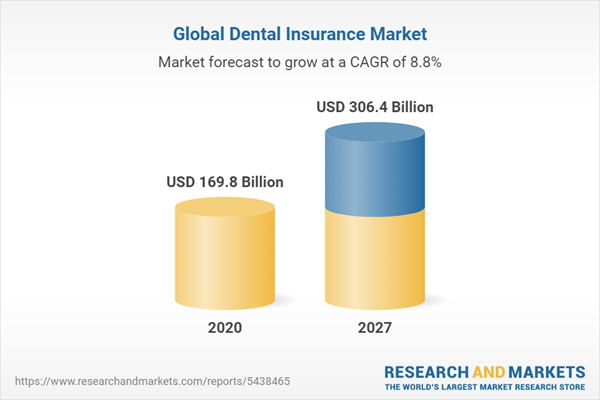

The global dental insurance market held a market value of USD 169.8 Billion in 2020 and is forecasted to reach USD 306.4 Billion by the year 2027. The market is anticipated to register a CAGR of 8.8% during the projected period.Global Dental Insurance Market is Forecasted to Grow at a CAGR of 8.8% During the Forecast Period 2017-2027

Dental insurances or dental plans are a type of health insurance, which is structured to pay a portion of the dental care costs. The market is expected to grow owing to the factors such as the continuous growth of the cosmetic industry and the rise in the prevalence of dental caries & periodontal diseases. Moreover, rising awareness regarding oral hygiene coupled with policy changes towards health insurance is also estimated to fuel the market growth.

Despite the driving factors, apathy towards dental care in emerging as well as underdeveloped economies are expected to hinder the market growth. Furthermore, a high cost associated with dental insurance premiums is also estimated to restrict the market growth.

Growth Influencers:

A rise in the prevalence of dental caries and periodontal diseases

With the growing prevalence of dental caries and various periodontal diseases, the demand for dental insurance is also increasing. According to an article by World Health Organization, as of March 2020, about 3.5 billion people are suffering from oral diseases, and approximately 530 million children suffered from dental caries of the primary teeth. According to the National Center for Biotechnology Information, as of May 2020, the prevalence of periodontal diseases ranges between 20% to 50%. Hence, the prevalence of dental caries and periodontal diseases is increasing, which is also expected to increase the adoption of dental insurance.

Rise in awareness towards oral hygiene

Awareness regarding oral hygiene is one of the most vital aspects of human health. This has massively increased the demand for dental hygiene. Hence, this has increased the adoption of oral hygiene services, which is also expected to boost the demand for dental insurance. This is because dental insurance covers tooth removal, treatment of infected nerves, drainage of minor oral infections, and dental surgical procedures. All these factors are increasing the adoption of dental insurance, hence fueling the market growth.

Segments Overview:

The global dental insurance market is segmented based on coverage, procedure, demographics, and end-users.

By Coverage

- Dental Health Maintenance Organizations (DHMO)

- Dental Preferred Provider Organizations(DPPO)

- Dental Indemnity Plans

- Others

The dental preferred provider organizations (DPPO) is expected to hold the largest market share of around 49% as it provides the option to consult any licensed specialist or dentist. The dental indemnity plans segment is expected to grow at a CAGR of 7.8% owing to its cost-effectiveness and ease of use.

By Procedure

- Preventive

- Major

- Basic

The basic procedure segment is expected to witness the fastest CAGR owing to its high adoption, while the preventive segment is anticipated to surpass a market value of USD 92 billion by 2023.

By Demographics

- Senior Citizens

- Minor

- Adults

The minor segment is anticipated to witness the fastest growth rate owing to the rising prevalence of dental issues in minors. The adults’ segment is expected to account for a market share of 53% in 2023 owing to the rapidly rising awareness regarding dental insurance amongst adults.

By End-Users

- Individual

- Enterprises

- Small Enterprises

- Medium Enterprises

- Large Enterprises

The enterprises' segment accounted for the largest market share owing to the growing adoption of dental insurance by companies to provide to their employees. Within the enterprises' segment, the medium enterprises' segment witnessed a growth rate of more than 9% during the forecast period.

Regional Overview

Based on region, the global dental insurance market is divided into Europe, Asia Pacific (excluding Japan), Middle East & Africa, Japan, North America, and South America.

The North American region held the largest market share of around 40% owing to the growing adoption of dental insurance in the region. According to the Centers for Disease Control and Prevention, as of May 2019, around 50.2% of the adults in the United States, had dental care coverage with their private health insurance.

The Europe region is expected to account for the second-largest market share owing to increasing awareness regarding dental insurance and its high adoption. The Asia Pacific and Japan regions are also estimated to witness significant growths.

Competitive Landscape

Major players operating in the global dental insurance market include AFLAC Inc., Aetna Inc., Allianz, Ameritas, AXA, Cigna, Delta Dental, HDFC ERGO Health Insurance Ltd. (Apollo Munich), MetLife Services and Solutions, LLC, United HealthCare Services, Inc, OneExchange, Envivas, United Concordia, and other prominent players.

The major 10 players in the market are expected to account for an approximate market share of 45%. These market players are involved in collaborations, mergers & acquisitions, and new product launches to strengthen their market presence. For instance, in August 2021, AXA sold its insurance operations in Singapore to HSBC for USD 0.6 billion. This transaction enabled AXA to focus on its core markets, especially in Asia.

The global dental insurance market report provides insights on the below pointers:

- Market Penetration: Provides comprehensive information on the market offered by the prominent players

- Market Development: The report offers detailed information about lucrative emerging markets and analyzes penetration across mature segments of the markets

- Market Diversification: Provides in-depth information about untapped geographies, recent developments, and investments

- Competitive Landscape Assessment: Mergers & acquisitions, certifications, product launches in the global Dental insurance market have been provided in this research report. In addition, the report also emphasizes the SWOT analysis of the leading players.

- Product Development & Innovation: The report provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The global Dental insurance market report answers questions such as:

- What is the market size and forecast of the Global Dental insurance Market?

- What are the inhibiting factors and impact of COVID-19 on the Global Dental insurance Market during the assessment period?

- Which are the products/segments/applications/areas to invest in over the assessment period in the Global Dental insurance Market?

- What is the competitive strategic window for opportunities in the Global Dental insurance Market?

- What are the technology trends and regulatory frameworks in the Global Dental insurance Market?

- What is the market share of the leading players in the Global Dental insurance Market?

- What modes and strategic moves are considered favorable for entering the Global Dental insurance Market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aetna Inc.

- AFLAC Inc.

- Allianz

- Ameritas

- AXA

- Cigna

- Delta Dental

- HDFC ERGO Health Insurance Ltd. (Apollo Munich)

- MetLife Services and Solutions, LLC

- United HealthCare Services, Inc

- OneExchange

- Envivas

- United Concordia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | August 2021 |

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 169.8 Billion |

| Forecasted Market Value ( USD | $ 306.4 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |