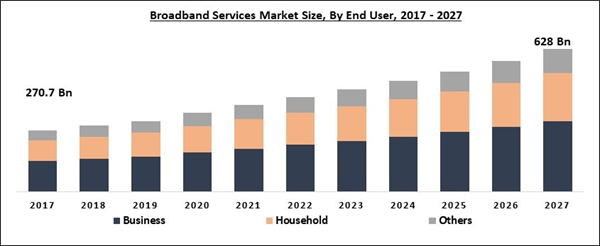

The Global Broadband Services Market size is expected to reach $628 billion by 2027, rising at a market growth of 8.6% CAGR during the forecast period. Broadband refers to a fast-speed internet connection technology that is utilized to transfer data, video, and voice across far-reaching distances rapidly. There are various kinds of broadband services like digital subscriber line (DSL), wireless, cable modem, fiber, broadband over powerlines. Fiber-optic broadband services are popular for their speed and reliability. The speed and working rely on the kind of broadband services the customer is availing. It is majorly function by the Internet service provider (ISP) that delivers the service and instruments to home or business online.

Broadband services provide superior internet service reliability, higher signal strength, large bandwidth, resistance to interference, and symmetric speed. Industries such as telecom, IT, education, eCommerce platforms, and hospital records are witnessing high demand for these services. In addition, they are significantly used in aerospace, defense, and marine.

As per the Organization for Economic Co-operation and Development (OECD), the increased number of wireless subscribers is creating new growth avenues for the broadband services market. Digital transformation in companies and higher adoption of online learning have fueled the requirement for digital education and created a consistent need for uninterrupted broadband connectivity. Moreover, the growth of the broadband services market is expected to be driven by the requirement for high-speed and smooth internet connections at companies, governments, individuals, & offices and a surge in demand for consumer broadband. In addition, the market growth is further fueled by the requirement for uninterrupted internet services in the education and IT industries.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic created uncertainty in the business activities of companies globally, hence drastically affecting the worldwide economy. Still, some lockdown restrictions persist in which companies are partially closed and people are forced to remain inside their home, has shown the requirement for digitalization to stay connected, run businesses, and maintain some level of normalcy. Education and fitness business models have increasingly moved to online coaching. In a similar fashion, the majority of companies have accepted the work from home model. These aspects along with a drastic rise in internet utilization for entertainment factors have boosted the growth & demand for broadband services in the last couple of months. Moreover, the majority of companies is expected to shift their strategies toward digital channels, hence accelerating the growth of the market.

Market Growth Factors:

The surge in demand for consumer broadband

The growth of the broadband services market is directly proportional to the demand for consumer broadband. Moreover, the growth of consumer broadband is expected to witness bright prospects due to the surge in the application of the internet in communication, sharing information, education & the entertainment industry. Moreover, the government is highly instrumental in boosting the demand for broadband internet services by offering superior public online services in all sectors, motivating rural and remote areas to utilize broadband internet services, setting up privacy and quality standards.

The high popularity of social media and OTT platforms

OTT platforms like Netflix and Amazon Prime are gaining more traction among the population across the globe, which is creating demand for broadband services in the market. In addition, the increasing demand for high-quality video content by the audience is motivating these platforms to introduce more video content on their platform. As a result, for a seamless and enhanced viewing experience, customers are installing broadband services, hence contributing to the growth of the broadband services market during the forecast period.

Market Restraining Factor:

The massive cost of fiber optic cable

The growth of the overall broadband services market is hampered by the huge cost of fiber optic cable. The fiber optic is an advanced technology that offers reliability and symmetrical speed options as compared to other internet services for consumers. Unlike other internet services, cable or copper installation adds to the already increased cost of fiber optic broadband services. Moreover, the installation of fiber optic lines is more complex and the cost evaluation is extremely hard for each building.

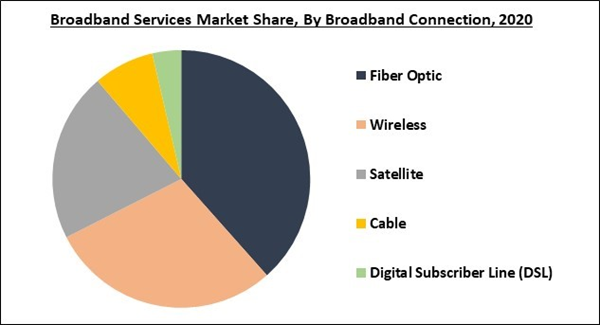

Broadband Connection Outlook

Based on Broadband Connection, the market is segmented into Fiber Optic, Wireless, Satellite, Cable, and Digital Subscriber Line (DSL). In 2020, the fiber optics segment procured the maximum revenue share of the broadband services market. Factor such as the ability of fiber optics to take high-quality network signals from the equipment of operator to a business, enterprise, or household is responsible for the growth of this segment.

End User Outlook

Based on End User, the market is segmented into Business, Household, and Others. The trend of online learning is constantly increasing as schools, colleges, and universities are increasingly adopting digital education models, hence needing a high-speed and reliable internet connection. Moreover, the surge in trend of a work-from-home model that witnessed a high surge because of the lockdowns imposed to curb the spread of COVID-19 pandemic and increasing entertainment and other media content online has allowed massive implementation of internet services in the household sector.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America is expected to emerge as the dominating region in the Broadband Services Market over the forecasting years. Several banks in the North American region like Bank of America, the Royal Bank of Canada, JPMorgan, and other financial service institutions are focusing on deploying blockchain technology and introducing full-scale commercial blockchain technology-based products.

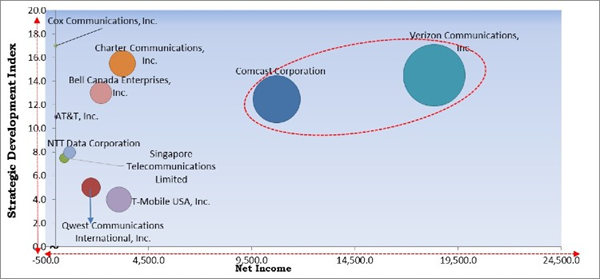

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Verizon Communications, Inc. and Comcast Corporation are the forerunners in the Broadband Services Market. Companies such as Charter Communications, Inc., T‑Mobile USA, Inc., Bell Canada Enterprises, Inc. are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AT&T, Inc. (AT&T Intellectual Property), Verizon Communications, Inc., Comcast Corporation, Qwest Communications International, Inc. (Lumen Technologies, Inc.), NTT Data Corporation, Charter Communications, Inc., T‑Mobile USA, Inc., Bell Canada Enterprises, Inc., Singapore Telecommunications Limited (Temasek Holdings), and Cox Communications, Inc.

Recent Strategies Deployed in Broadband Services Market

Partnerships, Collaborations and Agreements:

- Oct-2021: Verizon extended its partnership with Los Angeles Unified School District. The partnership aimed to offer entitled families access to mobile broadband plans, voice service plans, and equipment through the state, local, or non-profit organizations in California.

- Oct-2021: Singtel entered into a partnership with Ericsson, a Swedish multinational networking and telecommunications company. The partnership aimed to boost 5G adoption across various industries and leverage industry partnerships to develop and install next-generation 5G solutions in Singapore. Through this partnership, the networking expertise of Ericsson is expected to be integrated with 5G network, test facilities, and capabilities of Singtel.

- Oct-2021: AT&T signed a multi-year agreement with Frontier Communications, an American telecommunications company. Under this agreement, the two entities is expected to launch fiber-optic connectivity to large enterprises customers outside AT&T’s current footprint. The agreements aimed to strengthen the installation of 5G mobility network of AT&T. Moreover, AT&T is expected to provide large enterprise customers high-speed, low-latency, and highly secure connectivity in markets where it does not own a fiber network or presently plan to develop one.

- Oct-2021: AT&T signed a five-year agreement with Ericsson, a Swedish multinational networking and telecommunications company. Under this agreement, Ericsson is expected to assist AT&T to deliver its 5G network to a greater number of customers, companies, and first responders across major industries including 5G use cases in sports and venues, travel and transportation, entertainment, business transformation, and public safety.

- Sep-2021: Lumen Technologies joined hands with U.S. Postal Service (USPS). The collaboration is expected to strengthen and update its network services that support above 32,000 post offices and mail processing sites around the country. Under this collaboration, Lumen is expected to offer the USPS safe, highly resilient broadband, wireless access, software-defined networking, and managed network services that improve how these locations connect, collaborate, and interact with around 900 crucial information technology applications.

- Sep-2021: Verizon joined hands with The U.S. Department of Defense (DoD). Through this collaboration, Verizon is expected to offer its 5G Ultra Wideband mobility service to seven Air Force Reserve Command (AFRC) installations. Through its involvement in the OTL program, Verizon is offering 5G and other improved wireless network services across 17 Air Force bases across the United States.

- Sep-2021: AT&T teamed up with OneWeb, a global communications company building a capability to deliver broadband satellite internet services worldwide. The collaboration aimed to enhance connectivity access for the US-based telco’s enterprise, small and medium-sized businesses (SMBs), and government customers living in remote locations in the country while also improving connectivity for hard-to-reach cell towers.

- Aug-2021: Charter communication formed an agreement with the government of Scott County, a county in the U.S. state of Minnesota. The agreement aimed to introduce gigabit internet connectivity to above 5,300 rural, unserved homes and small businesses across the county.

- Aug-2021: Bell Canada formed an exclusive agreement with Casa Systems, a leading vendor of physical and cloud-native broadband technology solutions for wireless, cable, and fixed networks. Under this agreement, Casa Systems is expected to offer its latest 5G Sub-6 High-Gain Outdoor consumer premise equipment (CPE) for Wireless Home Internet service of Bell.

- Aug-2021: NTT came into a partnership with i-DATA, a wholly-owned subsidiary company of i-CABLE Communications. Through this partnership, the two companies is expected to address the growing demand for network reliability, business continuity, and cybersecurity in Hong Kong. Moreover, the partnership is expected to bring initiatives including managed network services to accelerate enterprises’ performance.

- Jul-2021: Charter Communications signed multi-year distribution agreements with ViacomCBS, an American diversified multinational mass media, and entertainment conglomerate corporation. These agreements is expected to support the ongoing carriage of ViacomCBS’ notable portfolio of broadcast, news, entertainment, and sports networks. Moreover, ViacomCBS’ portfolio of streaming services, including Paramount+, BET+ , Pluto TV, and Noggin is expected to be licensed for future distribution to Spectrum customers.

- Jul-2021: Bell Canada formed a multi-year partnership with Google Cloud, a suite of cloud computing services by Google. The partnership aimed to strengthen Bell's company-broad digital transformation, improve its network and IT infrastructure, and facilitate a more sustainable future. Through this partnership, 5G network leadership is expected to be combined with multicloud, data analytics, and artificial intelligence (AI) expertise of Google to provide enhanced experiences for customers across Canada.

Acquisitions and Mergers:

- Oct-2021: Comcast acquired Masergy, a software-defined networking services company. The acquisition aimed to boost the Comcast's growth catering to large and mid-size enterprises, mainly U.S.-based organizations with multi-site global operations, and strengthen its overall channel distribution strategy.

- Oct-2021: Comcast Government Services, a division of Comcast took over Defined Technologies, a proven reseller of IT and telecommunications technology products to government agencies. The acquisition aimed to support the quickly growing position of Comcast as a premier vendor of connectivity and communications solutions to government agencies.

- Oct-2021: Cox Communications completed the acquisition of the commercial services segment of Charlotte, N.C.-based Segra, one of the largest privately-held fiber infrastructure providers in the U.S. Through this acquisition, the company is expected to strengthen its focus on strategic infrastructure investments and its ongoing commitment to the business services market.

Product Launches and Product Expansions:

- Jul-2021: Cox Business rolled out Cox Business Net Assurance, the latest Internet continuity service. Through this launch, the company is expected to provide higher protection to its customers from losing Internet connection during outages with two methods. First, in case of a loss of Internet access, wired and private Wifi connections will automatically failover to an LTE wireless network. Second, if there is a power loss, an uninterruptible power supply (UPS) battery backup with surge protection gives approximately four hours of power to keep systems on.

- May-2021: Singtel rolled out its 5G Standalone (SA) network. The new network is expected to provide customers early access to the most sophisticated 5G connectivity across the world. 5G SA provides twice the responsiveness, 30% faster uploads, and higher authentication and encryption capability. Moreover, the network has superior bandwidth and near-instant responses that is expected to allow revolutionary applications such as self-driving cars, real-time immersive entertainment, and massive IoT (Internet of Things) connections.

- Mar-2021: AT&T introduced fixed 5G wireless solutions to the first nationwide business-focused broadband network. The new solutions is expected to integrate AT&T's Wireless Broadband and its notable business fiber network, further improved by adding the latest fixed 5G wireless solutions.

- Feb-2021: Spectrum Enterprise, a division of Charter Communication, rolled out Managed Network Edge (MNE), a managed network solution built on the Cisco Meraki cloud-based platform. This new solution streamlines the installation and management of single and multi-location local area networks (LAN) / wide area networks (WAN).

Geographical Expansions:

- Oct-2021: Comcast expanded its geographical footprint by investing $28 million. Through this investment, the company made available its next-generation, fiber-rich network across Beltway Region of Delaware, Maryland, Virginia, Washington, D.C., and West Virginia. Moreover, the company is expected to also expand the availability of its multi-Gigabit Ethernet services.

- Sep-2021: Bell expanded its geographical footprint by making available its pure fibre Internet service to homes and businesses in the villages of Memramcook and St. Martins. Through this expansion, the company is expected to offer fast-speed and high-capacity 100% fibre connections with Internet download speeds of up to 1.5 Gbps and access to leading Bell services such as Fibe TV.

- Jul-2021: Lumen expanded its geographical reach by making available its fiber network infrastructure in Europe, strengthening its service capabilities in France, Switzerland, and Spain. Through this expansion, the company aimed to provide high-performance fiber closer to end-users to offer faster connections, lower latency, and improved security, for an exceptional customer experience.

- Jul-2021: Verizon expanded its geographical footprints by making available its 5G Business Internet, a fixed-wireless Internet offering to parts of 42 U.S. cities. The offering is powered by 5G Ultra-Wideband and includes professional installation with no digging and a rapid timeline to deployment.

- Feb-2021: Singtel expanded its geographical reach by making available its 5G network coverage, bringing 5G indoors at VivoCity, the largest mall in Singapore. Through this launch, the company is expected to offer reliable connectivity and a constant high-speed experience, making a real difference for the company’s customers whether they are surfing, streaming videos, or gaming while on the go.

Scope of the Study

Market Segments Covered in the Report:

By Broadband Connection

- Fiber Optic

- Wireless

- Satellite

- Cable

- Digital Subscriber Line (DSL)

By End User

- Business

- Household

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- AT&T, Inc. (AT&T Intellectual Property)

- Verizon Communications, Inc.

- Comcast Corporation

- Qwest Communications International, Inc. (Lumen Technologies, Inc.)

- NTT Data Corporation

- Charter Communications, Inc.

- T‑Mobile USA, Inc.

- Bell Canada Enterprises, Inc.

- Singapore Telecommunications Limited (Temasek Holdings)

- Cox Communications, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- AT&T, Inc. (AT&T Intellectual Property)

- Verizon Communications, Inc.

- Comcast Corporation

- Qwest Communications International, Inc. (Lumen Technologies, Inc.)

- NTT Data Corporation

- Charter Communications, Inc.

- T Mobile USA, Inc.

- Bell Canada Enterprises, Inc.

- Singapore Telecommunications Limited (Temasek Holdings)

- Cox Communications, Inc.