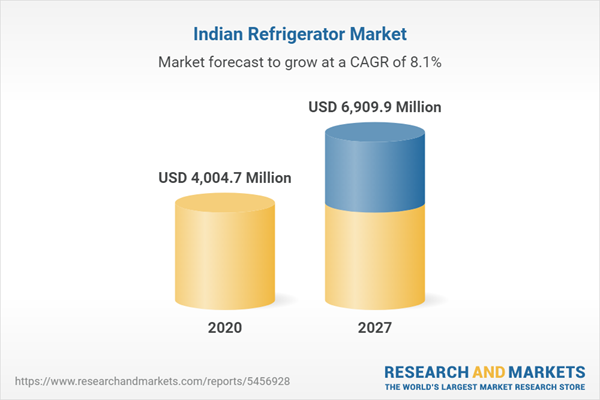

The India Refrigerator market held a market value of USD 4,004.7 Million in 2020 and is estimated to reach USD 6,909.9 Million by the year 2027. The market is expected to register a growth rate of 8.1% over the projected period. The number of units sold in 2020 was around 12,539.5 thousand.India Refrigerator Market is Projected to Grow at a CAGR of 8.1% During the Forecast Period 2017-2027

The market is witnessing significant growth owing to the factors such as increasing urbanization in India coupled with electrification supporting the expansion of demand. Furthermore, widespread usage in various industries, such as medical and food industry, among others, is also expected to boost the market growth. The market is expected to be negatively influenced by emission of harmful gases and refrigerants.

Growth Influencers:

Increasing urbanization in India

In India, the demand for refrigerators is more in the urban areas as compared to the rural areas, as the consumption pattern of food in urban residents is different. Furthermore, demand for refrigerators is also increasing owing to the rising disposable income, environmental changes, technological advancements, and rapid urbanization. Rapid lifestyle changes and growing urban population are also anticipated to fuel the market growth.

Segments Overview:

The India Refrigerator market is segmented into model type, retail format, capacity, technology, and end user.

By Model Type

- Mini Freezers

- Top Freezer

- Bottom Freezer

- Side by Side

- French Door

- Merchandizers

The top freezer segment is expected to hold the largest market share owing to its features such as having combined freezer and shelf size in a single unit, which avoids the need to buy a separate freezer. The French door segment is anticipated to witness the fastest growth rate of around 9.1% owing to their increasing demand for storing frozen food products. The merchandizers segment is estimated to surpass a market volume of more than 140 thousand units by 2024.

By Retail Format

- Online

- E-Commerce

- Brand Store

- Offline

- Specialty Stores

- Brand Stores

The offline segment is expected to account for the largest value as well as volume share owing to high penetration of offline stores in the Indian market. Within the online segment, the brand store segment is estimated to account for a market volume of about 140 thousand units by 2024.

By Capacity

- < 200 L

- 200-499 L

- 500-700 L

- 700 L

The 200 - 499 L segment is anticipated to hold the largest share in terms of revenue as well as the number of units sold. This is because of its rising usage in household uses. The 500 -700 L segment is expected to witness the fastest growth rate of around 8.4% owing to

By Technology

- Smart (Frost Free)

- Conventional (Direct Cool)

The conventional (direct cool) segment is expected to hold the largest market share owing to its inexpensive nature as compared to the other segment. The segment is also estimated to witness the largest number of units sold. The smart (frost free) segment is also anticipated to witness significant growth owing to rising adoption of technologically advanced products.

By End User

- Residential

- Commercials (HoReCa)

- Restaurants & café

- Hotels

- Hospitals & Pharmacies

- Others (Education, Enterprises)

The residential segment is anticipated to hold the dominant value and volume share owing to increasing demand for refrigerators in urban households in India. Within the commercials (HoReCa) segment, the hotels segment is expected to witness a market volume size of around 274.6 thousand units by 2026.

Regional Overview:

By region, the India Refrigerator market is divided into North India, South India, East India, and West India.

The South India region is expected to hold the largest market share owing to presence of many players in the region. The region consists of Tamil Nadu, Kerala, Karnataka, Telangana, and Andhra Pradesh. Karnataka is expected to witness a growth rate of about 8.3%. North India consists of states such as Uttar Pradesh, Rajasthan, Delhi, Punjab, Himachal Pradesh, Jammu & Kashmir, and Haryana. Punjab is expected to account for a market size of around USD 303.5 million by 2027.

The East India region is expected to grow at the fastest rate of 8.6% and consists of West Bengal, Bihar, Jharkhand, Orissa, Assam, and Rest of East India. West India consists of Gujarat, Goa, Madhya Pradesh, Chhattisgarh, and Maharashtra.

Competitive Landscape:

Local players operating in the India Refrigerator market include Blue Star Limited, Robert Bosch GmbH, Croma, Godrej Group, Tropicool India, Voltas, Inc., Electrolux AB, Samsung Electronics Co., Ltd., LG Electronics Inc., Whirlpool Corp., Liebherr-International Deutschland GmbH, Haier Group Corp, Panasonic Corp., and Hitachi Ltd, among others.

Major 5 players in the market hold approximately 90% of the market share. These market players are investing in product launches, collaborations, mergers & acquisitions, and expansions to create a competitive edge in the market. For instance, in February 2021, Blue Star Limited expanded its commercial refrigeration footprint by expanding its application areas in various industries such as agriculture, healthcare & pharmaceuticals, dairy, processed foods, ice-cream, fast food chains, restaurants, hotels, retail outlets, and quick service restaurants, among others. The company has a market share of around 60-70% in the healthcare and pharmaceutical segments for product categories such as medical freezers, pharma refrigerators, modular cold rooms, blood bank refrigerators, and ultra-low temperature freezers.

The India Refrigerator market report provides insights on the below pointers:

- Market Penetration: Provides comprehensive information on the market offered by the prominent players

- Market Development: The report offers detailed information about lucrative emerging markets and analyzes penetration across mature segments of the markets

- Market Diversification: Provides in-depth information about untapped geographies, recent developments, and investments

- Competitive Landscape Assessment: Mergers & acquisitions, certifications, product launches in the India Refrigerator market have been provided in this research report. In addition, the report also emphasizes the SWOT analysis of the leading players.

- Product Development & Innovation: The report provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

- India Refrigerator Market Analysis: Consumer Behavior Analysis consisting of Consumer Demographics and Consumer Trends & Preferences (Brand awareness, buying behaviour, factors affecting purchase decision, product penetration)

- Competitive Dashboard: Top players - Top Models Mapping

The India Refrigerator market report answers questions such as:

- What is the market size and forecast of the India Refrigerator Market?

- What are the inhibiting factors and impact of COVID-19 on the India Refrigerator Market during the assessment period?

- Which are the products/segments/applications/areas to invest in over the assessment period in the India Refrigerator Market?

- What is the competitive strategic window for opportunities in the India Refrigerator Market?

- What are the technology trends and regulatory frameworks in the India Refrigerator Market?

- What is the market share of the leading players in the India Refrigerator Market?

- What modes and strategic moves are considered favorable for entering the India Refrigerator Market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Blue Star Limited

- Robert Bosch GmbH

- Croma

- Godrej Group

- Tropicool India

- Voltas, Inc.

- Electrolux AB

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Whirlpool Corp.

- Liebherr-International Deutschland GmbH

- Haier Group Corp

- Panasonic Corp.

- Hitachi Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | September 2021 |

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 4004.7 Million |

| Forecasted Market Value ( USD | $ 6909.9 Million |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | India |