Building Information Modeling (BIM) Market Trends:

Technological advancements

Technological advancements in BIM, such as the integration of digital tools, three-dimensional (3D) modeling software, cloud computing, and data analytics, assist in enhancing the construction and design of infrastructure. In addition, the rising adoption of BIM software due to its user-friendliness is supporting the market growth. Apart from this, cloud-based BIM solutions allow for real-time collaboration among project stakeholders, regardless of their physical location, fostering seamless communication and data sharing. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) within BIM systems offers predictive analytics, enabling enhanced decision-making and problem-solving during project execution. In line with this, augmented reality (AR) and virtual reality (VR) technologies allow stakeholders to visualize BIM models in immersive environments. This aids in design reviews, client presentations, and on-site construction supervision. Furthermore, mobile applications for BIM enable field workers to access project information on-site, enhancing coordination, reducing errors, and improving the overall quality of project.Rising focus on cost-effective solutions

The escalating demand for BIM on account of the rising focus on cost-effective solutions is propelling the growth of the market. In line with this, BIM contributes to substantial financial benefits by enhancing collaboration, reducing errors, and optimizing resource allocation. Moreover, it allows construction professionals to identify and resolve issues before they escalate and minimize costly rework through improved coordination and clash detection. Apart from this, it facilitates efficient resource utilization, leading to reduced material wastage and labor costs. In addition, the increasing adoption of BIM, as it minimizes delays and ensures that projects are completed on schedule and within budget, is contributing to the market growth. Furthermore, BIM facilitates collaborative design and decision-making among architects, engineers, contractors, and other stakeholders. This reduces the need for costly revisions and change orders, saving both time and money. Additionally, BIM integration with prefabrication and modular construction methods enables the off-site fabrication of building components. This results in faster construction, reduced labor costs, and minimized on-site disruptions.Increasing awareness about maintaining sustainability

The rising awareness among individuals about maintaining sustainability is bolstering the growth of the market. In line with this, BIM provides essential tools for designing and constructing eco-friendly buildings. It allows architects and engineers to model energy-efficient systems, optimize material usage, and assess environmental impact. Moreover, BIM helps in achieving green building certifications and adhering to stringent environmental regulations by simulating the performance of sustainable design features. Besides this, the increasing adoption of BIM to reduce the carbon footprint and promote environmentally responsible construction practices is propelling the market growth. In addition, BIM tools can simulate the energy performance of the building, allowing for the optimization of heating, ventilation, and air conditioning (HVAC) systems, insulation, and other factors that impact energy efficiency. This results in buildings that consume less energy, reduce operational costs, and have a smaller carbon footprint. Apart from this, BIM allows for the evaluation of different construction materials based on their sustainability credentials.Building Information Modeling (BIM) Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on offering type, deployment mode, application, end use sector, and end user.Breakup by Offering Type:

- Software

- Services

Software accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the offering type. This includes software and services. According to the report, software represented the largest segment.Software comprises digital tools and platforms that enable users to create, manage, and manipulate three-dimensional (3D) models and associated project data. These software solutions are central to the BIM workflow and play a crucial role in facilitating collaboration and project management. Design and modeling software tools are used for creating 3D models and designs of buildings and infrastructure. Project management and collaboration software facilitate project planning, communication, and data sharing among stakeholders. Analysis and simulation software tools provide capabilities for simulating various aspects of construction, such as structural analysis, energy efficiency, and clash detection.

Services encompass a range of professional offerings that support the implementation and utilization of BIM in construction projects. These services are provided by BIM consulting firms and experts. BIM consulting and implementation services assist organizations in adopting BIM methodologies, workflows, and best practices. Moreover, BIM training and education are designed to upskill professionals in using software effectively.

Breakup by Deployment Mode:

- On-premises

- Cloud-based

On-premises holds the largest market share

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based. According to the report, on-premises accounted for the largest market share.On-premises BIM solutions involve software and infrastructure that are installed and operated locally on the servers and computers of organizations. Organizations have full control over their data and BIM software, which benefits in maintaining data security. On-premises BIM software can be customized to meet specific project or organizational needs. They require a significant upfront investment in hardware, software licenses, and IT infrastructure.

Cloud-based BIM solutions, also known as software as a service (SaaS) offering, are hosted and delivered via the cloud, accessible through web browsers or mobile applications. They can be accessed from anywhere with an internet connection, promoting remote collaboration and flexibility. Cloud solutions offer scalability, allowing organizations to easily adjust resources and licensing based on project requirements. They have a subscription-based or pay-as-you-go pricing model, reducing the upfront capital expenditure.

Breakup by Application:

- Preconstruction

- Construction

- Operations

Preconstruction represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes preconstruction, construction, and operations. According to the report, preconstruction represented the largest segment.Preconstruction applications of BIM involve its use in the initial phases of a building or infrastructure project, ranging from conceptual design through detailed planning and preparation before construction begins. BIM aids in creating 3D models for conceptual design, helping stakeholders visualize the appearance and layout of projects. It facilitates collaboration among architects, engineers, and designers, ensuring that design elements are coordinated and clash-free. BIM software can generate accurate cost estimates, helping project stakeholders develop budgets and financial plans.

Construction involves its use during the actual building phase, encompassing activities from project initiation to completion. BIM software helps construction managers with scheduling, resource allocation, and progress tracking. It also identifies clashes and conflicts in design and construction and reduces rework and delays. In addition, it assists in accurate material quantity calculations and procurement.

Operations focus on using BIM models and data for the maintenance, management, and operation of built assets after construction. BIM supports facilities managers in maintaining and optimizing building performance by providing detailed information about systems, equipment, and spaces. BIM data is used to track asset performance, plan maintenance, and make informed decisions throughout the lifecycle of assets. It aids in energy-efficient operations by monitoring and optimizing building systems for sustainability.

Breakup by End Use Sector:

- Commercial

- Residential

- Industrial

Commercial exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes commercial, residential, and industrial. According to the report, commercial represented the largest segment.The commercial sector includes a wide range of projects, such as office buildings, retail spaces, hotels, and entertainment venues. BIM is used for designing and planning office spaces efficiently, ensuring optimal space utilization and functionality. It aids in designing retail store layouts for improved product placement. It also supports the design and construction of hotels and hospitality facilities, enhancing guest experiences.

The residential sector encompasses housing projects ranging from single-family homes to multi-unit residential complexes. BIM assists architects in designing residential structures, optimizing layouts, and ensuring compliance with building codes. It streamlines construction planning and scheduling for residential projects while reducing construction timelines. It is also used for customizing home designs to meet individual client preferences.

The industrial sector includes projects, such as factories, warehouses, manufacturing facilities, and industrial infrastructure. BIM supports the efficient layout and design of manufacturing facilities, optimizing workflow and equipment placement. Moreover, BIM data is used for managing and maintaining industrial plants and facilities, enhancing operational efficiency.

Breakup by End User:

- Architects and Engineers

- Contractors and Developers

- Others

Architects and engineers represent the biggest market share

The report has provided a detailed breakup and analysis of the market based on the end user. This includes architects and engineers, contractors and developers, and others. According to the report, architects and engineers represented the largest segment.Architects and engineers are utilizing BIM for creating detailed 3D models of building designs, enabling improved visualization and exploration of design alternatives. Engineers utilize BIM for structural analysis and simulation, ensuring the structural integrity of the building. BIM facilitates collaboration between architects and engineers, ensuring that design elements are coordinated and that any conflicts or clashes are identified and resolved early.

Contractors and developers are primarily responsible for the construction and execution phases of a project. They use BIM to create detailed construction schedules and plans and optimize resource allocation and sequencing. It identifies clashes and conflicts in the design and construction phase, reducing costly rework and delays. Contractors and developers leverage BIM for accurate cost estimation, budget management, and procurement.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest building information modeling (BIM) market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to the presence of advanced information technology (IT) infrastructure. In addition, the growing demand for BIM due to the thriving construction industry in the region is offering a positive market outlook. Furthermore, the increasing focus on green building practices is supporting the market growth.Asia Pacific stands as another key region in the market, driven by favorable government initiatives. Apart from this, the wide availability of skilled labor, along with the rising number of BIM professionals in the region, is propelling the growth of the market.

Europe maintains a strong presence in the market, with the increasing adoption of BIM tools for designing and constructing eco-friendly structures. In addition, the rising number of infrastructure projects is impelling the market growth.

Latin America exhibits growing potential in the building information modeling (BIM) market on account of the increasing focus on green building initiatives. In line with this, the increasing utilization of BIM for project planning, design, coordination, and execution is supporting the market growth.

The Middle East and Africa region shows a developing market for building information modeling (BIM), primarily driven by favorable government initiatives. Besides this, the rising adoption of BIM technologies for accurate infrastructure development is impelling the market growth.

Leading Key Players in the Building Information Modeling (BIM) Industry:

Key players are investing in research and development (R&D) activities to create and enhance BIM software solutions. They are focusing on improving features, usability, and compatibility with other software platforms. In addition, various companies are offering training programs and resources to educate professionals about the effective use of their BIM tools in the construction and design industries. Besides this, they are working on integrating their software with other construction-related technologies, such as project management software, to offer comprehensive solutions for project stakeholders. Furthermore, companies are offering customization services to tailor BIM software to specific projects and client requirements, ensuring it meets the unique needs of different users.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABB Ltd.

- AECOM

- Autodesk Inc.

- Aveva Group Plc (Schneider Electric)

- Beck Technology Ltd.

- Bentley Systems Incorporated

- Dassault Systèmes SE

- Hexagon AB

- Nemetschek SE

- Trimble Inc.

Key Questions Answered in This Report

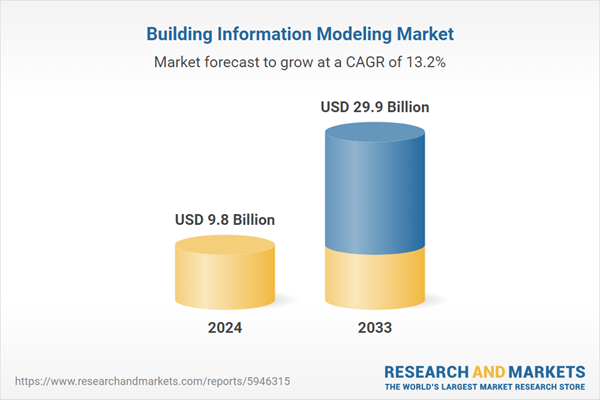

1. What was the size of the global building information modeling (BIM) market in 2024?2. What is the expected growth rate of the global building information modeling (BIM) market during 2025-2033?

3. What are the key factors driving the global building information modeling (BIM) market?

4. What has been the impact of COVID-19 on the global building information modeling (BIM) market?

5. What is the breakup of the global building information modeling (BIM) market based on the offering type?

6. What is the breakup of the global building information modeling (BIM) market based on the deployment mode?

7. What is the breakup of the global building information modeling (BIM) market based on application?

8. What is the breakup of the global building information modeling (BIM) market based on the end use sector?

9. What is the breakup of the global building information modeling (BIM) market based on the end user?

10. What are the key regions in the global building information modeling (BIM) market?

11. Who are the key players/companies in the global building information modeling (BIM) market?

Table of Contents

Companies Mentioned

- ABB Ltd.

- AECOM

- Autodesk Inc.

- Aveva Group Plc (Schneider Electric)

- Beck Technology Ltd.

- Bentley Systems Incorporated

- Dassault Systèmes SE

- Hexagon AB

- Nemetschek SE

- Trimble Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 9.8 Billion |

| Forecasted Market Value ( USD | $ 29.9 Billion |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |