Colonoscopies are performed with reusable scopes. They are flexible, fiber-optic instruments that are introduced into the anus and directed through the colon. The colonoscopes helps endoscopists detect chronic illnesses and check patients for malignant or precancerous diseases. People aged 50 years and above should get colonoscopies as part of a regular cancer screening regimen. In hospitals or ambulatory surgery center (ASCs), the procedures are carried out under mild sedation.

March is marked as the National Colorectal Awareness Month, dedicated to encouraging patients, survivors, and caregivers to share their stories, advocate for colorectal cancer prevention, and inform others about the importance of early detection. The Health Colorectal Cancer Awareness Campaign, launched in 2019, is the first system-wide cancer awareness and prevention effort at the University of California (UCLA). The campaign is a health leadership commitment to increase colorectal cancer and screening awareness in the UCLA Health patients and staff community and the greater Los Angeles area, including medically underserved populations. The multifaceted campaign has included public awareness events, Dress in Blue Day, patient and provider education, patient-directed educational videos, community lectures, radio and media appearances, employee wellness and nutrition lectures, and a social media campaign. The campaign format was changed slightly in March 2020 due to the COVID-19 pandemic; it provided virtual screening and awareness messages and evolved to include a stronger focus on stool testing to allow patients access to screening from home. Thus, such growing awareness about the effect of colon disorders will increase the adoption of colonoscopy tests during the forecast period, thus offering lucrative opportunities to the market players.

By Product Type, Colonoscopy Devices Market-Based Insights

Based on product type, the colonoscopy devices market is segmented into colonoscope, visualization systems, and other. The colonoscope segment held the largest market share in 2022. However, the visualization systems segment is anticipated to register the highest CAGR during 2022-2030. Video endoscopes are designed for colonoscopy examinations. As awareness of operator dependency on colonoscopy increases, some patients are interested in obtaining a video recording of their colonoscopy to ensure that their examination was of high quality or to view the procedure, as they are often unable to watch it in real time.By End User, Colonoscopy Devices Market-Based Insights

The colonoscopy devices market, by end user, hospitals, ambulatory surgery centers, and others. The hospital segment held the largest colonoscopy devices market share in 2022 and is anticipated to register the highest CAGR during 2022-2030, owing to the adoption of technological advancements in hospitals and the increasing number of screenings in hospital settings. Developing healthcare infrastructure in emerging markets, increasing emphasis on better patient outcomes, and rising healthcare expenditure are factors contributing to the growth of the hospital segment.European Society of Gastrointestinal Endoscopy, the World Health Organization, and the World Gastroenterology Organisation are a few of the major primary and secondary sources referred to while preparing the report on the colonoscopy devices market.

Table of Contents

Companies Mentioned

- AMBU AS

- Fujifilm

- Endomed systems gmbh

- Olympus

- Pentax

- GI View

- Boston Scientific Corporation

- Steris PLC

- Avantis Medical Systems

- SonoScape Medical Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | March 2024 |

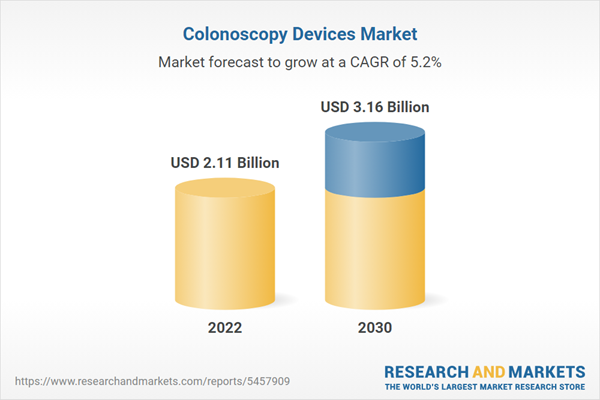

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 2.11 Billion |

| Forecasted Market Value ( USD | $ 3.16 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |