Pirelli Neumáticos de México, S.A. de C.V

- Continental Tire de Mexico S.A. de C.V.

- Yokohama Tire Mexico (YTMX)

- Nt Mexico S. De R.L. De C.V. (México) (Toyo Tires)

- Westlake México (Hangzhou Zhongce Rubber Company)

- JK Tornel, SA de CV

Report Scope:

In this report, the Mexico Replacement Tire Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Mexico Replacement Tire Market, By Tire Construction:

- Radial

- Bias

Mexico Replacement Tire Market, By Vehicle Type:

- Two-Wheeler

- Passenger Cars

- Commercial Vehicle

Mexico Replacement Tire Market, By Distribution Channel:

- Online

- Offline

Mexico Replacement Tire Market, By Region:

- Central

- Central North

- North

- South

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Mexico Replacement Tire Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bridgestone de Mexico SA de CV

- Industrias Michelin, S.Ade C.V.

- Hankook Tire de Mexico, S.A de C.V.

- Goodyear Servicios Comerciales, S.de R.L. de C.V.

- Pirelli Neumáticos de México, S.A. de C.V

- Continental Tire de Mexico S.A. de C.V.

- Yokohama Tire Mexico (YTMX)

- Nt Mexico S. De R.L. De C.V. (México) (Toyo Tires)

- Westlake México (Hangzhou Zhongce Rubber Company)

- JK Tornel, SA de CV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

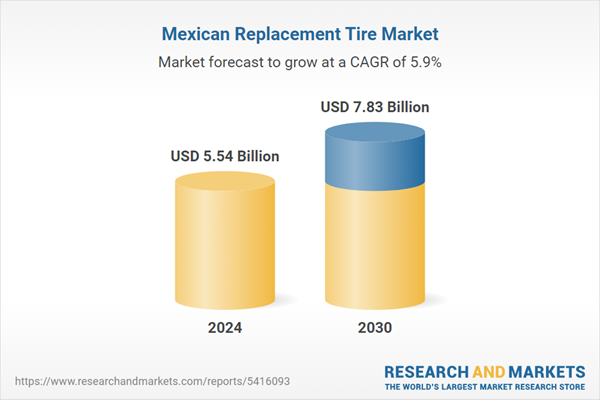

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.54 Billion |

| Forecasted Market Value ( USD | $ 7.83 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Mexico |

| No. of Companies Mentioned | 10 |