The COVID-19 pandemic has positively impacted the market growth and transformed the fortunes of ePharma companies owing to increasing consumer switch from traditional buying towards online purchases of general medications and medical devices, such as oximeters, thermometers, and health supplements. As per an article published by Economic Times in July 2021, the number of households utilizing ePharmacy services grew 2.5 times to 9.0 million during the pandemic. Moreover, the second wave of the Covid-19 epidemic has prompted a spike in demand for medical gadgets, personal protective equipment (PPE), as well as health supplements, and frequently accessible medications in the market.

In September 2020, UnitedHealth, purchased startup DivvyDose, a key player in the ePharmacy industry. DivvyDose, a competition to Amazon-owned PillPack, has been bought by UnitedHealth Group. Thus, the ePharmacy segment has also gained significant growth during the post lockdown period, as governments encouraged the delivery of medicines through e-commerce platforms as an essential service.

ePharmacy Market Report Highlights

- North America dominated the market in 2021 owing to the increased prevalence of chronic diseases, developed healthcare infrastructure, and penetration of IT in healthcare across the region. According to Clarivate Analytics, the usage of internet pharmacies has climbed by 17% in the U.S. during the previous year. Consumers aged 18 to 34 are the most likely to use it.

- Industry players in this market have significantly expanded their customer base as well as their product & service offerings to keep up with the growing needs of the consumers. As a result, in 2021 March, One of the U.K.'s digital prescription businesses has been bought by the corporation that runs the Rowlands drugstore chain and the Numark pharmacy membership business.

- The main focus of these players is on increasing the Customer Lifetime Value (CLTV) by catering to their healthcare needs in a comprehensive manner, as various online pharmacies have started offering additional services like e-diagnostics, e-consultation, and retailing of health & wellness products.

- Furthermore, a rise in the number of strategic initiatives is aiding market growth. For instance, in August 2020, Amazon India announced the launch of Amazon Pharmacy in Bengaluru, India. In June 2021, PharmEasy is purchasing a controlling share in Thyrocare Technologies, a diagnostics company. This alliance will provide huge potential and synergies for the whole Indian healthcare ecosystem of customers, physicians, and suppliers.

Table of Contents

Companies Mentioned

- The Kroger Co.

- Walgreen Co.

- Giant Eagle, Inc.

- Walmart, Inc.

- Express Scripts Holding Company

- CVS Health

- OptumRx, Inc.

- Rowlands Pharmacy

- DocMorris (Zur Rose Group AG)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | April 2022 |

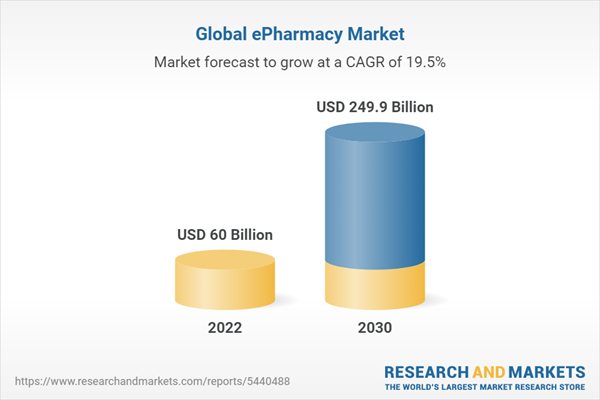

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 60 Billion |

| Forecasted Market Value ( USD | $ 249.9 Billion |

| Compound Annual Growth Rate | 19.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |