System Integration Market Size:

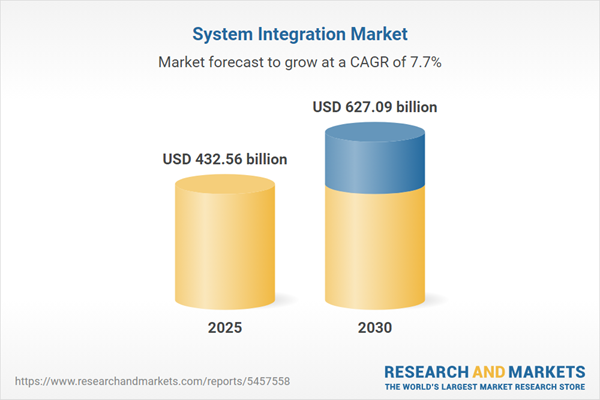

The System Integration Market is expected to grow from USD 432.564 billion in 2025 to USD 627.091 billion in 2030, at a CAGR of 7.71%.System integrators specialize in connecting component subsystems into cohesive, functional wholes through comprehensive system integration processes that address both automation requirements and operational optimization. This discipline encompasses the integration of physical and virtual organizational components, creating unified systems that enhance operational efficiency and enable advanced automation capabilities.

Technology Foundation and Integration Scope

System integration addresses both physical infrastructure components including diverse machine systems, computer hardware, and inventory management systems, alongside virtual elements such as database-stored information, software applications, and digital platforms. This comprehensive approach ensures seamless connectivity between traditionally disparate systems while optimizing overall operational performance.The integration process involves sophisticated coordination of hardware, software, and communication protocols to create unified operational environments. System integrators manage complex technical challenges including compatibility issues, data synchronization, and performance optimization across multiple platforms and technologies.

Modern system integration extends beyond basic connectivity to encompass advanced automation, data analytics, and intelligent system management capabilities. This evolution reflects increasing demand for sophisticated operational control and the growing complexity of industrial and commercial technology environments.

Market Dynamics and Growth Drivers

Industrial IoT and Automation Advancement

The proliferation of Internet of Things technology in industrial automation creates expanding opportunities for system integration services. IoT implementation requires sophisticated integration capabilities to connect sensor networks, data collection systems, and analytical platforms into coherent operational frameworks.Cloud computing technology advancements enable more sophisticated integration approaches, allowing distributed system components to operate as unified platforms while providing enhanced scalability and flexibility. This technological evolution supports complex integration projects that previously required extensive on-premise infrastructure.

Growing research and development activities drive innovation in integration methodologies and technologies, while emerging economies present expanding market opportunities as industrial modernization accelerates globally.

Safety and Security Requirements

Increasing safety and security concerns across industrial sectors drive demand for integrated automation systems that enhance operational monitoring and control capabilities. Industries including oil and gas, energy and utilities, and chemicals and petrochemicals prioritize comprehensive automation solutions that address regulatory compliance and environmental standards.Oil and gas operations, particularly refineries located in remote and hazardous environments, require sophisticated automation solutions to prevent accidents and equipment failures. Process automation enables continuous equipment monitoring and failure analysis while supporting data collection for efficiency improvement initiatives.

Energy sector transformation, including expanding solar and distributed energy resources integration, necessitates advanced power electronic device integration for energy conversion and grid management. These developments create substantial opportunities for specialized system integration services focused on energy infrastructure modernization.

Manufacturing Efficiency and Cost Optimization

Demand for low-cost, energy-efficient manufacturing processes drives adoption of integrated automation systems that optimize operational performance while reducing resource consumption. System integration enables manufacturers to implement comprehensive automation strategies that address multiple operational aspects simultaneously.Integration solutions support manufacturing process optimization through real-time monitoring, predictive maintenance capabilities, and automated quality control systems. These capabilities provide manufacturers with competitive advantages through improved efficiency and reduced operational costs.

Market Constraints and Implementation Challenges

Capital Investment Requirements

High initial investment requirements represent significant barriers to market expansion, as system integration projects typically require substantial capital expenditure for supervisory solutions, process analyzers, control valves, actuators, smart sensors, and communication networks. These components involve considerable installation and maintenance costs that increase total project expenses.Process analyzers, smart sensors, and actuators represent particularly significant cost considerations due to their specialized nature and ongoing maintenance requirements. These expenses can limit market accessibility for smaller organizations or projects with constrained budgets.

Infrastructure and Maintenance Considerations

Automation implementation and maintenance require ongoing investment commitments that extend beyond initial installation costs. Organizations must account for system updates, component replacements, and technical support requirements throughout system lifecycles.Additionally, fluctuating infrastructure investment patterns, including impacts from energy market volatility, can affect long-term project planning and investment decisions, creating uncertainty in market development patterns.

Strategic Market Outlook

The system integration market operates within a dynamic environment characterized by expanding automation requirements offset by significant investment barriers. Success requires balancing sophisticated integration capabilities with cost-effective implementation approaches while addressing emerging opportunities in IoT, energy infrastructure, and industrial automation sectors.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Market Segmentation

By Integration Model

- Vertical Integration

- Horizontal Integration

- Star Integration

- Common Data Format

By Type

- Enterprise Application Integration

- Data Integration

- Electronic Document Integration

By Industry Vertical

- BFSI

- Aerospace and Defense

- Information Communication & Technology

- Retail

- Government

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Tyco Integrated Security

- Convergint Technologies LLC

- Johnson Controls Inc.

- Schneider Electric

- Tech Systems Inc.

- Accenture Plc

- Harris Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 432.56 billion |

| Forecasted Market Value ( USD | $ 627.09 billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |