Online Sales Channel is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global alcoholic drinks market is significantly influenced by increasing premiumization and a growing demand for high-quality products. Consumers are progressively seeking beverages that offer superior craftsmanship, unique taste profiles, and authentic origins, moving away from mass-produced options. This trend is evident in categories like premium spirits, where consumers are willing to invest more for perceived higher value and an enhanced drinking experience. For instance, according to the Distilled Spirits Council of the United States, in February 2024, U. S. spirits supplier sales for Tequila and Mezcal collectively rose by 7.9% in 2023, achieving a total of $6.5 billion, indicating a strong preference for these higher-end categories. This sustained demand for premium offerings compels manufacturers to innovate and diversify their portfolios to cater to evolving consumer tastes.Key Market Challenges

The escalating regulatory scrutiny, which includes the implementation of higher excise taxes and increasingly restrictive advertising prohibitions, presents a significant impediment to the sustained growth of the global alcoholic drinks market. Higher excise taxes directly reduce consumer affordability and producer profitability, thereby suppressing demand. For example, according to SpiritsEUROPE, excise duties in Nigeria surged by 200% in 2022, and in Ghana by 100% in the same year, directly impacting sales volumes. These substantial tax increments force businesses to absorb costs or pass them to consumers, hindering market expansion and potentially stimulating illicit trade.Key Market Trends

The global alcoholic drinks market is increasingly shaped by strategic geographic expansion into developing markets, presenting substantial growth opportunities through rising disposable incomes and evolving consumer preferences. Companies are actively establishing their presence in regions with burgeoning middle classes. The Brewers Association, in its 2024 mid-year report, indicated that international markets, particularly Latin America and Asia, showed increased interest in imported craft beer, with export volumes growing by 4% in 2023. This trend is crucial for sustained market growth, enabling brands to diversify revenue streams.Key Market Players Profiled:

- Anheuser-Busch InBev

- Heineken Holding N.V.

- Diageo PLC

- Kweichow Moutai Co. Ltd.

- Pernod Ricard SA

- Molson Coors Beverage Company

- Carlsberg Group

- Thai Beverage Plc

- Asahi Group Holdings, Ltd.

- Kirin Holdings Company, Limited

Report Scope:

In this report, the Global Alcoholic Drinks Market has been segmented into the following categories:By Product:

- Beer

- Vodka

- Whisky

- Wine

- Rum

- Others

By Packaging Type:

- Bottles

- Can

By Distribution Channel:

- Liquor Stores

- On-Premises

- Online Sales Channel

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Alcoholic Drinks Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Alcoholic Drinks market report include:- Anheuser-Busch InBev

- Heineken Holding N.V.

- Diageo PLC

- Kweichow Moutai Co. Ltd.

- Pernod Ricard SA

- Molson Coors Beverage Company

- Carlsberg Group

- Thai Beverage Plc

- Asahi Group Holdings, Ltd.

- Kirin Holdings Company, Limited

Table Information

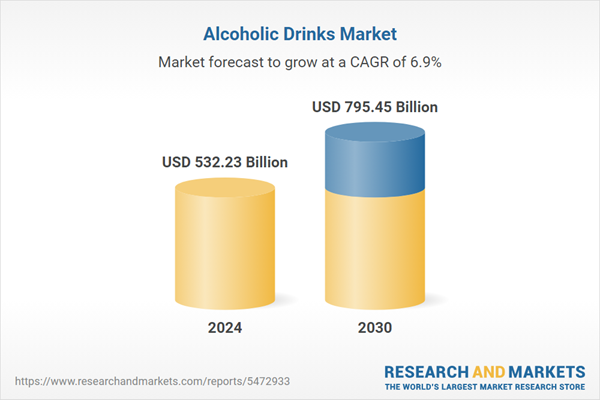

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 532.23 Billion |

| Forecasted Market Value ( USD | $ 795.45 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |