Free Webex Call

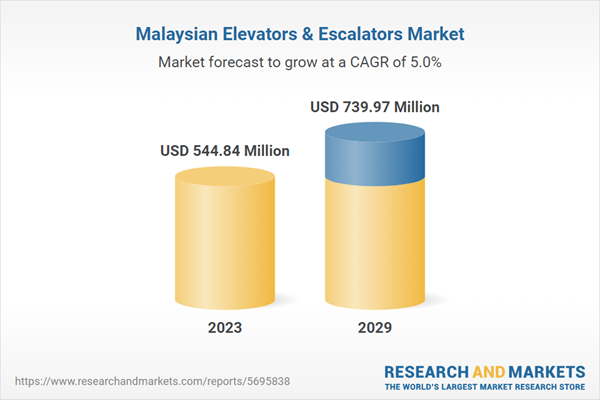

The Malaysia Elevators & Escalators Market was valued at USD 544.84 Million in 2023, and is expected to reach USD 739.97 Million by 2029, rising at a CAGR of 5.03%. Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

An elevator, or lift, serves as a mechanical apparatus installed within a structure to vertically convey people or objects between floors. It finds utility across diverse settings including residential complexes, commercial establishments, shopping centers, medical facilities, and industrial sites, facilitating the movement of passengers and goods efficiently. Elevators also serve industrial purposes, aiding in the transportation of equipment, materials, and finished products within factories and plants.

Escalators, alternatively termed as moving staircases, operate on electric power and are characterized by a system comprising a chain and drive sprocket, supported by dual tracks. Elevators are categorized into traction, hydraulic, and machine room-less traction variants, each tailored to specific architectural and functional requirements. Escalators are further classified into two types: moving stairs, providing inclined transportation, and moving walkways, facilitating horizontal movement.

Key Market Drivers

Growth of the Real Estate Sector

The robust growth of Malaysia’s real estate sector plays a pivotal role in driving the elevators and escalators market. With rising demand for residential, commercial, and mixed-use properties, developers are incorporating high-tech vertical transportation solutions to meet modern infrastructure needs. Malaysia’s real estate sector benefits from a favorable regulatory environment, foreign direct investment inflows, and government initiatives, such as the Malaysia My Second Home (MM2H) program. These programs attract international buyers and expats, boosting the demand for luxury residences and commercial spaces equipped with elevators and escalators.High-end residential properties, in particular, increasingly feature state-of-the-art elevators with advanced safety and energy-saving features, as these elements have become essential selling points. Commercial real estate is another key driver. Office buildings, shopping malls, and hotels require escalators and elevators to ensure seamless movement within their premises. For example, shopping malls like Pavilion Kuala Lumpur and Suria KLCC prioritize escalators and elevators as part of their design to handle high foot traffic. As the retail sector continues to expand, driven by consumer spending and tourism, the demand for escalators in these environments remains strong.

Additionally, the trend of mixed-use developments, which combine residential, retail, and office spaces, is gaining traction in Malaysia. Such projects, like Bukit Bintang City Centre (BBCC), require integrated elevator and escalator systems to cater to the diverse needs of users across different floors and areas. The real estate sector, including construction and property development, contributes around 5-6% of Malaysia's GDP annually. As of 2023, approximately 120,000 residential units are under construction, signaling continued demand for housing.

Expansion of the Tourism and Hospitality Industry

The expansion of Malaysia’s tourism and hospitality industry significantly drives the elevators and escalators market. Renowned for its vibrant culture, natural beauty, and strategic location in Southeast Asia, Malaysia attracts millions of tourists annually, necessitating the development of world-class hotels, resorts, and tourist attractions. The government’s emphasis on promoting tourism under initiatives like Visit Malaysia 2020 and long-term economic plans has resulted in a surge of investments in the hospitality sector. High-end hotels and resorts require elevators and escalators to provide convenience and enhance guest experience.For example, iconic establishments like the Genting Highlands Resort and luxury hotels in Langkawi are equipped with modern elevator systems to cater to a high volume of guests efficiently and safely. Beyond hospitality, tourist attractions such as observation towers, theme parks, and shopping malls rely heavily on vertical transportation. For instance, the Petronas Twin Towers and Menara KL are not only architectural landmarks but also significant contributors to the demand for elevators designed for high-speed and high-altitude travel. Similarly, escalators are indispensable in public spaces like airports, where smooth passenger flow is essential. The growing demand for luxury experiences in tourism is also influencing the choice of elevators and escalators. Features like panoramic glass elevators, smart control systems, and energy-efficient designs are increasingly favored to enhance the aesthetic and functional appeal of tourism-related infrastructure.

Rising Demand for Modernization and Maintenance Services

The rising demand for modernization and maintenance services in Malaysia is another significant driver of the elevators and escalators market. With a substantial number of aging buildings across the country, especially in urban centers like Kuala Lumpur, the need to upgrade and maintain existing elevator and escalator systems is critical. Many older residential and commercial buildings still use outdated vertical transportation systems that lack modern safety features, energy efficiency, and advanced technology. Property owners and managers are increasingly seeking modernization services to improve performance, comply with updated safety regulations, and extend the lifespan of their equipment.This trend is particularly prominent in older high-rise buildings, where elevators and escalators are essential for daily operations. The government’s push for sustainable building practices and green certifications has also spurred demand for upgrading elevators to energy-efficient models. Retrofitting older systems with regenerative drives, LED lighting, and smart control features helps reduce energy consumption and operating costs, aligning with Malaysia’s sustainability goals. Additionally, the emphasis on safety standards has led to a greater focus on regular maintenance.

Elevators and escalators are subject to stringent inspection requirements to ensure compliance with safety norms, driving the demand for reliable maintenance services. In heavily used environments such as shopping malls, transit stations, and office buildings, regular upkeep is critical to minimize downtime and ensure uninterrupted service. Modernization and maintenance services also cater to the growing trend of smart elevators and escalators. Upgrading existing systems with IoT-enabled features, remote monitoring, and predictive maintenance capabilities helps enhance user experience and operational efficiency.

Key Market Challenges

High Dependency on Imported Equipment

One significant challenge in the Malaysia Elevators & Escalators market is the high dependency on imported equipment, which increases operational costs and limits the availability of locally manufactured alternatives. Most elevator and escalator systems used in Malaysia are sourced from global manufacturers based in countries like China, Japan, South Korea, and Europe. This reliance creates several challenges for local market stakeholders, including increased procurement costs, longer lead times, and vulnerabilities to global supply chain disruptions. The dependence on imported equipment makes the market sensitive to fluctuations in currency exchange rates.Any depreciation of the Malaysian ringgit against foreign currencies directly impacts the cost of procurement, which can lead to higher prices for customers or squeezed profit margins for suppliers and service providers. Furthermore, global supply chain disruptions - such as those caused by the COVID-19 pandemic - can result in delays in the delivery of equipment and spare parts, affecting project timelines and maintenance schedules. Additionally, the lack of significant local manufacturing capabilities limits the scope for customization based on regional requirements.

Imported systems may not always be optimized for Malaysia’s specific needs, such as energy efficiency for tropical climates or compact designs for space-constrained urban environments. This gap creates a challenge for developers who seek tailored solutions to meet both functional and aesthetic needs in their projects. This dependency hampers the development of local expertise in elevator and escalator design and manufacturing. While Malaysia has a growing talent pool of skilled technicians for installation and maintenance, the absence of domestic manufacturing opportunities restricts innovation and knowledge-sharing within the industry.

Over time, this reliance could hinder the country's efforts to achieve self-sufficiency in infrastructure and reduce its carbon footprint associated with transporting heavy equipment from abroad. To overcome this challenge, Malaysia needs to encourage investments in local manufacturing facilities and incentivize technology transfer from global players. This can help reduce dependency on imports, lower costs, and boost the development of homegrown solutions, ensuring a more resilient and sustainable market.

Rising Maintenance Costs and Regulatory Compliance

Another major challenge in Malaysia’s Elevators & Escalators market is the rising maintenance costs and the increasing stringency of regulatory compliance. Elevators and escalators are subject to rigorous maintenance standards to ensure passenger safety and operational efficiency. However, these requirements also pose financial and operational challenges for stakeholders. Maintenance costs are steadily increasing due to several factors. The aging infrastructure in many buildings, especially in urban centers like Kuala Lumpur, requires frequent repairs and upgrades to meet current safety standards.Additionally, the integration of advanced technologies such as smart monitoring systems and energy-efficient components increases the complexity of maintenance tasks. While these technologies improve long-term performance, their initial implementation and upkeep often come at a higher cost, particularly when specialized training for technicians is required. Moreover, adherence to stringent safety and regulatory standards adds to the financial burden.

Malaysia’s authorities, such as the Department of Occupational Safety and Health (DOSH), have established comprehensive guidelines for elevator and escalator installation, inspection, and maintenance. Building owners and service providers must ensure compliance with these regulations, which often involves additional costs for certifications, inspections, and system upgrades. Failure to comply can lead to penalties, legal liabilities, and reputational damage, further motivating stakeholders to prioritize regulatory adherence despite the cost implications.

Another contributing factor is the shortage of skilled technicians who are well-versed in both traditional systems and modern technologies. The gap in skilled labor not only increases service costs but can also result in delays and inefficiencies in maintenance operations. For small and medium-sized enterprises (SMEs) managing older buildings, these rising costs can be particularly challenging, potentially leading to deferred maintenance and compromised safety. To address this issue, industry players and the government can collaborate to subsidize training programs for technicians, promote cost-sharing models for system upgrades, and streamline regulatory processes to reduce administrative burdens. By addressing these challenges, Malaysia can ensure a safer and more efficient elevator and escalator market while managing costs effectively for all stakeholders.

Key Market Trends

Increased Adoption of Smart and Energy-Efficient Elevators and Escalators

The Malaysia Elevators & Escalators Market is experiencing a significant shift towards smart and energy-efficient systems, driven by advancements in technology, government initiatives for green buildings, and rising awareness of sustainability. These innovative systems integrate Internet of Things (IoT) technology, artificial intelligence (AI), and machine learning to enhance functionality, improve safety, and reduce energy consumption. Smart elevators and escalators provide real-time data on usage patterns, maintenance needs, and performance metrics, enabling operators to optimize operations and prevent downtime.Features like destination control systems and predictive maintenance are particularly popular as they enhance efficiency and improve user experience. For example, destination control technology reduces waiting times by directing users to the most suitable elevator, improving traffic management in high-rise buildings. The Malaysian government’s commitment to sustainability through initiatives like the Green Building Index (GBI) further accelerates the adoption of energy-efficient systems.

Developers are encouraged to incorporate green solutions, such as regenerative drives that recover energy during braking or operation and advanced standby modes that reduce power consumption when elevators or escalators are idle. As urbanization continues to rise, particularly in metropolitan regions like Kuala Lumpur and Penang, the demand for smarter and environmentally friendly mobility solutions is projected to grow further. Manufacturers are actively innovating to cater to this trend, offering systems that meet both modern building standards and consumer expectations. The shift towards smart and energy-efficient technologies not only aligns with sustainability goals but also reduces operational costs for building owners, creating long-term value.

Focus on Modernization and Retrofit Solutions

As many buildings in Malaysia reach the end of their lifecycle or require upgrades to meet modern standards, the market for elevator and escalator modernization is gaining momentum. Building owners and operators are increasingly focusing on retrofitting existing systems to improve safety, energy efficiency, and reliability without the need for complete replacements. Modernization solutions include upgrading control systems, installing energy-efficient motors, and adding advanced safety features like emergency brakes and sensors. Retrofitting is especially relevant for older buildings in urban areas like Kuala Lumpur, where replacing entire systems can be costly and disruptive. By modernizing existing equipment, building owners can comply with updated safety regulations, reduce operating costs, and improve performance.The demand for modernization is also fueled by the growing expectations of end-users for smoother, quieter, and more efficient mobility solutions. With the advent of smart technology, many modernization projects incorporate IoT-enabled systems to facilitate predictive maintenance, reduce downtime, and provide better user experiences. Additionally, modernization is aligned with Malaysia’s push for green building practices.

By retrofitting older elevators and escalators with energy-efficient components, building operators can contribute to sustainability goals while benefiting from lower electricity bills and government incentives. Manufacturers and service providers are responding to this trend by offering tailored modernization packages, allowing customers to upgrade systems incrementally or comprehensively, based on their budget and needs. This flexibility, combined with the growing necessity for compliance with new building codes and standards, ensures that modernization and retrofit solutions remain a critical growth driver in Malaysia’s elevators and escalators market.

Segmental Insights

Service Insights

The New installation segment held the largest market share in 2023. New installations dominate the Malaysia Elevators & Escalators Market due to the country’s rapid urbanization, growing infrastructure projects, and increased real estate development. The demand for new vertical transportation systems is primarily driven by the construction of high-rise residential buildings, commercial complexes, and mixed-use developments in urban areas like Kuala Lumpur, Johor Bahru, and Penang. Malaysia’s urban population is steadily rising, fueling the need for modern housing and office spaces that incorporate advanced elevator and escalator systems. High-rise developments, often preferred in land-scarce cities, require efficient vertical mobility solutions to ensure smooth transportation of residents and workers. This trend directly supports the dominance of new installations in the market.large-scale infrastructure projects initiated under government programs, such as the 12th Malaysia Plan, significantly contribute to the demand for new elevators and escalators. Transport infrastructure, including Mass Rapid Transit (MRT) and Light Rail Transit (LRT) systems, integrates elevators and escalators to enhance accessibility and improve commuter experiences. These developments provide a consistent pipeline of opportunities for new system installations. Foreign investments in Malaysia’s real estate and infrastructure further bolster this segment. Developers prioritize installing cutting-edge elevator and escalator systems to attract tenants and investors by emphasizing safety, speed, and energy efficiency.

The adoption of smart technologies, such as IoT-enabled systems and destination control systems, is also becoming a standard feature in new installations, aligning with modern building designs. Furthermore, Malaysia’s economic growth and increasing urban lifestyle preferences ensure sustained construction activity. Unlike modernization, which caters to existing infrastructure, new installations cater to the growing number of new projects, ensuring their market dominance. As Malaysia continues to urbanize and expand its infrastructure, the new installation segment is expected to maintain its leading position in the elevators and escalators market.

Regional Insights

The West Malaysia is the largest region in the Malaysia elevators & escalators market. West Malaysia dominates due to its higher urbanization, more developed infrastructure, and greater concentration of commercial and residential projects. The region, especially the Klang Valley, which includes Kuala Lumpur, is the economic and commercial hub of Malaysia, driving a significant portion of demand for elevators and escalators. West Malaysia's urbanization has led to the construction of numerous high-rise buildings, shopping malls, office towers, and mixed-use developments, all of which require advanced vertical transportation solutions. Major developments like the Kuala Lumpur International Airport (KLIA), the Petronas Twin Towers, and various luxury apartments further amplify the demand for these systems.The high population density and rapid growth of key cities such as Kuala Lumpur, Johor Bahru, and Penang in West Malaysia also contribute to the region's dominance. As commercial and residential real estate continues to expand, particularly in metropolitan areas, the need for efficient elevators and escalators is higher. This growth is fueled by the influx of foreign investment and Malaysia’s ambitious infrastructure projects, which consistently prioritize vertical transportation solutions.

In contrast, East Malaysia (comprising Sabah and Sarawak) sees comparatively slower growth in the elevators and escalators market. While there are notable developments in cities like Kota Kinabalu and Kuching, East Malaysia remains less urbanized than West Malaysia. The demand for elevators and escalators is more limited, primarily catering to a smaller number of high-rise buildings and commercial spaces. Infrastructure development in East Malaysia is progressing, but the market remains smaller relative to West Malaysia, making it less dominant in the overall elevator and escalator landscape.

Key Market Players

- Otis Worldwide Corporation

- Schindler Holding Ltd.

- KONE Corporation

- ThyssenKrupp AG

- Mitsubishi Electric Corporation

- Fujitec Co., Ltd.

- Hitachi, Ltd.

- Hyundai Elevator Co. Ltd.

Report Scope:

In this report, the Malaysia Elevators & Escalators Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Malaysia Elevators & Escalators Market, By Type:

- Elevator

- Escalator

- Moving Walkways

Malaysia Elevators & Escalators Market, By Service:

- Maintenance & Repair

- New Installation

- Modernization

Malaysia Elevators & Escalators Market, By End User Industry:

- Residential

- Commercial

- Institutional

- Infrastructural

- Others

Malaysia Elevators & Escalators Market, By Technology:

- Traction

- Hydraulic

- Machine Room-Less Traction

Malaysia Elevators & Escalators Market, By Door Type:

- Automatic

- Manual

Malaysia Elevators & Escalators Market, By Region:

- West Malaysia

- East Malaysia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Malaysia Elevators & Escalators Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview

2. Research Methodology

5. Malaysia Elevators & Escalators Market Outlook

6. West Malaysia Elevators & Escalators Market Outlook

7. East Malaysia Elevators & Escalators Market Outlook

8. Market Dynamics

11. Company Profiles

Companies Mentioned

- Otis Worldwide Corporation

- Schindler Holding Ltd.

- KONE Corporation

- ThyssenKrupp AG

- Mitsubishi Electric Corporation

- Fujitec Co., Ltd.

- Hitachi, Ltd.

- Hyundai Elevator Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | December 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 544.84 Million |

| Forecasted Market Value ( USD | $ 739.97 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Malaysia |

| No. of Companies Mentioned | 8 |