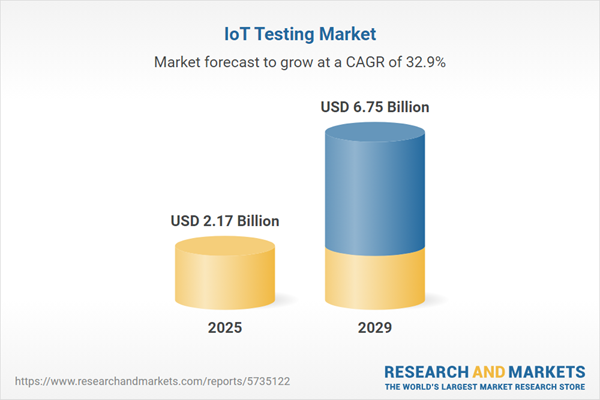

The IoT testing market size is expected to see exponential growth in the next few years. It will grow to $6.75 billion in 2029 at a compound annual growth rate (CAGR) of 32.9%. The growth in the forecast period can be attributed to scale of IoT deployments, integration with AI and ml, focus on edge computing, evolving connectivity standards, continuous deployment practices. Major trends in the forecast period include edge computing testing challenges, continuous testing in devops, test automation growth, compliance and regulatory testing, AI and ml in testing.

The expansion in the usage of IoT (Internet of Things) devices contributes to the demand for IoT testing, propelling the growth of the IoT testing market. IoT, encompassing a system of interconnected devices accessible through the internet, finds applications in a wide array of gadgets and sectors, including smartwatches, refrigerators, air conditioners, lock systems, infrastructure, and healthcare products. Thorough testing of these devices is crucial to ensure their connectivity, performance, usability, and security. Gartner estimates project that the number of IoT devices in operation will surpass 20 billion by 2026, further driving the growth of the IoT testing market.

The surge in mobile connections is anticipated to be a key driver for the expansion of the IoT testing market. Mobile connections involve the interaction between a mobile device and a cell tower, facilitating the device's access to the internet and other mobile network services. These connections play a vital role in IP testing, adapting to specific test requirements. As of February 2023, Uswitch Limited reports that there were 71.8 million mobile connections in the UK, reflecting a 3.8% increase (approximately 2.6 million) from 2021. Moreover, with 95% of the UK's 68.3 million population expected to own a smartphone by 2025, the rising number of mobile connections is poised to drive the growth of the IoT testing market.

Virtualization for IoT test automation is emerging as a key trend in the IoT testing market. It addresses challenges faced in traditional testing, such as scalability issues for connected devices, maintenance concerns, difficulties with unit-level code checking, and high-performance deliverables. By simulating hardware and software, virtualization aligns dependencies with actual behavior, resulting in more accurate test outcomes. This approach accelerates testing processes and reduces the overall effort involved. Key components include sensor, API, and service virtualization, each playing distinct roles in the testing framework. For instance, Telenor IoT introduced a new testing facility, the Telenor IoT Test Lab, in Karlskrona, Sweden, in spring 2024. This lab provides a unique platform for customers to understand how their connected IoT products will perform prior to deployment.

Leading companies in the IoT testing market are actively innovating with technologies such as Executive Risk View to enhance their market profitability. Executive Risk View is a solution designed to standardize risk scoring for both cloud and on-premises environments. Rapid7 Inc., a US-based software company, introduced Executive Risk View in July 2023 as part of its Cloud Risk Complete offering. This solution addresses the evolving risk management landscape in hybrid environments by providing security leaders with a comprehensive and contextual view. It enables them to monitor overall risk across cloud and on-premises assets, enhancing their understanding of organizational risk status and trends.

In March 2023, Cognizant, a U.S.-based information technology firm, acquired Mobica for an undisclosed amount. This acquisition is intended to strengthen Cognizant's internet of things (IoT) software engineering capabilities, enabling the development of advanced connected solutions. Mobica, based in the UK, specializes in software services, including IoT testing.

Major companies operating in the IoT testing market include Apica, Beyond Security, Bitbar, Capgemini, Cognizant, Device Insight GmbH, Happiest Minds Technologies, HCL Technologies, Hexaware Technologies, Infosys Limited, Keysight Technologies, LambdaTest, Oracle Corporation, Parasoft, Praetorian, QualityLogic, Rapid7, Rohde & Schwarz Cybersecurity GmbH, Sauce Labs, SmartBear Software, Spirent Communications, TATA Consultancy Services, Testrig Technologies, Thales Group, Trustwave Holdings, Viavi Solutions, Wipro Limited, Worksoft, XS Matrix, Zephyr.

The Asia-Pacific was the largest region in the IoT testing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the global iot testing market share report during the forecast period. The regions covered in the iot testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the iot testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

IoT testing involves evaluating the functionality, security, performance, and reliability of Internet of Things (IoT) devices and their ecosystems. This process is crucial for ensuring that devices operate correctly, securely, and efficiently in real-world settings.

Key types of IoT testing include functional, usability, security, compatibility, performance, and network testing. Functional testing verifies software against specified requirements by testing each function, comparing inputs and outputs. IoT testing employs software and hardware tools for devices such as connected cars, smart appliances, energy meters, wearables, and healthcare devices.

The iot testing market research report is one of a series of new reports that provides iot testing market statistics, including IoT industry global market size, regional shares, competitors with a iot testing market share, detailed iot testing market segments, market trends and opportunities, and any further data you may need to thrive in the IoT industry. This iot testing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The IoT (Internet of Things) testing market includes revenues earned by entities by offering testing services for IoT, which include usability, security, connectivity, performance, regulatory testing, and others. IoT is a system of connected devices that can communicate and interact with each other and can be accessed through the internet. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

IoT Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on iot testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for iot testing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The iot testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Testing Type: Functional Testing; Usability Testing; Security Testing; Compatibility Testing; Performance Testing; Network Testing2) By Testing Tools: Software Tools; Hardware Tools

3) By Applications: Connected Cars; Smart Appliances; Smart Energy Meters; Wearable Devices; Smart Healthcare Devices

Subsegments:

1) By Functional Testing: Device Functionality Testing; Firmware Testing; Sensor and Actuator Testing2) By Usability Testing: User Interface Testing; User Experience Testing; Accessibility Testing

3) By Security Testing: Vulnerability Assessment; Penetration Testing; Data Security Testing

4) By Compatibility Testing: Device Compatibility Testing; OS and Platform Compatibility; Cross-Browser Compatibility

5) By Performance Testing: Load Testing; Stress Testing; Scalability Testing

6) By Network Testing: Connectivity Testing; Bandwidth and Latency Testing; Network Protocol Testing

Key Companies Mentioned: Apica; Beyond Security; Bitbar; Capgemini; Cognizant

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Apica

- Beyond Security

- Bitbar

- Capgemini

- Cognizant

- Device Insight GmbH

- Happiest Minds Technologies

- HCL Technologies

- Hexaware Technologies

- Infosys Limited

- Keysight Technologies

- LambdaTest

- Oracle Corporation

- Parasoft

- Praetorian

- QualityLogic

- Rapid7

- Rohde & Schwarz Cybersecurity GmbH

- Sauce Labs

- SmartBear Software

- Spirent Communications

- TATA Consultancy Services

- Testrig Technologies

- Thales Group

- Trustwave Holdings

- Viavi Solutions

- Wipro Limited

- Worksoft

- XS Matrix

- Zephyr

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.17 Billion |

| Forecasted Market Value ( USD | $ 6.75 Billion |

| Compound Annual Growth Rate | 32.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |