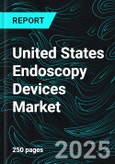

United States Endoscopy Device Market is anticipated to undergo a CAGR of 6.06% during the forecast years (2024 to 2030)

The escalating occurrence of brain and spinal cord tumors in the United States is poised to propel an increase in the endoscopy device market. According to the information published by the American Cancer Society in 2023, about 24,810 malignant brain or spinal cord tumors are projected to be recognized in the United States. Endoscopes, with their minimally invasive competencies, offer essential advantages in diagnosing and treating those conditions. Surgeons increasingly rely upon endoscopic strategies for precise visualization and intervention in delicate neural structures. As the demand surges for advanced endoscopic techniques tailored to neurosurgical applications, the market for endoscopy devices is expected to increase appreciably, addressing the urgent healthcare needs related to brain and spinal cord tumors.Technological improvements are poised to fuel the rise of the United States endoscopy tool market. Innovations, including high-definition imaging, miniaturization, and healing abilities, enhance the precision, performance, and versatility of endoscopic techniques. These advancements allow healthcare companies to perform complex diagnostic and therapeutic interventions with greater accuracy and patient comfort. As demand grows for a new endoscopic system that offers advanced visualization and remedy effects, the market is predicted to increase, pushed by the persistent evolution of cutting-edge technology in endoscopy. Hence, the United States endoscopy device market was US 11.53 Billion in 2023.

It is worth noting that government agencies increasingly help innovative thoughts that improve endoscope techniques and ensure they are infection-free. For example, in April 2022, the US FDA updated a safety communication on duodenoscopes, recommending that hospitals and endoscopy centers transition to new, modern designs to address concerns about reprocessing and patient cross-contamination. Further, businesses running in this market are driving a boom through various strategic projects, including product approvals, launches, partnerships, and acquisitions, all aimed toward expanding their endoscopy offerings.

Endoscopes are one of the primary device types used in endoscopy in the United States market

By product type, the United States endoscopy device market is fragmented into Endoscopes, Visualization & Documentation Systems, Mechanical Endoscopic Equipment, Accessories, and Other Endoscopy Equipment. Endoscopes represent one of the foremost product types in the United States endoscopy device market. This is due to their versatility and widespread application across clinical specialties. These devices enable minimally invasive visualization and intervention in various body cavities, which include the gastrointestinal tract, respiration system, and urinary tract. With non-stop technological improvements, endoscopes offer high-definition imaging, healing abilities, and more suitable maneuverability, making them indispensable for analysis and treatment. Their pivotal function in present-day healthcare drives sizable demand, cementing endoscopes as essential U.S. endoscopy device market additives.Gastrointestinal endoscopy is one of the most commonly used applications in the US endoscopy device market

By application, the United States endoscopy device market is segmented into Bronchoscopy, Arthroscopy, Laparoscopy, Urology endoscopy, Neuroendoscopy, Gastrointestinal endoscopy, Gynecology endoscopy, ENT endoscopy, and others. Gastrointestinal endoscopy has emerged as one of the most utilized applications in the United States endoscopy device market. With millions of processes conducted yearly, it is a cornerstone in diagnosing and treating digestive disorders like ulcers, polyps, and cancers. Endoscopic techniques provide unprecedented visualization and healing skills in the gastrointestinal tract, facilitating minimally invasive interventions and enhancing patient outcomes. As the need for particular diagnostic and healing processes continues to push upward, gastrointestinal endoscopy remains a primary cognizance, driving the increase in the U.S. endoscopy device market.Single-use endoscopy devices are a significant segment of the United States market

By hygiene, the United States endoscopy device market is classified into Single Use, Reprocessing, and Sterilization. Single-use endoscopy devices are one of the considerable sections in the United States market. This is because of their inherent benefits in infection control, convenience, and cost-effectiveness. With a heightened emphasis on patient protection and lowering healthcare-associated infections, single-use devices provide a sterile, disposable alternative to conventional reusable systems. This eliminates the need for reprocessing, reducing the hazard of cross-contamination and streamlining workflow. Also, the cost efficiencies related to single-use devices attract healthcare centers looking to optimize operational efficiency while maintaining excessive care requirements.Hospitals are among the major sectors in the endoscopy device market in the United States

By end-user, the United States endoscopy device market is categorized into Hospitals, Ambulatory Surgery Centers, and Others. Hospitals constitute one of the dominant segments in the United States endoscopy device market. This is attributed to their excessive patient magnitude and numerous medical specialties. Hospitals are primary customers of endoscopy devices. Endoscopic procedures, including gastroenterology, pulmonology, and urology, are routinely done throughout departments. The need for a superior endoscopic system to cater to varied clinical wishes solidifies hospitals' importance in the market.California is one of the leading states in the United States endoscopy device market

By state, the United States endoscopy device market is divided into California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, and the Rest of United States. California stands out as one of the most prevalent states in the United States endoscopy device market. This is due to its robust healthcare infrastructure, technological innovation, and huge population. Home to numerous main medical facilities and research establishments, California fosters conducive surroundings for adopting present-day endoscopy technologies. The area's various demographics and excessive healthcare spending also contribute to significant demand for endoscopic strategies and devices. With a dynamic healthcare landscape and emphasis on innovation, California is pivotal in driving increases and improvements within the U.S. endoscopy device market.Key Players

The leading companies in the United States endoscopy device market are Johnson & Johnson, Stryker, Boston Scientific, CONMED, Medtronic Plc, Fujifilm Holdings., and Smith and Nephew.In February 2023v- Boston Scientific Corporation received FDA approval for LithoVue Elite Single-Use Digital Flexible Ureteroscope System. It is one of the first systems to monitor intrarenal pressure in real time during ureteroscopy procedures.

In January 2023 - UC Davis Health opened a new, more spacious endoscopy suite in the United States that features advanced technology and integrated care to accommodate the growing volume of endoscopy procedures.

Product Type - United States Endoscopy Devices Market breakup in 5 viewpoints:

1. Endoscopes2. Visualization & Documentation Systems

3. Mechanical Endoscopic Equipment

4. Accessories

5. Other Endoscopy Equipment

Application - United States Endoscopy Devices Market breakup in 9 viewpoints:

1. Bronchoscopy2. Arthroscopy

3. Laparoscopy

4. Urology endoscopy

5. Neuroendoscopy

6. Gastrointestinal endoscopy

7. Gynecology endoscopy

8. ENT endoscopy

9. Others

Hygiene - United States Endoscopy Devices Market breakup in 3 viewpoints:

1. Single Use2. Reprocessing

3. Sterilization

End-User - United States Endoscopy Devices Market breakup in 3 viewpoints:

1. Hospitals2. Ambulatory Surgery Centers

3. Others

States - United States Endoscopy Devices Market breakup in 29 viewpoints:

1. California2. Texas

3. New York

4. Florida

5. Illinois

6. Pennsylvania

7. Ohio

8. Georgia

9. New Jersey

10. Washington

11. North Carolina

12. Massachusetts

13. Virginia

14. Michigan

15. Maryland

16. Colorado

17. Tennessee

18. Indiana

19. Arizona

20. Minnesota

21. Wisconsin

22. Missouri

23. Connecticut

24. South Carolina

25. Oregon

26. Louisiana

27. Alabama

28. Kentucky

29. the Rest of United States

All the Key players have been covered from 3 Viewpoints:

- Overview

- Recent Development

- Revenue Analysis

Company Analysis:

1. Johnson & Johnson2. Stryker

3. Boston Scientific

4. CONMED

5. Medtronic Plc

6. Fujifilm Holdings

7. Smith and Nephew

Table of Contents

Companies Mentioned

- Johnson & Johnson

- Stryker

- Boston Scientific

- CONMED

- Medtronic Plc

- Fujifilm Holdings

- Smith and Nephew

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | February 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 11.53 Billion |

| Forecasted Market Value ( USD | $ 17.41 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 7 |