Speak directly to the analyst to clarify any post sales queries you may have.

The Global Halal Food Market Report 2021-24 presents an overall analysis of global halal food markets across 17 Harmonized System (HS) code categories that are identified as requiring some level of halal certification. The Report analyzes and ranks the five most attractive halal food categories (see below) and covers each category’s historical (2014-19) and projected growth (2020-24) in imports to the OIC (Organization of Islamic Cooperation), and provides the largest importing and supplying markets for each category. Readers will also find insights into production costs and profitability for each category, significant developments, key players (see below) and investment benchmarks. Through this multi-faceted analysis, the Report also presents opportunities and challenges in each of the five most attractive food categories and the halal food market. (The Report includes: 36 Tables, 17 Figures, 4 full Appendix Tables)

Get a complimentary 1-hour analyst walk-through and Q&A after purchase.

Headline insights

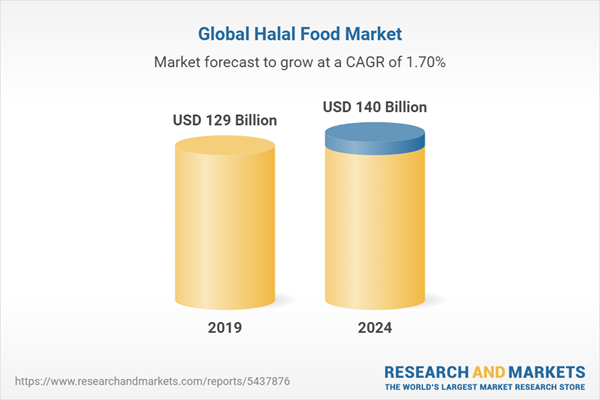

The Global Halal Food Market Report 2021-24 estimates global halal food trade (imports to OIC member countries) to be valued at US$ 129 billion in 2019 and is projected to grow at 1.7% CAGR, reaching US$ 140 billion by 2024.

This increasing trend is largely driven by an increase in consumer demand, followed by a rising Muslim population globally. The industry is also witnessing an increasing preference for convenient, nutritionally enriched, and functional food & beverages amidst the COVID-19 pandemic. The Islamic economy space has also attracted the attention of top global brands creating innovative products and services across sectors. The governments of both OIC and non-OIC countries, food companies, and the private sector are making significant investments in the halal market.

Key questions addressed

- What is the context of the global halal food market opportunity?

- What is the halal food certification process and regulation landscape?

- What are the top halal food consumption and trading markets?

- What are the top 5 most attractive halal food categories?

- Within each of the top 5 categories, what are the top trading markets, production costs, profitability, investments, recent developments and key players?

- What are the global halal food market opportunities and challenges for investors, businesses and governments?

Categories covered

The most attractive halal food categories profiled in this report include:

- Meat and offal

- Cereal, Pasta, and Bakery Products

- Fats and Oils

- Soups, Sauces and Other Processed Foods

- Dairy

Key Players covered

- BRF SA (Brazil)

- Allana (India)

- Indofood CBP (Indonesia)

- Danone (France)

- Golden Agri-Resources (GAR) (Indonesia)

- Savola (Saudi Arabia)

- Nestle (Switzerland)

- Kerry Group (Ireland)

- Almarai (Saudi Arabia)

- Fonterra (New Zealand)

Recent developments

Find an array of recent developments impacting the halal food industry and the major categories. These include the increasing momentum of blockchain technology, rise in snacks and canned products amidst COVID-19 pandemic, and alternative food, such as plant-based food, and innovation in the Islamic markets.

Table of Contents

1 Executive Summary

1.1 Summary Description

1.2 Summary Infographics

1.2.1 Halal Food, Top 5 Most Attractive Category, Market Size (US$ Million) and Growth (2014-2024)

1.2.2 Halal Food Most Attractive Markets, 2019 (US$ Million)

1.2.3 Halal Food Categories Most Imported by OIC, by Value (US$ Million) and Growth (2019-2022)

1.2.4 Halal Food Investments Opportunity, 2019 (US$ Million)

2 Halal Food Market: Global Context

2.1 Halal Food Introduction

2.2 Halal Food Compliance Across the Food Value Chain

2.3 Halal Food Demand-Side and Supply-Side Growth Drivers

3 Halal Food Compliance Landscape

3.1 Halal Market Regulatory Ecosystem

3.2 Halal Food Standards Issued in Key Markets

3.3 Halal Food Certification Process

4 Halal Food Markets and Trade

4.1 Halal Food Consumption Markets

4.2 Halal Food OIC Importing Markets

4.3 Halal Food Suppliers to OIC Markets

5 Most Attractive Halal Food Category Profiles

5.1 Meat and offal

5.1.1 Top Importing and Supplying Markets

5.1.2 Production Costs and Profitability

5.1.3 Investments

5.1.4 Key Recent Developments

5.1.5 Opportunities and Challenges

5.1.6 Key Supplier Company Profiles

- BASF

- Allana

5.2 Cereal, Pasta, and Bakery Products

5.2.1 Top Importing and Supplying Markets

5.2.2 Production Costs and Profitability

5.2.3 Investments

5.2.4 Key Recent Developments

5.2.5 Opportunities and Challenges

5.2.6 Key Supplier Company Profiles

- Indofood CBP

- Danone

5.3 Fats and Oils

5.3.1 Top Importing and Supplying Markets

5.3.2 Production Costs and Profitability

5.3.3 Investments

5.3.4 Key Recent Developments

5.3.5 Opportunities and Challenges

5.3.6 Key Supplier Company Profiles

- Savola

- Golden Agri-Resources (GAR)

5.4 Soups, Sauces and Other Processed Foods

5.4.1 Top Importing and Supplying Markets

5.4.2 Production Costs and Profitability

5.4.3 Investments

5.4.4 Key Recent Developments

5.4.5 Opportunities and Challenges

5.4.6 Key Supplier Company Profiles

- Nestle

- Kerry Group

5.5 Dairy

5.5.1 Top Importing and Supplying Markets

5.5.2 Production Costs and Profitability

5.5.3 Investments

5.5.4 Key Recent Developments

5.5.5 Opportunities and Challenges

5.5.6 Key Supplier Company Profiles

- Almarai

- Fonterra

6 Halal Food Opportunities and Challenges

7 Report Purpose and Methodology

8 Acknowledgment

9 Appendix

9.1 Full Table: Halal Food Muslim Spend, by Country (2019-2024) (US$ Million)

9.2 Full Table: Halal Food Suppliers to OIC, by Country (2019-2024) (US$ Million)

9.3 Full Table: Halal Food OIC Importers, by Country (2019-2024) (US$ Million)

9.4 Halal Food: Most Attractive Categories Prioritization (Complete List)

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allana (India)

- Almarai (Saudi Arabia)

- BRF SA (Brazil)

- Danone (France)

- Fonterra (New Zealand)

- Golden Agri-Resources (GAR) (Indonesia)

- Indofood CBP (Indonesia)

- Kerry Group (Ireland)

- Nestle (Switzerland)

- Savola (Saudi Arabia)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | June 2021 |

| Forecast Period | 2019 - 2024 |

| Estimated Market Value ( USD | $ 129 Billion |

| Forecasted Market Value ( USD | $ 140 Billion |

| Compound Annual Growth Rate | 1.7% |

| Regions Covered | Global |