One of the key drivers of the Vietnam online food delivery market is the rising adoption of smartphones and internet connectivity, particularly among younger, urban populations. According to the data published by ITA, Mexico's digital economy, with over 97 million internet users (81% of the population), is projected to reach $63 billion in e-commerce by 2025. Key government initiatives include the National Digital Strategy and the establishment of the Digital Transformation Agency, while the fintech sector boasts over 500 startups as of 2023.This digital shift has made food delivery platforms more accessible and convenient, allowing consumers to order meals with ease. Additionally, the growing demand for quick and contactless services, especially after the COVID-19 pandemic, has further accelerated the use of online food delivery apps. The convenience factor continues to reshape dining habits across major cities in Vietnam.

Another significant driver is the evolving lifestyle of Vietnamese consumers, with busy work schedules and a preference for ready-to-eat meals fueling demand. The rise of dual-income households and a growing middle class are contributing to higher disposable incomes, encouraging more frequent use of food delivery services. Furthermore, increased investments in logistics, improved delivery infrastructure, and strategic partnerships with restaurants are enhancing customer experience and efficiency, pushing the market toward sustained growth.

Vietnam Online Food Delivery Market Trends:

Strategic partnerships and collaborations

Strategic partnerships between online food delivery platforms and popular local restaurants contribute significantly to market growth. Collaborations enhance the variety of cuisines available, attract a broader customer base, and streamline logistics. By joining forces, these entities create synergies that benefit both the platforms and the restaurants, fostering a competitive edge in the market. Moreover, these partnerships often involve joint marketing efforts, co-branded promotions, and shared technology resources. This collaborative approach not only enriches the customer experience with diverse dining options but also optimizes operational efficiency for both platforms and restaurants. According to industry reports, Vietnamese consumers spent USD 1.4 Billion on online food delivery platforms such as Grab, ShopeeFood, Baemin, and GoJek. The mutual support in marketing and logistics results in a win-win scenario, solidifying the market presence of online food delivery platforms while boosting the visibility and reach of local eateries. This interconnected ecosystem strengthens customer loyalty, as users appreciate the seamless integration of their favorite restaurants into the online delivery landscape.Customer loyalty programs and discounts

Online food delivery platforms often employ customer loyalty programs, discounts, and promotional offers to retain existing customers and attract new ones. These initiatives create a sense of value for users, encouraging repeat business and expanding the customer base. As consumers seek cost-effective dining options, loyalty programs and discounts play a pivotal role in influencing their choices. Furthermore, these customer loyalty programs contribute to building a strong relationship between users and online food delivery platforms. The reward systems, which may include points, exclusive deals, or freebies, incentivize continued patronage. The growing popularity of these programs is evident in Vietnam, where the Vietnam Food and Beverage Market Report 2024, developed from research across 4,005 restaurants/cafes and 4,453 diners nationwide, highlights the effectiveness of loyalty programs and discounts in influencing consumer behavior. Discounts offered during promotional periods or on specific orders serve as powerful enticements, making online food delivery more appealing than traditional dining options. This strategic use of incentives fosters customer retention and also cultivates a positive brand image, positioning these platforms as value-driven and customer-centric entities in the competitive online food delivery market.Rising integration of cloud kitchens

The integration of cloud kitchens or virtual kitchens is a driving force providing a favorable Vietnam online food delivery market outlook. These kitchens operate solely for fulfilling online orders, eliminating the need for a physical dining space. This model reduces overhead costs for restaurants and allows them to cater exclusively to the growing demand for online deliveries. The increased prevalence of cloud kitchens enhances the efficiency and scalability of online food delivery services. Moreover, the integration of cloud kitchens revolutionizes the culinary landscape by enabling greater agility and innovation. With a focus on digital orders, restaurants can experiment with diverse menus, respond quickly to changing consumer preferences, and optimize their operations for maximum efficiency. The absence of physical dining spaces streamlines costs, enabling these establishments to offer competitive pricing. This innovative model aligns with the modern consumer's demand for convenience, speed, and variety, further propelling the online food delivery market's growth. The strategic adoption of cloud kitchens not only benefits restaurants but also enhances the overall flexibility and adaptability of the online food delivery ecosystem.Vietnam Online Food Delivery Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the Vietnam online food delivery market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on order method and cuisine.Analysis by Order Method:

- Mobile Application

- Website

Analysis by Cuisine:

- Vietnamese Cuisine

- Western Cuisine

- Italian Cuisine

- South Asian Cuisine

- Others

Regional Analysis:

- Southern Vietnam

- Northern Vietnam

- Central Vietnam

Competitive Landscape:

The Vietnam online food delivery market is characterized by intense competition, driven by rapid urbanization, growing smartphone penetration, and increasing consumer preference for convenience. Companies are striving to enhance user experience through faster delivery times, intuitive app interfaces, and varied payment options. Aggressive promotional strategies, including discounts and loyalty programs, are commonly employed to attract and retain customers. Moreover, partnerships with local restaurants and cloud kitchens are expanding service reach and menu offerings. As competition intensifies, businesses are investing in technology and logistics to differentiate themselves and scale operations efficiently. This competitive push continues to shape and expand overall Vietnam online food delivery market demand.The report provides a comprehensive analysis of the competitive landscape in the Vietnam online food delivery market with detailed profiles of all major companies, including:

- Vietnammm.com (Takeaway.Com N.V.)

- Foody.vn

- Now.vn

- Eat.vn

- Grab Food

Key Questions Answered in This Report

1. How big is the online food delivery market in the Vietnam?2. What factors are driving the growth of the Vietnam online food delivery market?

3. What is the forecast for the online food delivery market in the Vietnam?

4. Which region accounts for the largest Vietnam online food delivery market share?

5. Who are the major players in the Vietnam online food delivery market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Vietnam Online Food Delivery Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Offline and Online Order Mode

5.5 Market Breakup by Order Method

5.6 Market Breakup by Cuisine

5.7 Market Breakup by Region

5.8 Market Forecast

5.9 SWOT Analysis

5.9.1 Strengths

5.9.2 Weaknesses

5.9.3 Opportunities

5.9.4 Threats

5.10 Value Chain Analysis

5.11 Porter’s Five Forces Analysis

5.11.1 Overview

5.11.2 Bargaining Power of Buyers

5.11.3 Bargaining Power of Suppliers

5.11.4 Degree of Rivalry

5.11.5 Threat of New Entrants

5.11.6 Threat of Substitutes

5.12 Key Market Drivers and Success Factors

6 Market by Order Method

6.1 Mobile Application

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Website

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market by Cuisine

7.1 Vietnamese Cuisine

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Western Cuisine

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Italian Cuisine

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 South Asian Cuisine

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market by Region

8.1 Southern Vietnam

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Northern Vietnam

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Central Vietnam

8.3.1 Market Trends

8.3.2 Market Forecast

9 Competitive Landscape

9.1 Market Structure

9.2 Key Players

10 Key Player Profiles

10.1 Vietnammm.com (Takeaway.Com N.V.)

10.1.1 Company Overview

10.1.2 Company Description

10.1.3 Financials

10.1.4 Key Product and Services

10.1.5 Key Business Strategies and Plans

10.2 Foody.vn

10.2.1 Company Overview

10.2.2 Company Description

10.2.3 Key Product and Services

10.2.4 Key Business Strategies and Plans

10.3 Now.vn

10.3.1 Company Overview

10.3.2 Company Description

10.3.3 Product Portfolio

10.3.4 Key Business Strategies and Plans

10.4 Eat.vn

10.4.1 Company Overview

10.4.2 Company Description

10.4.3 Key Product and Services

10.4.4 Key Business Strategies and Plans

10.5 Grab food

10.5.1 Company Description

10.5.2 Key Product and Services

10.5.3 Key Business Strategies and Plans

List of Figures

Figure 1: Vietnam: Online Food Delivery Market: Major Drivers and Challenges

Figure 2: Vietnam: Online Food Delivery Market: Value Trends (in Million USD), 2019-2024

Figure 3: Vietnam: Food Delivery Market: Breakup by Offline and Online Order Mode (in %), 2024

Figure 4: Vietnam: Online Food Delivery Market: Breakup by Order Method (in %), 2024

Figure 5: Vietnam: Online Food Delivery Market: Breakup by Cuisine (in %), 2024

Figure 6: Vietnam: Online Food Delivery Market: Breakup by Region (in %), 2024

Figure 7: Vietnam: Online Food Delivery Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 8: Vietnam: Online Food Delivery Industry: SWOT Analysis

Figure 9: Vietnam: Online Food Delivery Industry: Value Chain Analysis

Figure 10: Vietnam: Online Food Delivery Industry: Porter’s Five Forces Analysis

Figure 11: Vietnam: Online Food Delivery Market: Ordering through Mobile Application (in Million USD), 2019 & 2024

Figure 12: Vietnam: Online Food Delivery Market Forecast: Ordering through Mobile Application (in Million USD), 2025-2033

Figure 13: Vietnam: Online Food Delivery Market: Ordering through Website (in Million USD), 2019 & 2024

Figure 14: Vietnam: Online Food Delivery Market Forecast: Ordering through Website (in Million USD), 2025-2033

Figure 15: Vietnam: Online Food Delivery Market (Vietnamese Cuisine): Value Trends (in Million USD), 2019 & 2024

Figure 16: Vietnam: Online Food Delivery Market Forecast (Vietnamese Cuisine): Value Trends (in Million USD), 2025-2033

Figure 17: Vietnam: Online Food Delivery Market (Western Cuisine): Value Trends (in Million USD), 2019 & 2024

Figure 18: Vietnam: Online Food Delivery Market Forecast (Western Cuisine): Value Trends (in Million USD), 2025-2033

Figure 19: Vietnam: Online Food Delivery Market (Italian Cuisine): Value Trends (in Million USD), 2019 & 2024

Figure 20: Vietnam: Online Food Delivery Market Forecast (Italian Cuisine): Value Trends (in Million USD), 2025-2033

Figure 21: Vietnam: Online Food Delivery Market (South Asian Cuisine): Value Trends (in Million USD), 2019 & 2024

Figure 22: Vietnam: Online Food Delivery Market Forecast (South Asian Cuisine): Value Trends (in Million USD), 2025-2033

Figure 23: Vietnam: Online Food Delivery Market (Other Cuisines): Value Trends (in Million USD), 2019 & 2024

Figure 24: Vietnam: Online Food Delivery Market Forecast (Other Cuisines): Value Trends (in Million USD), 2025-2033

Figure 25: Southern Vietnam: Online Food Delivery Market (in Million USD), 2019 & 2024

Figure 26: Southern Vietnam: Online Food Delivery Market Forecast (in Million USD), 2025-2033

Figure 27: Northern Vietnam: Online Food Delivery Market (in Million USD), 2019 & 2024

Figure 28: Northern Vietnam: Online Food Delivery Market Forecast (in Million USD), 2025-2033

Figure 29: Central Vietnam: Online Food Delivery Market (in Million USD), 2019 & 2024

Figure 30: Central Vietnam: Online Food Delivery Market Forecast (in Million USD), 2025-2033

List of Tables

Table 1: Vietnam: Online Food Delivery Market: Key Industry Highlights, 2024 and 2033

Table 2: Vietnam: Online Food Delivery Market Forecast: Breakup by Order Method (in Million USD), 2025-2033

Table 3: Vietnam: Online Food Delivery Market Forecast: Breakup by Cuisine (in Million USD), 2025-2033

Table 4: Vietnam: Online Food Delivery Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 5: Vietnam: Online Food Delivery Market Structure

Table 6: Vietnam: Online Food Delivery Market: Key Players

Table 7: Vietnammm.com (Takeaway.Com N.V.): Key Products and Services

Table 8: Foody.vn: Key Products and Services

Table 9: Now.vn: Key Products and Services

Table 10: Eat.vn: Key Products and Services

Table 11: Grab food: Key Products and Services

Companies Mentioned

- Vietnammm.com (Takeaway.Com N.V.)

- Foody.vn

- Now.vn

- Eat.vn

- Grab food

Table Information

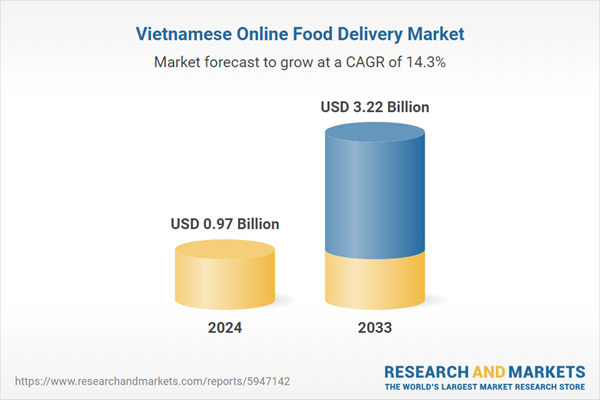

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 0.97 Billion |

| Forecasted Market Value ( USD | $ 3.22 Billion |

| Compound Annual Growth Rate | 14.3% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 5 |