Advancements in Manufacturing Units for Producing Nucleic Acid by CDMOs

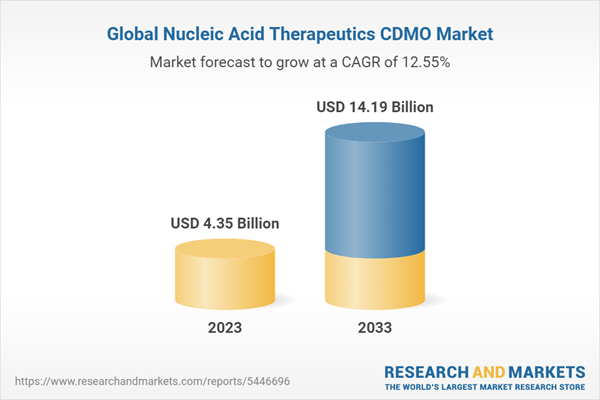

The global nucleic acid therapeutics CDMO market was valued at $3.88 billion in 2022 and is expected to reach $14.19 billion by 2033, growing at a CAGR of 12.55% during the forecast period 2023-2033. The market is driven by factors such as the growing demand for nucleic acid therapeutics applications to treat chronic and genetic diseases, manufacturing advancement for producing nucleic acid by CDMO (a contract development and manufacturing organization), increasing FDA(Food and Drug Administration) approvals of nucleic acid therapeutics, and increasing investment for the expansion of CDMO manufacturing units.

Market Lifecycle Stage

The global nucleic acid therapeutics CDMO market is developing. The global nucleic acid therapeutics CDMO market has witnessed several collaborations among the market players. The collaborations are aimed at combining capabilities, expanding the customer base, and marketing, among others.

The opportunity for growth of the global nucleic acid therapeutics CDMO market lies in continued research and development activities for manufacturing innovative nucleic acid therapeutics. Many pharmaceutical companies are expanding their businesses and becoming more outsourcing-oriented.

Impact of COVID-19

The COVID-19 pandemic had a low impact on the nucleic acid therapeutics contract development and manufacturing organization (CDMO) sector. The demand for nucleic acid-based COVID-19 vaccines and therapies has led to an increased demand for CDMO services. Many CDMOs have experienced an uptick in orders for services such as nucleic acid synthesis, formulation, and manufacturing of viral vectors.

The future impact of COVID-19 on the demand and supply across the global nucleic acid therapeutics CDMO market depends on the abilities of stakeholders to withstand unforeseeable scenarios in the future. The intensity of impact due to COVID-19 in the future will depend on the current efforts being made by companies to equip their supply chains with the necessary components and processes to remain responsive.

Market Segmentation

Segmentation 1: by Product Type

- Standard Nucleic Acid

- Micro-Scale Nucleic Acid

- Large-Scale Nucleic Acid

- Custom Nucleic Acid

- Modified Nucleic Acid

- Primers

- Probes

- Other Nucleic Acid

- Other Services

Segmentation 2: by Technology

- Column-Based Method

- Microarray-Based Method

The global nucleic acid therapeutics CDMO market (by technology) is expected to be dominated by the column-based method.

Segmentation 3: By Chemical Synthesis Method

- Solid-Phase Oligonucleotide Synthesis (SPOS)

- Liquid-Phase Oligonucleotide Synthesis (LPOS)

The global nucleic acid therapeutics CDMO market (by chemical synthesis method) is expected to be dominated by solid-phase oligonucleotide synthesis.

Segmentation 4: By End User

- Pharmaceutical Companies

- Academic Research Institute

- Diagnostic Laboratories

The global nucleic acid therapeutics CDMO market (by end user) is expected to be dominated by pharmaceutical companies.

Segmentation 5: by Region

- North America - U.S., Canada

- Europe - Germany, U.K., France, Italy, Spain, and Rest-of-Europe

- Asia-Pacific - China, Japan, India, Australia, and Rest-of-Asia-Pacific

- Rest-of-the-World

The global nucleic acid therapeutics CDMO market (by region) is dominated by the North America region.

Recent Developments in Global Nucleic Acid Therapeutics CDMO Market

- In June 2021, Danaher Corporation acquired Aldeveron for $9.6 billion. Through this acquisition, the company will expand its manufacturing capacity in plasmid DNA and mRNA.

- In January 2023, Agilent Technologies, Inc. invested $725 million to increase its manufacturing capacity for therapeutic nucleic acids.

- In March 2022, IMM, a partner of VGXI, has recently announced that it received a $12 million grant from the National Institutes of Health (NIH) to support the Phase 1 clinical trial of a DNA vaccine aimed at preventing Alzheimer's disease. The vaccine will be manufactured using VGXI's expertise in contract manufacturing of DNA plasmids for human clinical trials, produced in accordance with GMP standards.

- In April 2022, BACHEM partnered with Eli Lilly and Company to develop and manufacture active pharmaceutical ingredients based on oligonucleotides, a rising new class of complex molecules.

- In September 2021, AGC Biologics expanded the company’s Heidelberg facility to increase manufacturing capacities for plasmid-DNA (pDNA) and messenger RNA (mRNA) projects.

- In August 2022, Codexis and Molecular Assemblies announced the execution of a commercial license and enzyme supply agreement for an optimized TdT enzyme for enzymatic DNA synthesis.

- In June 2020, OliX Pharmaceuticals, Inc. partnered with LGC Biosearch Technologies Inc. to scale up the production of OliX’s OLX301D therapeutic candidate.

Demand - Drivers and Limitations

The following are the drivers for the global nucleic acid therapeutics CDMO market:

- Growing Demand for Nucleic Acid Therapeutics Application to Treat Chronic and Genetic Diseases

- Increasing FDA or European Medicines Agency (EMA) Approvals of Nucleic Acid Therapeutics

- Advancements in Manufacturing Units for Producing Nucleic Acid by CDMOs

The market is expected to face some limitations as well due to the following challenges:

- Substantial Variations in Nucleic Acid Leading to Complications in Therapeutic Classification

- Lack of Expertise in Developing Nucleic Acid Therapeutic

How can this report add value to an organization?

Growth/Marketing Strategy: The global nucleic acid therapeutics CDMO market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint ventures.

Competitive Strategy: The global nucleic acid therapeutics CDMO market has witnessed several investments for the expansion of CDMO manufacturing units by the market players. The expansion is aimed at increasing the manufacturing capacity. To meet the growing demand for their services, CDMOs are expanding their manufacturing units and investing in new technologies. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Companies Profiled

- Agilent Technologies, Inc.

- AGC Biologics

- Asymchem Inc.

- BACHEM

- BioCina

- CMIC HOLDINGS Co., Ltd.

- Codexis, Inc.

- Danaher Corporation

- Eurofins Scientific

- GeneOne Life Science

- Kaneka Corporation

- LGC Science Group Holdings Limited

- Maravai LifeSciences Holdings, Inc.

- Merck KGaA

- Nippon Shkubai Co., Ltd

- ST Pharm

- Thermo Fisher Scientific Inc.

Table of Contents

Companies Mentioned

- Agilent Technologies, Inc.

- AGC Biologics

- Asymchem Inc.

- BACHEM

- BioCina

- CMIC HOLDINGS Co., Ltd.

- Codexis, Inc.

- Danaher Corporation

- Eurofins Scientific

- GeneOne Life Science

- Kaneka Corporation

- LGC Science Group Holdings Limited

- Maravai LifeSciences Holdings, Inc.

- Merck KGaA

- Nippon Shkubai Co., Ltd

- ST Pharm

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 206 |

| Published | April 2023 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 4.35 Billion |

| Forecasted Market Value ( USD | $ 14.19 Billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |