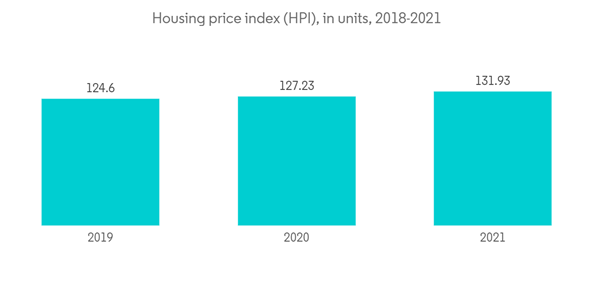

Though housing is becoming expensive in the country, the demand is also growing significantly, driving the market. Furthermore, rising international investors in the market are propelling the market growth.

Key Highlights

- Following the pandemic's catastrophic shock, the Spanish economy improved substantially throughout 2021. With a decline of about 16% in the last quarter of 2020, La Rioja was the Spanish region where the pandemic's impact on real estate values was higher than the previous year. The autonomous city of Melilla was the only place in Spain where there was an increase compared to pre-pandemic data.

- Since the beginning of 2023, it appears that the Spanish real estate market has made a complete recovery to pre-covid levels and is regaining its health. According to the National Institute of Statistics, home transactions in 2021 will be the highest in 14 years. According to Forbes, it will continue to expand at the same dynamic rate that it began in 2021, and it will escape real estate bubbles. Following confinement and societal limitations, there is a greater demand among the Spanish people for larger homes, particularly those with outdoor areas. In cities such as Madrid, a significant portion of the city center population has chosen to live outside of the inner city circle in exchange for a higher standard of life, in greener regions, and with more living room.

- According to the National Institute of Statistics (INE), in January 2022, a staggering 52,684 property transactions took place in Spain, which is the highest figure for the first month of the year since 2008. February 2022's figures were slightly higher at 53,623 transactions, which is an annual increase of 24%. 20.4% of February's property transactions were new homes and 79.6% were used. The number of new homes being purchased increased by 9.2% compared to February 2021 and used homes increased by 28.4%.

Spain Residential Real Estate Market Trends

Rise in International Property Buyers in Spain

Spain is a popular, safe, and stable international destination for visitors, investors, and those looking to relocate with a rich cultural tradition. International interest from buyers both inside and outside the European Union is increasing. Real estate regained popularity, especially in seaside resorts and Spain's major cities. In terms of investment, Madrid, Valencia, and Malaga are the provinces with the highest possibilities for recovery.Other places, on the other hand, are expected to recover quickly. The Balearic Islands and Barcelona, for instance, are two of the most popular tourist destinations in the world. British property buyers, especially British retirees, were the foreign nationals who contributed the most to real estate investment in Spain. Now the situation changed, and many are selling their properties.

In the second quarter of 2021, the British continued to lead the investment rankings, according to the Land Registry, accounting for 9.5% of total purchases in the country. The total number of foreign buyers in Spain in the second quarter of 2021 was just over 13,600. While the numbers of foreign buyers are still below pre-pandemic levels, data from the Spanish Land Registry (Registradores) shows the proportion of foreign buyers across the country on a whole increased by 0.23 percentage points, from 9.52% in the first quarter of 2021 to 9.75% in the second quarter of 2021. It also suggests that international buyers are beginning to return.

Centro de Información Estadstica del Notariado provided statistical figures on real estate sales for the second half of 2021. The data presented in the research shows that real estate sales to foreign buyers surged by 41.9% in Spain. Due to a 27.4% growth in the number of foreign purchasers residing in Spain, the Spanish real estate market is looking positive in terms of annual yield. Additionally, the percentage of homes bought by non-resident foreign buyers increased by 64.5%, reaching 54.8%. The Balearic Islands attracted the highest interest in sales of real estate. The Balearic Islands experienced the most significant increase in real estate sales with 81.5%, Authentic Andalusia with 55%, and the golden state Valencia with 44%, followed after.

Housing sales growing substantially in the country driving the market

The sale of dwelling homes in Spain increased by 38.1% in 2021, reaching 676,775 units, and the average price per sq m increased by 5.3% to EUR 1,507 (USD 1601.04) per sq m, while mortgage loans for housing acquisition increased by 35.7%. Flat sales climbed by 38.2% Y-o-Y to 507,209 units, while single-family home sales increased by 37.8% Y-o-Y to 169,566 units in 2021. The prices of flats increased by 3.6% in 2021 compared to 2020, reaching EUR 1,701 (USD 1807.15) per sq m, while the cost of single-family homes averaged EUR 1,195 (USD 1269.57) per sq m, registering an increase of 10%.For the first time since 2014, the sale of brand-new houses exceeded the barrier of 100,000 operations. According to the INE, there were precisely 115,038 sales, 37.7% more than in 2020. In 2021, on average, seven autonomous communities saw their operations rise by more than 34.6%. Valencia, Castilla-La Mancha, Castilla y Leon, Madrid, Cantabria, Andalusia, and La Rioja were among them. The latter saw the most significant increase, with 42.7% more properties sold than in 2020. On the other hand, the Basque Country saw an annual gain of 15.8%. According to the statistics on transfers of property rights from the National Research Institute (INE), the sale of houses increased by 40.6% in September 2021 compared to September 2020. In the first nine months of 2021, home sales increased by 37.6%.

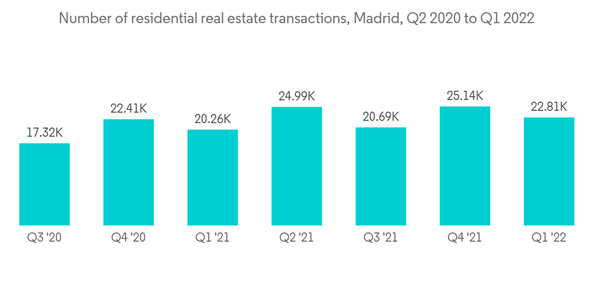

Approximately 23,000 residential real estate transactions were registered in Madrid during the first quarter of 2022. This was a slight decrease from the previous quarter when the record number of 25,000 homes were sold.

Spain Residential Real Estate Industry Overview

The Spanish residential real estate market is competitive with the presence of property developers like Neinor Homes, AEDAS Homes, Via Celere, and AELCA. The market also witnessed the entry of new players like Kronos Homes and Q21 Real Estate Market. The growing presence of international funds and foreign capital is increasingly attracting domestic developers to have joint ventures to gain a foothold in the country and enhance their financial strength and management expertise. Recent examples of these ventures include HIG and Monthisa, Pimco and Lar España, and KKR's partnership with Qubit. The market recovery in Spain's residential real estate is expected to continue to attract more players to enter the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- MetroVacesa

- Neinor Homes

- AEDAS homes

- Via Celere

- AELCA

- Acciona Inmobiliaria

- KRONOS

- Pryconsa

- Q21 Real Estate

- Spain Homes*