Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

There are two main categories of antifungal drugs: local and systemic. Depending on the specific condition being treated, local antifungals are commonly applied topically or vaginally, while systemic antifungals are administered orally or intravenously. Examples of systemically administered medicines include itraconazole, fluconazole, ketoconazole, voriconazole, posaconazole, and isavuconazole.

Antifungal medications can function in one of two ways: they can directly kill fungal cells or inhibit their growth and development. Moreover, antifungal medications work by targeting structures or functions that are essential in fungal cells but not in human cells, allowing them to combat fungal infections without harming human cells. The fungal cell membrane and cell wall are frequently targeted components, as they surround and protect the fungal cell. Compromising either of these structures can cause the fungal cell to burst open and die.

Key Market Drivers

Rising Prevalence of Fungal Infections

The increasing prevalence of fungal infections is a key driver for the revenue growth in the market. Research indicates that fungal pathogens are responsible for approximately 13 million infections and 1.5 million deaths worldwide each year. Antifungal medications are also administered orally. On March 30, 2023, GSK plc and SCYNEXIS, Inc. announced an exclusive license agreement for Brexafemme, a first-in-class antifungal approved by the U.S. Food and Drug Administration (FDA) for the treatment of Vulvovaginal Candidiasis (VVC) and the reduction of the incidence of recurrent VVC (RVVC). This exclusive licensing deal grants GSK the sole right to commercialize Brexafemme for VVC and RVVC while continuing the development of ibrexafungerp, which is currently in phase III clinical trials for the possible treatment of Invasive Candidiasis (IC), a potentially fatal fungal infection.The prevalence of fungal infections has been on the rise in recent years, prompting concerns within the healthcare industry. Contributing factors to this alarming trend include increasing global temperatures, the prevalence of chronic illnesses, and compromised immune systems. Hospital-acquired fungal infections, or nosocomial infections, have become a significant concern, with approximately 1.7 million hospitalized patients contracting such infections in 2019, according to the Centers for Disease Control and Prevention (CDC).

Key Market Challenges

Adverse Health Effects

There are several disadvantages associated with antifungal drugs. One key factor is that individuals with weakened immune systems, such as those with acquired immunodeficiency syndrome (AIDS), lupus, cancer, and other conditions, are more susceptible to dangerous fungal infections known as opportunistic infections. This vulnerability poses a challenge to the revenue growth of the antifungal drug market.Furthermore, the type of medicine, dosage strength, and the specific fungus being treated can all influence the outcome of the medication. Common side effects may include pain in the abdomen, unsettled stomach, diarrhea, and itchy, scorching, or rashy skin. These symptoms can also have a negative impact on the revenue growth of the market.

In addition to these challenges, antifungal medication can produce major side effects, including liver damage such as jaundice, anaphylaxis, and other severe allergic responses. Blisters and peeling skin are also symptoms of severe allergic skin reactions that can occur as a result of using antifungal drugs. Considering these factors, it becomes evident that while antifungal drugs are necessary for treating fungal infections, they do come with significant drawbacks that need to be taken into account.

Key Market Trends

Increase In the Number of Research and Development Activities

The increase in the number of research and development (R&D) activities in the field of antifungal drugs is expected to significantly boost the demand for these medications. Antifungal drugs are critical for treating a wide range of fungal infections, from superficial conditions like athlete's foot to life-threatening systemic infections. Increasing R&D investments lead to the discovery of new antifungal compounds and formulations. These innovations are likely to result in the development of more effective drugs with improved mechanisms of action, enhancing the arsenal of treatment options available.R&D efforts are dedicated to understanding and combating antifungal resistance. Researchers are working to identify the mechanisms behind resistance and develop strategies to overcome it. This will ensure the continued effectiveness of antifungal drugs, driving their demand. Research in the field of fungal biology is uncovering specific molecular targets within fungal cells that can be exploited for drug development. Targeted therapies can enhance drug efficacy and reduce side effects, making antifungal drugs more appealing to healthcare providers and patients.

Key Market Players

- Abbott Laboratories Inc.

- Astellas Pharma Inc.

- Bayer AG

- GSK plc

- Glenmark Pharmaceuticals Limited

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Mycovia Pharmaceuticals, Inc.

- Apex Laboratories Pvt. Ltd.

Report Scope:

In this report, the Global Anti-Fungal Drugs Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Anti-Fungal Drugs Market, By Drug Class:

- Azoles

- Echinocandins

- Polyenes

- Allylamines

- Others

Anti-Fungal Drugs Market, By Indication:

- Candidiasis

- Aspergillosis

- Mucormycosis

- Dermatophytosis

- Others

Anti-Fungal Drugs Market, By Infection Type:

- Superficial Fungal Infection

- Systemic Fungal Infection

Anti-Fungal Drugs Market, By Route of Administration:

- Topical

- Oral

- Parenteral

- Others

Anti-Fungal Drugs Market, By End User:

- Homecare

- Hospitals

- Clinics

- Others

Anti-Fungal Drugs Market, By Distribution Channel:

- Retail Pharmacy

- Hospital Pharmacy

- Online Pharmacy

Anti-Fungal Drugs Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Anti-Fungal Drugs Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Abbott Laboratories Inc.

- Astellas Pharma Inc.

- Bayer AG

- GSK PLC

- Glenmark Pharmaceuticals Limited

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Mycovia Pharmaceuticals, Inc.

- Apex Laboratories Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

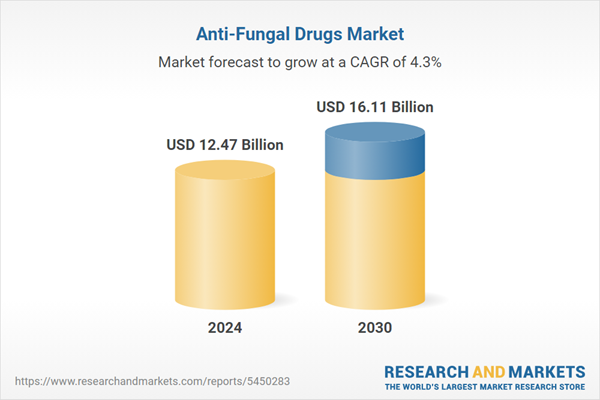

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.47 Billion |

| Forecasted Market Value ( USD | $ 16.11 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |