Metal Finishing Chemicals Market Size:

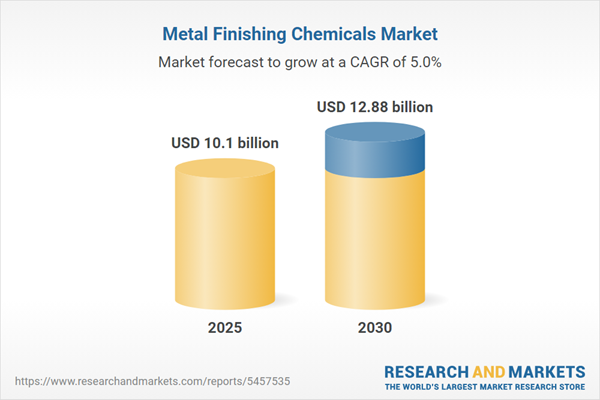

The Metal Finishing Chemicals Market is expected to grow from USD 10.103 billion in 2025 to USD 12.882 billion in 2030, at a CAGR of 4.98%.The metal finishing chemicals industry serves as a critical component in modern manufacturing, providing essential solutions for enhancing metallic surface properties through polishing, plating, and etching processes. These specialized chemicals enable precise control over surface characteristics including corrosion resistance, tarnish prevention, electrical conductivity, wear resistance, reflectivity, hardness, and chemical durability.

Market Position and Industrial Significance

Metal finishing chemicals occupy a strategic position within the broader chemical manufacturing sector, addressing the increasing industrial demand for durable, wear-resistant products across multiple applications. The market's expansion reflects growing requirements for surface treatment solutions that extend product lifecycles and enhance performance characteristics in demanding operational environments.The industry benefits from diverse application opportunities spanning automotive manufacturing, printed circuit board production, and aerospace maintenance operations. Government policies supporting industrial manufacturing and technological advancement create favorable conditions for sustained market development, while evolving industrial requirements continue to drive innovation in chemical formulations and application processes.

Primary Growth Drivers

Automotive Industry Integration

The automotive sector represents a cornerstone application for metal finishing chemicals, particularly through electroplating processes. Electrodeposition technology provides cost-effective solutions for applying thin, protective metal coatings to automotive components, addressing critical performance requirements for corrosion resistance, wear protection, and aesthetic enhancement.Automotive applications encompass diverse component categories including transmission systems, engine assemblies, drive axles, and exterior elements. Each application demands specific finishing characteristics tailored to operational requirements, environmental exposure, and aesthetic standards. The automotive industry's continued emphasis on component durability and performance reliability ensures sustained demand for advanced metal finishing solutions.

The electroplating process offers manufacturers economical methods for achieving superior surface properties while maintaining cost efficiency in high-volume production environments. This combination of performance enhancement and economic viability positions metal finishing chemicals as indispensable elements in automotive manufacturing processes.

Expanding Industrial Applications

Beyond automotive applications, the metal finishing chemicals market benefits from growth in printed circuit board manufacturing, where precise surface treatments ensure electrical conductivity and component reliability. The aerospace sector contributes additional demand through maintenance, repair, and overhaul operations requiring specialized surface treatments for critical components operating under extreme conditions.Market Challenges and Constraints

Environmental and Regulatory Compliance

The metal finishing chemicals industry faces significant challenges related to hazardous waste disposal and wastewater management. Regulatory frameworks governing chemical processing and environmental protection create compliance requirements that impact operational costs and process design considerations. These regulations necessitate investment in waste treatment systems and sustainable processing technologies, affecting market dynamics and competitive positioning.Environmental concerns drive industry evolution toward more sustainable formulations and processing methods, requiring ongoing research and development investments to maintain regulatory compliance while preserving performance characteristics.

Material Substitution Pressures

The increasing adoption of plastic materials in traditional metal applications presents a fundamental challenge to market expansion. Manufacturers recognize cost advantages and performance benefits achievable through metal-to-plastic substitution, particularly in weight-sensitive applications such as automotive manufacturing.Plastic materials offer manufacturers reduced production costs, improved product quality metrics, and significant weight reduction benefits. In automotive applications, plastic components contribute to overall vehicle weight reduction, enhancing fuel efficiency and reducing transportation costs throughout the supply chain. These superior characteristics of plastic materials create competitive pressure on metal finishing applications, potentially limiting market expansion opportunities.

Strategic Market Outlook

The metal finishing chemicals market operates within a dynamic environment characterized by expanding industrial applications offset by material substitution trends and environmental compliance requirements. Success requires balancing traditional market strengths in automotive and aerospace applications while adapting to sustainability demands and competitive material alternatives. Industry participants must focus on developing environmentally compliant formulations while maintaining performance standards essential for critical industrial applications.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Metal Finishing Chemicals Market Segmentation:

By Type

- Inorganic Chemicals

- Organic Chemicals

- Hybrid/Specialty Chemicals

- Others

By Application

- Plating

- Conversion Coating

- Cleaning

- Rust Prevention

- Electropolishing

- Etching

- Degreasing

By End-User Industry

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- General Manufacturing

- Construction & Architecture

- Industrial Equipment & Machinery

- Medical Devices

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Atotech

- BASF SE

- MacDermid Alpha

- Quaker Houghton

- Henkel AG & Co. KGaA

- TIB Chemicals AG

- Technic, Inc.

- Chemetall GmbH

- Artek Surfin Chemicals Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 10.1 billion |

| Forecasted Market Value ( USD | $ 12.88 billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |