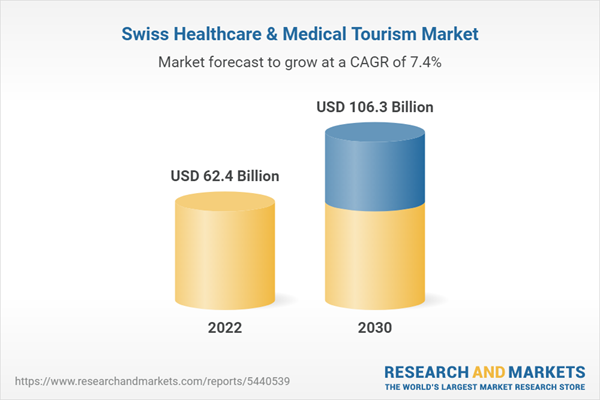

The Switzerland healthcare & medical tourism market size is anticipated to reach USD 106.3 billion by 2030, registering a CAGR of 7.4% from 2023 to 2030. The high quality of care, the expansion of the service portfolio by care providers, and initiatives to promote medical tourism are anticipated to boost the market growth during the forecast period.

As medical tourism is a key contributor to market growth, the government is undertaking efforts to improve the quality of care. The total number of tourists traveling to Switzerland for medical treatment is rapidly increasing. Even though the cost of medical care is high compared to other European countries, Switzerland has always been a popular destination for medical tourism. This can be attributed to the well-established healthcare infrastructure with trained healthcare professionals, high-quality care, high patient privacy standards, and beautiful locations.

The COVID-19 pandemic negatively impacted the medical tourism industry. Due to travel restrictions and fear of contracting the coronavirus, many patients postponed their plans and/or had to seek treatment in their own countries. Many wellness resorts and hospitals witnessed a decline in overnight stays due to the pandemic.

Partnerships and collaborations to provide care enabled service providers to compete with other players and establish a strong foothold in the market. In August 2020, Berit Klinik announced its collaboration with the Appenzell Ausserrhoden Hospital Association to set up a private-public partnership. As part of the partnership, the two hospitals will jointly operate an orthopedic department at Heiden Hospital. The market also witnessed certain investments in establishing new healthcare centers. For instance, in January 2019, Clinique de Montchoisi, in collaboration with Dr. Piet Noé, funded the construction of Rwanda Charity Eye Hospital, a 100-bed hospital in Rwanda. Such measures assist in fulfilling the increasing demand for care services in the market.

This product will be delivered within 1-3 business days.

As medical tourism is a key contributor to market growth, the government is undertaking efforts to improve the quality of care. The total number of tourists traveling to Switzerland for medical treatment is rapidly increasing. Even though the cost of medical care is high compared to other European countries, Switzerland has always been a popular destination for medical tourism. This can be attributed to the well-established healthcare infrastructure with trained healthcare professionals, high-quality care, high patient privacy standards, and beautiful locations.

The COVID-19 pandemic negatively impacted the medical tourism industry. Due to travel restrictions and fear of contracting the coronavirus, many patients postponed their plans and/or had to seek treatment in their own countries. Many wellness resorts and hospitals witnessed a decline in overnight stays due to the pandemic.

Partnerships and collaborations to provide care enabled service providers to compete with other players and establish a strong foothold in the market. In August 2020, Berit Klinik announced its collaboration with the Appenzell Ausserrhoden Hospital Association to set up a private-public partnership. As part of the partnership, the two hospitals will jointly operate an orthopedic department at Heiden Hospital. The market also witnessed certain investments in establishing new healthcare centers. For instance, in January 2019, Clinique de Montchoisi, in collaboration with Dr. Piet Noé, funded the construction of Rwanda Charity Eye Hospital, a 100-bed hospital in Rwanda. Such measures assist in fulfilling the increasing demand for care services in the market.

Switzerland Healthcare & Medical Tourism Market Report Highlights

- In terms of end-use, the public care segment dominated the market with the largest market share of 73.7% in 2022. The private care segment is expected to grow at the fastest CAGR during the forecast period. When compared to public hospitals, private hospitals in Switzerland offer inpatient hospital treatments at a much lower tariff, thus increasing the inclination toward private hospitals amid the cost of medical care in the country

- In terms of service, the radiology segment held the largest revenue share of 24.0% in 2022. This is attributed to the availability of cutting-edge technology and highly skilled radiologists, which attract both domestic and international patients seeking accurate and reliable diagnostic services

- The industry is witnessing product launches and initiatives for business expansion. For instance, in September 2018, SIS Medical launched three balloon catheters that are NIC Nano hydro, NIC 1.1 hydro, and EasyT, which are used to dilate closed and narrow vessels during interventional cardiology. The efforts for product innovation will help meet the demand for cardiovascular treatment and improve the quality of care

This product will be delivered within 1-3 business days.

Table of Contents

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

Chapter 3. Switzerland Healthcare & Medical Tourism Market Variables, Trends & Scope

Chapter 4. Switzerland Healthcare & Medical Tourism: End-use Estimates & Trend Analysis

Chapter 5. Switzerland Healthcare & Medical Tourism: Service Estimates & Trend Analysis

Chapter 6. Competitive Landscape

List of Tables

List of Figures

Companies Mentioned

- Klinik Hirslanden

- Swiss Medica XXI Century S.A.

- Biologic Aesthetic Dentalcare

- Berit Klinik

- Clinique de Genolier

- Clinique de Montchoisi

- Hirslanden Clinique Cecil

- Private Clinic Mentalva

- Rehabilitation Clinic Zihlschlacht

- Grand Resort Bad Ragaz

- Clinica Sant’Anna

- The Waldhotel

- Swiss Medical Network

- The Swiss Leading Hospital

- Privatklinik Hohenegg AG

- Klinik Im Park

- Private Clinic Meiringen

- Hirslanden Klinik Aarau

- Pyramide am See Clinic

- Salem-Spital

- Schmerzklinik Basel

- Klinik Beau-Site

- Colline SW!SS REHA

- Berit Clinic

- Bern Hospital Center for Geriatric Medicine

- cereneo Schweiz AG

- CLINIC BAD RAGAZ

- LEUKERBAD CLINIC

- Clinique de Maisonneuve

- Clinique Valmont

- Hochgebirgsklinik Davos

- Hof Weissbad AG

- Klinik Schloss Mammern

- Oberwaid AG

- Rehaklinik Dussnang AG

- Salina Rehabilitation Clinic

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | September 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 62.4 Billion |

| Forecasted Market Value ( USD | $ 106.3 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Switzerland |

| No. of Companies Mentioned | 36 |