Environmental concerns and supportive government policies are key drivers for the growth of the car sharing market. Car-sharing services help in achieving environmental sustainability through the reduction of privately owned vehicles, which reduces greenhouse gas emissions and reduces urban congestion. Governments worldwide are implementing policies and incentives to encourage car sharing to achieve environmental goals. The integration of shared mobility options in public transportation systems across the United States is also facilitated by federal funding programs that aim at enhancing accessibility and minimizing dependence on private cars. More so, some states have tax credits for employers to encourage car sharing among their employees, hence encouraging more uptake of shared mobility solutions. The environmental benefits paired with government support create a friendly environment for the growth of car-sharing services, satisfying wider goals of sustainable urban development and a reduced carbon footprint.

The U.S. car sharing market is emerging as a major disruptor, holding 80.00% of the total share. This market is growing because of urbanization, environmental awareness, and support policies. Because of population growth in the cities, it poses significant challenges like traffic congestion and parking availability. This service is quite helpful because car-sharing can be taken for short time periods on flexible and economic terms as a mode of vehicle ownership for millennial and Gen Z customers. Technological advancements, such as app-based booking, GPS tracking, and remote vehicle access, are making these services more accessible and user-friendly. Moreover, concern for the environment is creating pressure on consumers and policy makers to make sustainable modes of transportation. Electric vehicle integration into car-sharing fleets is on the rise, while federal and state incentives are prompting low-emission vehicle adoption. According to recent reports, greenhouse gas emissions can decrease by as much as 34% in urban areas if shared mobility services replace personal car ownership.

Car Sharing Market Trends:

Growing Integration of EVs

One of the significant trends in the market is the widespread adoption of electric vehicles. As environmental awareness continues to rise and regulations regarding emissions levels become stringent, various car sharing companies across countries are widely adopting EVs that appeal to eco-friendly individuals. For instance, in September 2023, Autonomy, one of the electric vehicle subscription companies, and the leading all-electric vehicle car-sharing platform, EV Mobility, LLC., collaborated to accelerate flexibility by making an electric vehicle available to anyone with a credit card, valid driver's license, and smartphone. Similarly, in September 2023, Marubeni Corporation introduced a PoC project for the car-sharing of electric vehicles (EVs) in Gunma Prefecture, Japan. In line with this, the research conducted by the European Energy Agency reveals electric cars emit roughly 17-30% less carbon as compared to gasoline or diesel vehicles. Apart from this, EVs not only aid in reducing pollution but also lower operational costs associated with fuel and maintenance, thereby aligning with global sustainability goals. For instance, in March 2024, Uber developed a luxury electric vehicle-sharing service called 'Uber Comfort Electric' in New York City, U.S. In addition, it also unveiled a new product feature called 'Emissions Scorecard' to encourage customers to make eco-friendly choices. Furthermore, in January 2024, Míocar, one of the nonprofit car-sharing platforms, expanded its reach across the rural California Central Valley to bring electric transportation options and vehicles to low-income communities.Increasing Digital Advancements

The inflating technological advancements, coupled with the elevating adoption of mobile apps, are positively influencing the car sharing market outlook, thereby enhancing user experience and operational efficiency. For instance, in March 2024, Arval Group developed a mobile car sharing application exclusively dedicated to companies, which focuses on the mobility and comfort of employees. The Arval Car Sharing app, like other apps in the Arval portfolio, assists fleet managers in streamlining fleet costs and provides employees with cars they can easily share. As stated by the GSMA's annual State of Mobile Internet Connectivity Report 2023 (SOMIC), over half of the global population, which is roughly 4.3 Billion people currently owns a smartphone. Besides this, mobile apps are gaining extensive traction, as they allow users with easy access to unlocking, booking, and locating vehicles. For example, in May 2024, Roamly, one of the API-enabled digital insurance platforms, announced the introduction of its proprietary car share insurance product specifically designed for commercial fleet vehicle operators. Through the launch, car sharing marketplace companies can cover the specific needs of users during both non-rental and rental periods, thereby providing modernized insurance coverage to reward car-sharers while also removing premiums for features they aren't using, which, in turn, aids in safeguarding their profits. Apart from this, in April 2024, Yango, a global tech company, introduced Yango SuperApp, which makes it easy for individuals to select and rent a vehicle with just a few taps on their devices.Emphasis on Urban Mobility Solutions

The rising traffic congestion, along with limited parking spaces, are making car sharing an integral part of urban mobility solutions. For instance, in January 2024, one of the German-based remote-driving startups, Vay, introduced a remotely driven rental car service in Las Vegas, Nevada, that enables users to rent a car on a per-minute basis, thereby offering a cost-effective and hassle-free mobility solution. Additionally, cities are collaborating with car sharing companies to integrate these services into public transportation networks to offer residents with convenient and flexible transportation options. For instance, in December 2023, Zipcar teamed up with university campuses, cities, and both commercial and residential businesses to provide electric vehicles to drivers seeking easy and affordable access. Additionally, the company committed to dedicating 25% of its electric fleet to disadvantaged communities in need of affordable, convenient transportation for work, errands, or visiting family and friends. Apart from this, in May 2024, Seattle-based car-sharing firm Zero Emission Vehicle Cooperative (ZEV Co-op) partnered with Gonzaga University, Urbanova, and Avista to introduce an electric vehicle car sharing program in Spokane, U.S. In line with this, it allows users to borrow a car by joining ZEV CO-op and paying an hourly fee to use the car.Car Sharing Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global car sharing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on car type, business model, and application.Analysis by Car Type:

- Economy

- Executive

- Luxury

- Others

Analysis by Business Model:

- P2P

- Station Based

- Free-Floating

Analysis by Application:

- Business

- Private

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

North America Car Sharing Market Analysis

The car-sharing market in North America is expanding due to a combination of economic, technological, and environmental factors. Growing consumer demand for flexible and cost-effective transportation alternatives has driven the adoption of car-sharing services, especially among younger generations who prioritize convenience and affordability over ownership. Rising urbanization and concerns about congestion and emissions have further emphasized the appeal of shared mobility, with services offering a sustainable solution to reduce the number of vehicles on the road. Technological advancements, such as GPS-enabled apps and seamless vehicle access, have enhanced user experiences, making car-sharing more accessible and efficient. Additionally, government policies promoting environmental sustainability, including incentives for electric vehicle (EV) adoption within car-sharing fleets, have bolstered the market. With reduced costs for maintenance, insurance, and parking, alongside environmental benefits like lower emissions, car sharing is increasingly becoming a preferred choice for individuals and businesses across North America.United States Car Sharing Market Analysis

The car-sharing industry in the United States is witnessing significant expansion, propelled by various factors such as increased environmental consciousness, urban development, and changing consumer tastes. A report from Washington State University projects that 75% of Americans plan to emphasize sustainability while traveling, indicating an increasing demand for environmentally friendly transportation choices. Car-sharing services are also gaining recognition as a more sustainable option owing to its reduced carbon footprint relative to conventional vehicle ownership. Besides this, burgeoning urbanization is also impacting consumer choices significantly, particularly among millennials and Gen Z, who are preferring flexible mobility options that remove the financial and logistical stresses of car ownership. The ease of mobile applications for reservations, payments, and vehicle monitoring additionally boosts the attractiveness of car-sharing services. Moreover, the increase of electric vehicle (EV) fleets in car-sharing services is in harmony with government efforts to encourage electric mobility, contributing to the expansion of the market. Collectively, these elements are promoting the growth of car-sharing as an effective, sustainable transportation option in urban regions throughout the US.Europe Car Sharing Market Analysis

In the European countries, the car-sharing market is being driven by factors including strong environmental policies, burgeoning urbanization, and a growing preference for sustainable and cost-effective transportation options. European cities like Berlin, Paris, and Amsterdam are experiencing increasing adoption of car-sharing solutions owing to stringent environmental regulations in order to reduce carbon emissions. In line with this, the widespread application of public transportation is also influencing shared mobility trends, with 81% of Europeans relying on public transit for day-to-day travel, according to a GART/UTPF study presented at EuMo. This presents an opportunity for car-sharing services to complement public transport, offering an efficient alternative for individuals who do not own a private vehicle. Furthermore, supportive government policies and incentives for EVs are also encouraging car-sharing companies to expand their EV fleets in the region, thereby favoring the market growth. The integration of car-sharing with existing public transport systems provides a seamless, sustainable transportation option, making it an attractive solution for Europeans looking for flexible mobility.Asia Pacific Car Sharing Market Analysis

The car-sharing market in the Asia Pacific region is significantly being driven by a n expanding middle-class population coupled with increasing environmental pollution and relative concerns. The region is also experiencing heightening urbanization which is also driving the demand for car sharing particularly in the areas with high traffic congestion such as New Delhi, Tokyo, Seoul, and Shanghai. This is prompting governments to implement stricter regulations that in turn are favoring shared mobility. The region is also experiencing a shift in the mindset of the younger population increasingly turning to car-sharing services as a flexible and cost-effective alternative to traditional car ownership. According to GSMA, in 2022, mobile technologies and services contributed nearly 5% to Asia Pacific’s GDP, amounting to USD 810 Billion in economic value. This widespread adoption of mobile technologies has facilitated the growth of car-sharing platforms, making it easier for consumers to access these services via smartphones. Furthermore, investments in electric vehicle (EV) infrastructure are accelerating the adoption of car-sharing fleets, supporting the region’s shift toward sustainable mobility solutions. These factors are driving the growing demand for car-sharing in urban areas across APAC.Latin America Car Sharing Market Analysis

In Latin America, the car-sharing market is primarily influenced by burgeoning urbanization, rising traffic congestion, and economic conditions. In urban areas such as São Paulo, Mexico City, and Buenos Aires, the expensive costs of vehicle ownership present car-sharing services consumers as a desirable and economical options. Moreover, increasing worries regarding air pollution are motivating consumers to look for sustainable transportation options. As per GSMA, mobile services and technologies accounted for 8% of Latin America's GDP in 2023, underscoring the region's growing dependence on digital platforms. The extensive use of mobile technology simplifies access to car-sharing services for consumers, accelerating the market's expansion throughout the region.Middle East and Africa Car Sharing Market Analysis

In the Middle East and Africa, the car-sharing industry is fueled by urban growth, increasing traffic congestion, and a rising need for adaptable transportation solutions. Cities such as Dubai and Johannesburg are experiencing a growing interest in car-sharing as a substitute for personal vehicle ownership, particularly among younger individuals. According to the Dubai Water and Electricity Authority, the count of EVs in Dubai increased to 25,929 by December 2023, an increase from 15,100 in 2022, highlighting the area's dedication to sustainable transportation. The increase in EV adoption, along with technological progress, is boosting the development of car-sharing services in the area.Competitive Landscape:

Leading players in the car-sharing market are implementing multifaceted strategies to enhance their services and expand their reach. A significant trend is the integration of electric vehicles (EVs) into their fleets, driven by environmental concerns and supportive government policies. For instance, several companies have partnered with various EV manufacturers to offer drivers discounted rates, thereby promoting the adoption of electric vehicles through their platform. Technological innovation is another focal point. Companies are advancing autonomous driving technologies, aiming to introduce robotaxi services that could revolutionize car sharing by reducing the need for human drivers and potentially lowering operational costs. Strategic partnerships are also shaping the market. Companies are collaborating with other players to integrate self-driving vehicles into their platform exemplifies efforts to enhance service offerings and operational efficiency through alliances.The report provides a comprehensive analysis of the competitive landscape in the car sharing market with detailed profiles of all major companies, including:

- Cambio Mobilitätsservice GmbH & Co. KG

- Car2Go Ltd.

- CarShare Australia Pty. Ltd.

- Cityhop Ltd.

- Communauto Inc.

- DriveNow GmbH & Co. KG (BMW AG)

- Ekar FZ LLC

- Getaround Inc.

- HOURCAR

- Locomute (Pty.) Ltd.

- Lyft Inc.

- Mobility Cooperative

- Modo Co-operative

- Turo Inc. (ICA)

- Zipcar Inc. (Avis Budget Group)

Key Questions Answered in This Report

1. What is car sharing?2. How big is the car sharing market?

3. What is the expected growth rate of the global car sharing market during 2025-2033?

4. What are the key factors driving the global car sharing market?

5. What is the leading segment of the global car sharing market based on car type?

6. What is the leading segment of the global car sharing market based on business model?

7. What is the leading segment of the global car sharing market based on application?

8. What are the key regions in the global car sharing market?

9. Who are the key players/companies in the global car sharing market?

Table of Contents

Companies Mentioned

- Cambio Mobilitätsservice GmbH & Co. KG

- Car2Go Ltd.

- CarShare Australia Pty. Ltd.

- Cityhop Ltd.

- Communauto Inc.

- DriveNow GmbH & Co. KG (BMW AG)

- Ekar FZ LLC

- Getaround Inc.

- HOURCAR

- Locomute (Pty.) Ltd.

- Lyft Inc.

- Mobility Cooperative

- Modo Co-operative

- Turo Inc. (ICA)

- Zipcar Inc. (Avis Budget Group)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | August 2025 |

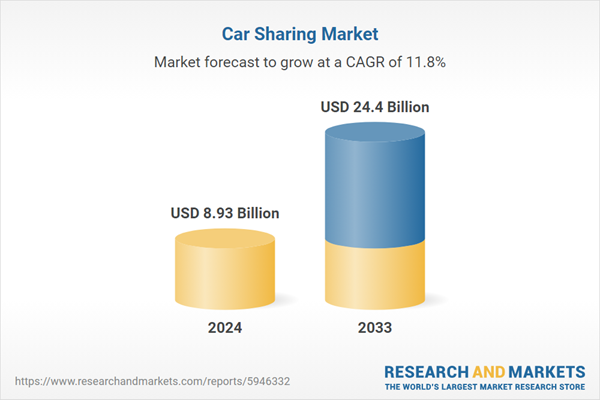

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 8.93 Billion |

| Forecasted Market Value ( USD | $ 24.4 Billion |

| Compound Annual Growth Rate | 11.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |