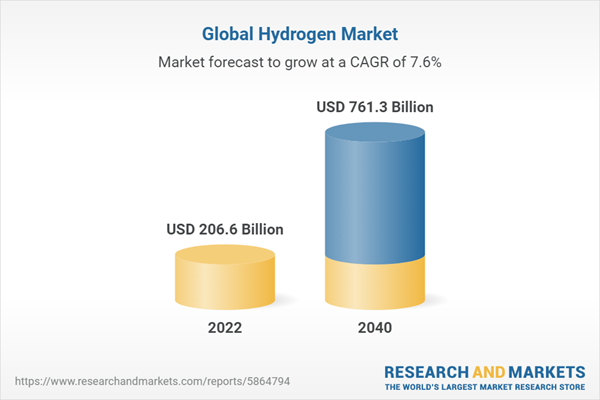

The global Hydrogen market was valued at US$ 206.6 Bn in 2022 and is forecasted to reach US$ 761.3 Bn by 2040, growing at a Compound Annual Growth Rate (CAGR) of 7.58%. In terms of volume, the market accounted for 73,844.6 tons in 2022, predicted to grow at a CAGR of 7.15% during the forecast period from 2023 - 2040.Global Hydrogen Market Forecast till 2040: Set to Reach US$ 761.3 Billion by 2040 with a CAGR of 7.58%

Growth Influencers:

Key drivers triggering the growth of the Hydrogen market are the surge in the production of iron, steel, ammonia, and other valuable chemicals where hydrogen plays a prime role, and the rise in Steam Methane Reforming (SMR) technology. However, strict procurement policies imposed by the government might serve as a restraint to the market growth.Segment Overview:

The Hydrogen market is categorized based on Technology, Application, and Delivery Mode.By Technology

- Thermal Process

- Steam Methane Reforming

- Partial Oxidation

- Coal Gasification

- Biomass Gasification

- Electrolytic Process

- SOEC

- SOFC

- PEM

- AEM

By Application

- Methanol Production

- Ammonia Production

- Petroleum Refinery

- Heat Treatment

- Renewable Energy

- Hydrogen Fuel Cell

- Fuel Cell Vehicles

- Fuel Cell Ships

- Fuel Cell Battery

- Mobile Power Generation

- Others

- Others

By Delivery Mode

- Captive

- Merchant

Regional Overview:

Based on Region, the market is divided into North America, Europe, Asia Pacific, & Rest of WorldNorth America

- US

- Canada

Europe

- Germany

- France

- UK

- Norway

- Netherlands

- Rest of Europe

Asia Pacific

- China

- India

- Japan

- ASEAN

- South Korea

- Rest of Asia Pacific

Rest of the World

- Middle East & Africa

- South Africa

Competitive Landscape:

The competitive landscape of the Hydrogen market is quite diverse with numerous prominent players contributing to its growth. Key players in this sector include Air Liquide International S.A., Air Products and Chemicals, Inc., Aquahydrex, Atawey, Claind, Cummins, Ergousp, Fuel Cell Energy, Green Hydrogen Systems, Heliogen, Hydrogenics, HyTech Power, Inox, ITM Power, and Linde plc.Additional significant contributors to the market are McPhy Energy, Messer Group GmbH, NEL Hydrogen, Plug Power, PowerTap, Showa Denko, Starfire Energy, Taiyo Nippon, Uniper, Weldstar, Inc., Xebec Adsorption Inc., and several other notable players. The cumulative market share of the four major players is close to 48.8%, reflecting the robust competition within the sector.

Moreover, many of these companies are engaged in significant research and development activities, partnerships, and collaborations. For instance, in July 2021, Air Liquide strengthened its support to Energy Observer, aiming to demonstrate the key role of hydrogen in the energy transition, indicating the potential for future advancements in the market.

Report Insights:

- The Hydrogen market is poised to grow at a CAGR of 7.58% from 2023 to 2040.

- The rise in key industrial sectors and the Steam Methane Reforming (SMR) technology are driving the market growth.

- Electrolytic Process under 'Technology' and Ammonia Production under 'Application' are the most promising segments.

- North America and Asia Pacific are the key regions contributing to the market growth.

Questions to be Answered:

- What is the estimated growth rate of the global Hydrogen market?

- What are the key drivers and potential restraints?

- Which market segments are expected to witness significant growth?

- Who are the leading players in the market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide International S.A.

- Air Products and Chemicals, Inc.

- Aquahydrex

- Atawey

- Claind

- Cummins

- Ergousp

- Enapter AG

- EvolOH, Inc.

- Fuel Cell Energy

- Green Hydrogen Systems

- Heliogen

- Hydrogenics

- HyTech Power

- Inox

- ITM Power

- Linde plc

- McPhy Energy

- Messer Group GmbH

- NEL Hydrogen

- Plug Power

- PowerTap

- Siemens AG

- Showa Denko

- Starfire Energy

- Taiyo Nippon

- Uniper

- Verdagy

- Weldstar, Inc.

- Xebec Adsorption Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 690 |

| Published | June 2023 |

| Forecast Period | 2022 - 2040 |

| Estimated Market Value ( USD | $ 206.6 Billion |

| Forecasted Market Value ( USD | $ 761.3 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |