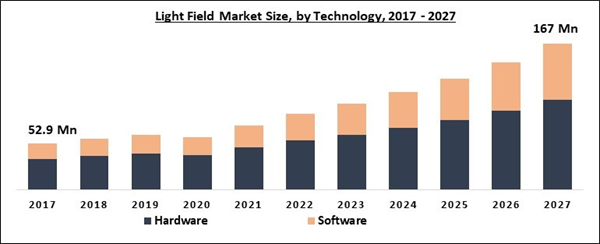

The Global Light Field Market size is expected to reach $167 Million by 2027, rising at a market growth of 14.6% CAGR during the forecast period. The light field helps to estimate the magnitude and intensity of light that travels in every direction over each point in space. The light field market is likely to witness bright growth prospects due to the constant technological advancements and massive utilization of 3D imaging technologies. Factors such as the growing demand for imaging devices and emerging 4D & 5D technologies are responsible for the growth & demand for light field technology in the global market.

Factors such as huge demand for 3D high-speed video capture, visual effect technology for entertainment purposes, utilization of sophisticated and latest 4G & 5G technologies, and just-in-time marketing are playing pivotal roles in boosting the growth & demand for light field technology in the market. Moreover, increasing demand for the adoption of prototyping, artificial technologies, and medical imaging with computational abilities is expected to create lucrative growth opportunities for the light field market.

Additionally, the entertainment & media industry can deploy this technology in museums, theaters, apps with the help of virtual reality headsets in order to appeal to end-users. This assists in obtaining real-time content with the help of micro-lens and enables the maximum fidelity of models, lighting, texture, and reflection in the case of computer graphics. The global light field market is expected to witness bright growth prospects due to the constant innovations and massive utilization of 3D imaging.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic had an adverse impact on the growth & demand for light field technologies, thus creating disruption in the overall market. Due to this, the growth of the market witnessed a drastic decline during the first half of 2020. On the other hand, this trend is expected to change in the latter half of the year as the demand is anticipated to fuel because of the increase in demand from the media & entertainment sector.

The value & supply chain of the light field market has significantly been impacted by the outbreak of the COVID-19 pandemic. Some of the major manufacturers of the light field are the US, Japan, and China and these nations were hit hard by the global pandemic. For this reason, the supply chain of the technology was disrupted, thus hindering the market growth during the pandemic. Currently, the industrial, healthcare, and architecture have low demand for the technology which is expected to continue for some more time because of the global pandemic.

Market Growth Factors:

Visual effects in games and movies can be enhanced by the technology

Light field technology is in high demand among Hollywood studios and VR companies for the purpose of cinematic and next-gen content. The entertainment sector is witnessing massive adoption of VFX that is generally called visual effects for developing visually improved imagery using computer graphics and animation. Presently, 3D animation software is helpful in such situations, in which still images are obtained and processed with the help of different kinds of 3D animation tools.

HD viewing is witnessing a massive demand

In the last couple of years, there has been extensive research in light field imaging due to its capacity to develop a natural viewing environment. Content quality and user-viewing experience have improved significantly after the advent of 3D technology. With the help of 3D technology, it is possible to offer high-definition (HD) content in order to improve the viewing experience using advanced 3D-integrated devices like VR and 3D display units.

Market Restraining Factor:

Low availability of proficient workforce

In order to gain technical knowledge in developing light-field, it requires a long time and is a challenging task. The technicians who offer light-field imaging and develop light field displays should have the required skills and experience in 3D project development. As per the Media & Entertainment Skills Council (MESC), installing light field technology in animation is a tedious process as various animators do not have the necessary skills. Thus, it is a must to put investment in enhancing workforce skills and fulfilling the regulations of the animation industry.

Technology Outlook

Based on Technology, the market is segmented into Hardware and Software. Hardware segment is further segmented into Imaging Solutions and Light Field Displays. The hardware segment procured the maximum revenue share of the light field sensor market in 2020. The segment is likely to show a similar kind of trend even during the forecasting period. Factor such as a surge in the research for designing light field displays like VR headsets and light field screens is responsible for the growth of this segment.

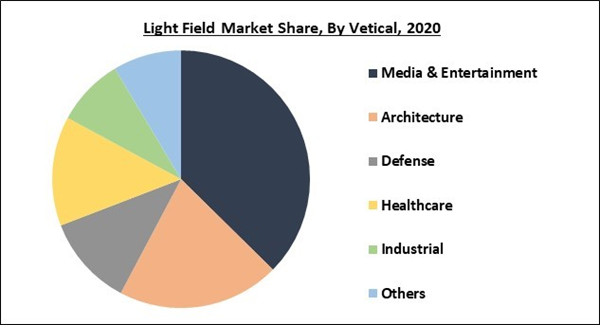

Vertical Outlook

Based on Vertical, the market is segmented into Media & Entertainment, Architecture, Defense, Healthcare, Industrial, and Others. VR and AR systems are the main applications of auto stereoscopy. AR technology is extremely helpful in enhancing the perception of reality among viewers on screens or glasses. Likewise, VR technology also changes the real world with a simulated one on screen and glasses. Support devices, hardware, and software are included in the light field display development kit and they allow the companies to develop industry-leading mixed-reality products.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. APAC is expected to exhibit the highest growth rate during the forecasting period. Asia pacific has massive potential as it is an emerging region that has massive opportunities for the media and entertainment industry. China is the prominent country of the APAC region due to the huge media & entertainment and healthcare sectors.

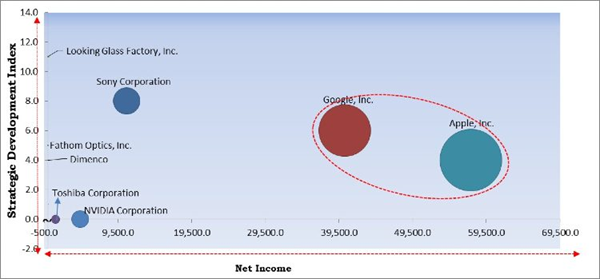

Cardinal Matrix - Light Field Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Apple, Inc. and Google, Inc. are the forerunners in the Light Field Market. Companies such as NVIDIA Corporation, Dimenco, Sony Corporation are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Toshiba Corporation, Apple, Inc., Sony Corporation, Google, Inc., NVIDIA Corporation, Dimenco, Raytrix GmbH, Holografika, Fathom Optics, Inc. and Looking Glass Factory, Inc.

Recent Strategies Deployed in Light Field Market

- Jul-2021: Looking Glass Factory rolled out the Looking Glass 4K Gen2 and Looking Glass 8K Gen2. Through this launch, the company expanded its advanced product line. These second-generation displays have the latest “blockless” design, and thus creating thinner, lighter hardware and advanced optics designed to decrease ambient reflections and enhance group view ability.

- May-2021: Google rolled out a 3D videoconferencing booth Project Starline utilizing a 65-inch light field display. Through this launch, the company aimed to make video conferencing more immersive by turning a person into a hologram. Moreover, the product was developed in-house, along with volumetric video capture and spatial audio technology.

- Feb-2021: Fathom Optics came into an exclusive US technical support agreement with All Printing Resources (APR). This agreement aimed to help APR becoming a trusted source for process certification, plate making, production orders from on boarded/certified converters, and design services and is expected to assist Fathom Optics to expand the reach of the new technology to converters.

- Feb-2021: Sony introduced FX6 Full-frame Professional Camera and FE C 16-35mm T3.1G E-mount lens. Through this launch, the company aimed to expand its Cinema line. Moreover, the latest FX6 is a dynamic tool for every kind of visual storyteller and constantly expanding the boundaries of imaging technology on the basis of the requirements of customers.

- Jan-2021: Fathom Optics unveiled a software platform. Through this launch, the company is expected to bring printed 3D and motion graphics to packaging without the need for specialty inks or substrates and without requiring additional materials like lenticulars or foils.

- Dec-2020: Looking Glass Factory introduced Looking Glass Portrait, the first personal holographic display. The product is expected to help individuals who work or play in 3D including photographers, Unity and Unreal developers, filmmakers, early adopters, 3D designers, and those who intend to explore three-dimensional capture and creation.

- Nov-2020: Dimenco entered into a global strategic partnership with Blink, a home automation company that produces battery-powered home security cameras. The partnership aimed to integrate the leading eye-tracking software platform of Blink with Simulated Reality (SR), an advanced glasses-free 3D display technology of Dimenco that is setting a new standard for visualization. Through this partnership, the companies is expected to bring next-generation 3D display experience with the help of deep skills in business and innovation strategy, product ideation, and technology development.

- Oct-2020: Sony Electronics launched Spatial Reality Display (SR Display), the latest product manufactured with the Eye-Sensing Light Field Display (ELFD) technology of Sony. The product utilizes spatial reality to integrate the virtual and physical world to develop a 3D optical experience that is viewable to the naked eye.

- Oct-2020: Looking Glass Factory formed a partnership with Kitware, a technology company based in the US. Together, the companies is expected to develop mainline versions of ParaView and 3D Slicer to make sure long-term support and unleashing the capability for all derivative software to add up to Looking Glass support.

- Jul-2020: Dimenco came into an exclusive distribution agreement with Cornes, a leading specialist importer, and distributor of electronic devices. Through this agreement, the companies is expected to aim to expand their Simulated Reality technology (SR) in Japan. Moreover, Cornes Technologies is expected to be the exclusive sales channel in Japan for its SR DevKit of which Dimenco installed multiple units in 2020.

- Dec-2019: Apple took over Spectral Edge, a UK-based startup. Through this acquisition, the company aimed to enhance iPhone Photography.

- Nov-2019: Looking Glass Factory launched Looking Glass 8K Immersive Display. Through this launch, the company is expected to offer a way to view 3D assets as holograms, with the requirement to utilize VR headsets.

- Feb-2019: Sony Semiconductor Solutions formed a partnership with Light, the computational imaging company behind the L16 camera. The partnership aimed to develop new multi-camera applications and solutions beginning with the introduction of smartphones containing four or more cameras. Through this partnership, the companies is expected to jointly work on the development and marketing of multi-image sensor solutions.

- Mar-2018: Google unveiled Welcome to Light Fields, a free app on Steam. The app is expected to offer users a guided tour of the Light Field technology and allows them to explore the future of VR apps and video games.

Scope of the Study

Market Segments Covered in the Report:

By Technology

- Hardware

- Imaging Solutions

- Light Field Displays

- Software

By Vertical

- Media & Entertainment

- Architecture

- Defense

- Healthcare

- Industrial

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Toshiba Corporation

- Apple, Inc.

- Sony Corporation

- Google, Inc.

- NVIDIA Corporation

- Dimenco

- Raytrix GmbH

- Holografika

- Fathom Optics, Inc.

- Looking Glass Factory, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Toshiba Corporation

- Apple, Inc.

- Sony Corporation

- Google, Inc.

- NVIDIA Corporation

- Dimenco

- Raytrix GmbH

- Holografika

- Fathom Optics, Inc.

- Looking Glass Factory, Inc.