Fiberglass is a composite material composed of fine glass fibers embedded in a resin matrix. It is widely used in various industries due to its exceptional strength, lightweight nature, and insulating properties. The glass fibers in fiberglass are typically made from silica-based materials, such as sand, and are manufactured through a process called fiberization. The fibers are then combined with a thermosetting resin, commonly polyester or epoxy, which acts as a binding agent. This combination results in a versatile material that possesses high tensile strength, excellent resistance to corrosion, and superior thermal and electrical insulation properties. Fiberglass finds extensive applications in sectors such as construction, automotive, aerospace, marine, and electrical industries. Its versatility allows it to be molded into complex shapes and used for a wide range of products, including pipes, tanks, panels, insulation, boat hulls, automobile parts, and aircraft components.

The growing construction industry, particularly in emerging economies, is a major driver. Fiberglass is widely used in construction for applications, such as insulation, roofing, and reinforcement, due to its excellent strength-to-weight ratio and insulation properties. Additionally, the automotive industry plays a significant role in the demand for fiberglass. As the industry shifts toward lightweight materials to improve fuel efficiency and reduce emissions, fiberglass is increasingly used in the manufacturing of automotive components like body panels, interiors, and structural reinforcements. Besides this, the renewable energy sector is driving the demand for fiberglass. Fiberglass is used in the production of wind turbine blades due to its high strength and resistance to corrosion. With the increasing focus on renewable energy generation, the demand for fiberglass in the wind energy sector is expected to witness substantial growth. Other than this, the aerospace industry contributes to the demand for fiberglass. The material's lightweight nature and high strength make it suitable for aerospace applications, including aircraft interiors, panels, and structural components.

Fiberglass Market Trends/Drivers:

- Growing Construction Industry

Automotive Industry Shift towards Lightweight Materials

The automotive industry's emphasis on fuel efficiency and reducing emissions has led to a growing demand for lightweight materials, including fiberglass. Fiberglass is being increasingly used in the manufacturing of automotive components such as body panels, interiors, and structural reinforcements. Its high strength, coupled with its lightweight nature, helps to reduce the overall weight of vehicles without compromising on safety and performance. This results in improved fuel efficiency and lower carbon emissions. Additionally, fiberglass offers design flexibility, enabling automakers to create complex shapes and aerodynamic designs. As the automotive industry continues to focus on sustainability and efficiency, the demand for fiberglass is expected to witness substantial growth.Renewable Energy Sector's Demand for Wind Turbine Blades

Fiberglass is extensively used in the production of wind turbine blades due to its high strength, durability, and resistance to corrosion. With the global shift towards clean and sustainable energy sources, there has been a rapid increase in wind energy installations. As a result, the demand for fiberglass in the manufacturing of wind turbine blades has witnessed significant growth. Fiberglass blades offer several advantages, including lighter weight, increased length, and improved aerodynamics, leading to higher energy generation efficiency. The ongoing investments in wind power projects, government support, and favorable policies aimed at reducing carbon emissions contribute to the growing demand for fiberglass in the renewable energy sector.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global fiberglass market report, along with forecasts at the global, regional and country levels from 2023-2028. Our report has categorized the market based on glass product type, glass fiber type, resin type, application and end user.Breakup by Glass Product Type:

- Glass Wool

- Direct and Assembled Roving

- Yarn

- Chopped Strand

- Others

Direct and assembles roving represented the largest segment

The report has provided a detailed breakup and analysis of the market based on the product type. This includes glass wool, direct and assembles roving, yarn, chopped strand, and others. According to the report, direct and assembles roving represented the largest segment.Direct and assembled roving are key product types in the fiberglass market. Direct roving consists of continuous glass filaments that are bundled together for strength and used in applications such as pultrusion, filament winding, and weaving. Assembled roving, on the other hand, is made by combining multiple strands of direct roving, enhancing its mechanical properties. Assembled roving finds applications in sectors such as automotive, aerospace, and infrastructure for reinforcement purposes.

Glass wool is widely used for thermal and acoustic insulation purposes. It is composed of fine glass fibers that are bonded together to form a wool-like material. Glass wool offers excellent thermal insulation properties, making it suitable for applications in the construction, HVAC, and industrial sectors.

Fiberglass yarn is a versatile product used in various industries, including textiles, electrical insulation, and composites. It is composed of multiple glass filaments twisted or plied together to form a strong and flexible yarn. Fiberglass yarn offers high tensile strength, heat resistance, and chemical stability, making it suitable for applications such as fabric production, reinforcement in composites, and electrical insulation.

Chopped strand is another important product type in the fiberglass market. It consists of short glass fibers typically ranging from a few millimeters to several centimeters in length. Chopped strands are used in industries such as automotive, construction, and consumer goods to reinforce plastics, thermoplastics, and composites. They improve the strength, impact resistance, and dimensional stability of the final products.

Breakup by Glass Fiber Type:

- E-Glass

- A-Glass

- S-Glass

- AR-Glass

- C-Glass

- R-Glass

- Others

E-glass holds the largest market share

The report has provided a detailed breakup and analysis of the market based on the glass fiber type. This includes E-glass, A-glass, S-glass, AR-glass, C-glass, R-glass, and others. According to the report, E-glass represented the largest segment.E-glass is the most commonly used glass fiber type in the fiberglass market. It is known for its excellent electrical insulation properties, high tensile strength, and moderate chemical resistance. E-glass fibers are widely used in various industries, including construction, automotive, electrical, and telecommunications. They are used for applications such as reinforcement in composites, insulation, thermal and acoustic insulation, and electrical components.

S-glass fibers are known for their superior strength and stiffness compared to E-glass. They have a high tensile modulus and excellent resistance to impact, making them suitable for applications in industries like aerospace, defense, and sports equipment. S-glass fibers are often used in high-performance composites where strength and durability are crucial.

AR-glass (alkali-resistant glass) fibers are specifically designed to have excellent resistance to alkalis, making them suitable for applications in the construction industry, particularly for reinforcement in concrete and cement products. AR-glass fibers are used to enhance the strength, durability, and crack resistance of concrete structures, such as bridges, buildings, and tunnels.

Breakup by Resin Type:

- Thermoset Resin

- Thermoplastic Resin

Thermoset resins are widely used in the fiberglass market. These resins undergo a chemical reaction when cured, resulting in a rigid and durable material. The most common thermoset resins used in fiberglass applications are polyester and epoxy. Polyester resins offer good corrosion resistance and are commonly used in industries such as construction, marine, and automotive. Epoxy resins provide high mechanical strength, excellent adhesion, and chemical resistance, making them suitable for applications in aerospace, electrical, and composite manufacturing.

Thermoplastic resins are another category of glass resins used in fiberglass. Unlike thermoset resins, thermoplastics can be melted and re-molded multiple times without undergoing significant chemical changes. This property allows for easy processing and recycling. Examples of thermoplastic resins used in fiberglass applications include polypropylene (PP), polyethylene terephthalate (PET), and polyamide (PA). Thermoplastic resins find applications in industries such as automotive, consumer goods, and packaging.

Breakup by Application:

- Composites

- Insulation

Composites account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes composites and insulation. According to the report, composites represented the largest segment.Fiberglass composites are widely utilized in various industries due to their excellent strength-to-weight ratio and versatility. The reinforcing properties of fiberglass make it an ideal choice for composite materials. Fiberglass composites are used in applications such as automotive components, aerospace structures, wind turbine blades, boat hulls, and sporting goods. The combination of fiberglass with resins or thermoplastics results in lightweight, durable, and strong materials that can be molded into complex shapes. These composites offer benefits such as high strength, corrosion resistance, impact resistance, and design flexibility, making them suitable for a wide range of applications.

Fiberglass insulation is a key application in the construction and HVAC (heating, ventilation, and air conditioning) industries. Fiberglass insulation is used to reduce heat transfer, provide thermal insulation, and improve energy efficiency in buildings. It is commonly installed in walls, ceilings, roofs, and HVAC ducts to control temperature, reduce noise transmission, and conserve energy. Fiberglass insulation is known for its excellent thermal and acoustic insulation properties, fire resistance, moisture resistance, and ease of installation. It plays a crucial role in enhancing the energy efficiency and comfort of residential, commercial, and industrial buildings.

Breakup by End User:

- Construction

- Automotive

- Wind Energy

- Aerospace and Defense

- Electronics

- Others

Automotive applications dominate the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes construction, automotive, wind energy, aerospace and defense, electronics, and others. According to the report, automotive represented the largest segment.Fiberglass is highly valued for its lightweight, high strength, and resistance to corrosion, making it an excellent choice for automotive manufacturing. This lightweight feature directly contributes to the growing demand for more fuel-efficient vehicles as it allows for decreased vehicle weight and improved fuel economy. In line with this, the high strength of fiberglass ensures the durability and longevity of automotive components, adding to the safety and reliability of vehicles. Furthermore, fiberglass is cost-effective and easily molded, catering to the design flexibility required in the automotive sector. Furthermore, with the rise of electric vehicles, the need for heat-resistant and electrically insulating materials is rising, thereby driving the demand for fiberglass.

Breakup by Region:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

Asia Pacific exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest market.The Asia Pacific region stands as the largest market for fiberglass, largely due to its booming industrial growth, rapid urbanization, and increased infrastructure development. As home to some of the world's fastest-growing economies like China and India, the region has seen an amplified demand for fiberglass in various sectors, including automotive, construction, and electronics. The automotive sector, particularly, is experiencing swift expansion due to increased vehicle production and a push for lightweight, fuel-efficient materials. The construction industry, on the other hand, is propelled by urbanization and the demand for durable, lightweight, and corrosion-resistant materials. Additionally, favorable government policies and low manufacturing costs in the region foster local production and attract international companies. Besides this, the high population in the region, combined with growing disposable incomes, is driving consumer demand, thereby fueling the market further.

Competitive Landscape:

Key players are continuously investing in research and development activities to innovate and introduce new fiberglass products. They focus on developing advanced fiberglass materials with improved strength, durability, and performance characteristics to cater to the evolving needs of various industries. This includes the development of specialized fiberglass composites, high-performance insulation materials, and lightweight components for applications in automotive, aerospace, and construction sectors. Additionally, companies in the market are engaging in mergers, acquisitions, and collaborations to strengthen their product portfolios, expand their customer base, and enhance their manufacturing capabilities. These strategic moves allow companies to gain access to new technologies, markets, and distribution networks. By acquiring or partnering with complementary businesses, key players can offer comprehensive solutions and expand their global reach. Besides this, key players are forming partnerships and collaborations with other companies, research institutes, and industry associations to foster innovation, exchange expertise, and develop novel fiberglass solutions. These collaborations help in leveraging combined strengths and resources to address market demands more effectively.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Asahi Fiber Glass Co. Ltd. (Yoshino Gypsum Co. Ltd.)

- Braj Binani Group

- Chongqing Polycomp International Corp. (Yuntianhua Group Co. Ltd.)

- Johns Manville (Berkshire Hathway Inc.)

- Knauf Insulation

- Owens Corning

- PFG Fiber Glass Corporation (Nan Ya Plastics Corporation)

- Taishan Fiberglass Inc (Sinoma Science & Technology Co. Ltd.)

- Taiwan Glass Industry Corporation

Recent Developments:

Nippon Electric Glass Co. Ltd. launched LX Premium, a multilayered radiation shielding glass produced by laminating an LX-57B radiation shielding lead glass panel with special cover glass panels.PFG Fiber Glass Corporation has been actively improving and adopting new advanced manufacturing technologies in the fiberglass industry. They have focused on advancements in binder and bushing design, equipment, and process improvement, as well as glass component development to enhance the quality and efficiency of fiberglass production.

Asahi Fiber Glass Co. Ltd has made recent developments in the fiberglass industry. The company is known for manufacturing and selling glass wool for use as residential insulation.

Key Questions Answered in This Report:

- How has the global fiberglass market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global fiberglass market?

- What is the impact of each driver, restraint, and opportunity on the global fiberglass market?

- What are the key regional markets?

- Which countries represent the most attractive fiberglass market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the fiberglass market?

- What is the breakup of the market based on the glass fiber type?

- Which is the most attractive glass fiber type in the fiberglass market?

- What is the breakup of the market based on the resin type?

- Which is the most attractive resin type in the fiberglass market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the fiberglass market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the fiberglass market?

- What is the competitive structure of the global fiberglass market?

- Who are the key players/companies in the global fiberglass market?

Table of Contents

Companies Mentioned

- Asahi Fiber Glass Co. Ltd. (Ypshino Gypsum co. Ltd)

- Braj Binani Group

- China Jushi Co. Ltd.

- Chongqing Polycomp International Corp.

- Compaigne De Saint-Gobain S.A.

- Johns Manville (Berkshire Hathaway Inc.)

- Knauf Insulation

- Nippon Electric Glass Co. Ltd.

- Owen Corning

- PFG Fiber Glass Corporation (Nan Ya Plastics Corporation)

- Taishan Fiberglass Inc. (Sinoma Science & Technology Co. Ltd.)

- and Taiwan Glass Industry Corporation

Table Information

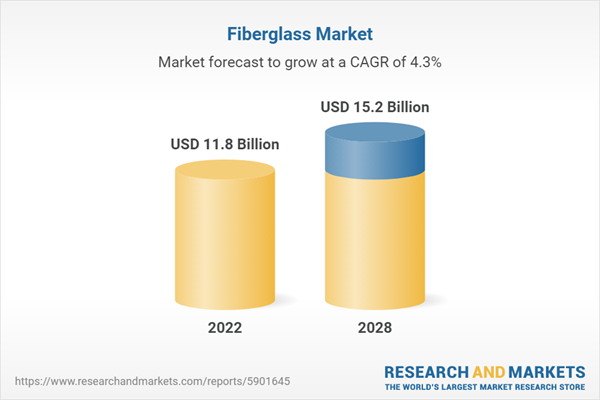

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 11.8 Billion |

| Forecasted Market Value ( USD | $ 15.2 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |