The power and control cable market is a critical component of the electrical cables industry, enabling efficient transmission of electricity and control signals across various sectors. Power cables facilitate the delivery of electrical energy, while control cables manage equipment operations, serving as essential infrastructure for industries, utilities, and renewable energy systems. As of 2025, the market is experiencing steady growth driven by industrialization, infrastructure upgrades, and increasing energy demands. This summary outlines key growth drivers and regional trends shaping the power and control cable market.

Market Growth Drivers

Industrial Applications

Power and control cables are indispensable in industrial settings, acting as the backbone for transmitting power and control signals to diverse machinery and equipment. Their versatility supports a wide range of applications, from manufacturing to automation, making them critical to industrial infrastructure. In July 2023, India's manufacturing sector recorded a 4.6% growth rate, according to the Ministry of Statistics and Programme Implementation, reflecting sustained industrial expansion. This growth drives demand for robust electrical networks, increasing the need for power and control cables to ensure seamless operations and support industrial competitiveness.Renewable Energy and Infrastructure Upgrades

The global shift toward renewable energy sources, such as wind and solar, significantly boosts the demand for power cables to connect these energy sources to the grid. Additionally, the need for modernized grid infrastructure to support growing energy production fuels market growth. In the United States, electricity production reached 434,489.2 GWh in July 2023, a 5.3% increase from July 2021, as reported by the International Energy Agency. This surge, coupled with investments in grid enhancements, underscores the critical role of power and control cables in optimizing energy transmission and distribution.Diverse Applications Across Sectors

Beyond utilities, power and control cables are integral to industries such as mining, petrochemical refineries, airport lighting, electric vehicle (EV) charging stations, and earth-moving machinery. The expansion of these sectors, particularly the rise of EV infrastructure, further propels market growth. The increasing adoption of power and control cables in these applications highlights their durability, resistance to electrical interference, and suitability for demanding environments.Regional Outlook

The United States is projected to experience steady growth in the power and control cable market, driven by robust energy production and favorable investments in grid infrastructure. The cables high applicability in power grids, utilities, and industrial automation systems supports their demand. The expansion of EV charging infrastructure and other industrial applications further strengthens the market's positive outlook in the region.The power and control cable market is thriving due to its critical role in industrial operations, renewable energy integration, and infrastructure modernization. The surge in industrial activities, particularly in regions like India, and the increasing energy demands in the United States drive the need for reliable power and control cables. As industries and utilities continue to expand and innovate, the market is expected to maintain its growth trajectory, supported by the cables versatility and essential function in powering modern infrastructure.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Power and Control Cable Market Segmentation

By Type

- Power Cable

- Control Cable

By Material

- Copper

- Aluminum

- Others

By End-User

- Residenital

- Commercial

- Industrial

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Belden Inc.

- Multicable Corporation

- Nexans S.A

- Prysmian S.p.A.

- Orient Cables Pvt. Ltd.

- Teldor Cables & Systems Ltd.

- Techno Flex Cables

- CMI Ltd.

- Havells India Ltd.

- Furukawa Electric Co, Ltd.

- Southwire Company, LLC

- LS Cable & System

- Thermo Cables Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

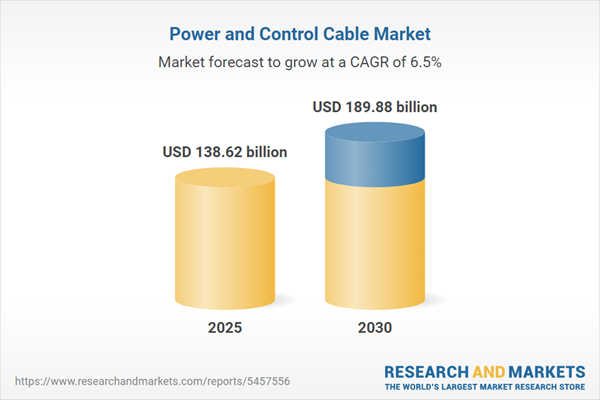

| Estimated Market Value ( USD | $ 138.62 billion |

| Forecasted Market Value ( USD | $ 189.88 billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |