Smartphone consists of an integrated computer and other features, such as web browsing, operating system, as well as the ability to run software applications. Increasing penetration of Internet of Things is expected to boost the market growth. Furthermore, rapid technological advancements is also expected to fuel the market growth. Despite the driving factors, health risks due to prolonged exposure to smartphones are expected to hinder the market growth during the forecast period.

Growth Influencers:

Increasing penetration of IoT

Internet of Things is one of the emerging communication concept which interconnects a variety of devices, including smartphones, with data, processes, and people and enables a seamless communication. Smartphone-enabling technologies, such as Bluetooth, built-in sensors, NFC, and RFID tracking, enables smartphones to be a vital part of IoT world. According to NASSCOM, the number of IoT devices, including smartphones, has increased from 200 million units in 2016 and more than 2.7 billion units in 2020. Hence, increasing penetration of IoT in smartphones is expected to boost the market growth.

Segments Overview:

The global Smartphones market is segmented the brand, operating system, RAM size, generation, screen size, price range, distribution channel, component-hardware, and component-software.

By Brand

- Apple

- Samsung

- Xiaomi

- Oppo

- Huawei

- VIVO

- Others

The Samsung segment is expected to account for the largest market share of over 30% owing to its high demand globally for past few decades. The Xiaomi segment is anticipated to witness the fastest growth rate of more than 14% owing to increasing adoption owing to cheap prices as compared to other brands.

By Operating System

- Android

- Windows

- iOS

- Palm OS

- Others (Sailfish, Tizen, and Blackberry OS)

The Android segment is estimated to hold the largest market share of more than 70% owing to its user friendly nature. The iOS segment is expected to account for 35% of the Android segment’s volume in 2021 and this is estimated to reach 37% in 2030.

By RAM Size

- Below 2GB

- 2GB-4GB

- 4GB-8GB

- More than 8GB

The 4GB-8GB is a major segment and contributes to more than the combined market size of 2GB-4GB and the more than 8GB segment owing to rising demand for 4GB-8GB RAM size smartphones, especially by younger population.

By Generation

- 3G

- 4G

- 5G

The 5G segment is anticipated to witness the fastest growth rate owing to increasing technological advancements by market players for manufacturing 5G smartphones. The 3G and 4G segments are also estimated to grow at significant rates.

By Screen Size

- Below 4.0”

- 4.0”-5.0”

- Above 5.0”

The above 5.0” segment is expected to be the major segment and the unit sales of this screen size is estimated to be more than the combined unit sales of the remaining screen sizes. This is owing to rising demand for above 5.0” screen size smartphones.

By Price Range

- < US$ 100

- US$ 101 - US$ 200

- US$ 201 - US$ 500

- US$ 501

The US$ 201 - US$ 500 segment is anticipated to witness the fastest growth rate of around 7.9% owing to increasing availability of smartphones in this price range. Around 700 million units of US$ 501 smartphones are expected to be sold by 2028.

By Distribution Channel

- Online

- Brand Website

- E-Marketplaces

- Offline

- Multi Brand Store

- Brand Store

The offline segment is estimated to account for the largest market share owing to high preference of offline stores for buying smartphones, especially in the developing economies. The online segment is expected to grow at the fastest rate owing to growing adoption of e-commerce websites.

By Component Hardware

- Battery

- Display Technology

- LCD

- LED

- OLED

- System-on-a-chip (SoC)

- CPU

- Graphics Processing Unit

- Memory Management Unit

- Connectivity

- Modems

- Camera

- Sensors

- Accelerometer

- Gyroscope

- Digital Compass

- Ambient Light Sensor

- Proximity Sensor

The sensors segment is expected to account for a major share of the market, i.e. around 27% owing to various technological advancements in the smartphones for inclusion of various types of sensors in the device. The camera segment is estimated to grow at the fastest rate of around 8.5% owing to rising demand for good quality of camera for photography and videography purposes, especially in the younger population.

By Component-Software

- Kernel

- Middleware

- Application Execution Environment (AEE)

- User Framework Environment

- Application Suite

The kernel segment is estimated to hold the largest market share and is also expected to grow at the fastest rate of 8.1% owing to its rising demand. Middleware, AEE, user framework environment, and application suite segment is expected to witness significant growth rates.

Regional Overview

Based on region, the global Smartphones market is divided into Europe, North America, Asia, Middle East, Africa, and South America.

The Asia Pacific region is expected to hold the largest market share and is also estimated to witness the fastest growth rate of 6.49% owing to presence of major market players in the region, especially in China. Furthermore, presence of various manufacturing facilities in the Asia Pacific countries owing to availability of cheap labor.

North America region is anticipated to hold the second largest market share owing to the presence of Apple brand in the U.S., which is amongst the major brands of smartphones globally.

Competitive Landscape

Key players operating in the global Smartphones market include ZTE Corp., Samsung Electronics, Huawei Technologies Co., Ltd., Apple Inc., Vivo Communication Technology Co. Ltd., Xiaomi Corporation, Guangdong OPPO Mobile Telecommunications Corp., Ltd, Nokia Corporation, AsusTek Computer Inc., Sony Corporation, Micromax Informatics Ltd., Realme, Panasonic Corp, Motorola, Inc., HTC Corporation, Lenovo Group Limited, BBK Electronics Corp. Ltd., Mobicel, and Transsion Group, among others.

The approximate market share of the major 6 players is more than 65%. These market players are engaged in mergers & acquisitions, collaborations, and new product launches to strengthen their market presence. For instance, in November 2021, ZTE Corporation collaborated with Riedel Communications for deploying custom-made private 5G as a service on a campus network and also to jointly explore the huge potential of 5G networks.

The global Smartphones market report provides insights on the below pointers:

- Market Penetration: Provides comprehensive information on the market offered by the prominent players

- Market Development: The report offers detailed information about lucrative emerging markets and analyzes penetration across mature segments of the markets

- Market Diversification: Provides in-depth information about untapped geographies, recent developments, and investments

- Competitive Landscape Assessment: Mergers & acquisitions, certifications, product launches in the global Smartphones market have been provided in this research report. In addition, the report also emphasizes the SWOT analysis of the leading players.

- Product Development & Innovation: The report provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

- Consumer Behaviour Analysis- By Age, Gender, Region, Education Qualification, Average Annual Income - Brand Awareness; Consumer Buying Preferences (Smartphone Selection Scenario); By Brand, Price Range, Channel, Operating Segment, Screen Size; Influencing Factors on Purchase of a Smartphone; Average Replacement Rates (in Months), by Top Country; Type of Influence on Purchase of Smartphones

- Top Entry-Level Smartphones; Top Performance Smartphones; Media-Centric Smartphones

- Role of Telecom Operators in the innovating ‘digital age’; smartphone insurance-overview of major policy instruments; EXIM landscape

- Technology Lifecycle; Strategical Overview

The global Smartphones market report answers questions such as:

- What is the market size and forecast of the Global Smartphones Market?

- What are the inhibiting factors and impact of COVID-19 on the Global Smartphones Market during the assessment period?

- Which are the products/segments/applications/areas to invest in over the assessment period in the Global Smartphones Market?

- What is the competitive strategic window for opportunities in the Global Smartphones Market?

- What are the technology trends and regulatory frameworks in the Global Smartphones Market?

- What is the market share of the leading players in the Global Smartphones Market?

- What modes and strategic moves are considered favorable for entering the Global Smartphones Market?

- What are the number of smartphone users worldwide, in Billions? What are the shipments of top selling mobile in Billion?

- What is the penetration rate of smartphone: U.S. Smartphone Ownership Demographics (%)?

Table of Contents

Chapter 1. Research Framework1.1 Research Objective

1.2 Product Overview

1.3 Market Segmentation

Chapter 2. Research Methodology

2.1 Qualitative Research

2.1.1 Primary & Secondary Sources

2.2 Quantitative Research

2.2.1 Primary & Secondary Sources

2.3 Breakdown of Primary Research Respondents, By Region

2.4 Assumption for the Study

2.5 Market Size Estimation

2.6. Data Triangulation

Chapter 3. Executive Summary: Global Smartphone Market

Chapter 4. Global Smartphone Market Overview

4.1. Industry Value Chain Analysis

4.1.1. Developers

4.1.2. Assembling

4.1.3. Marketing and Distribution

4.1.4. Retailers

4.1.5. End Users

4.2. Industry Outlook

4.2.1. No. of Smartphone Users, Worldwide

4.2.2. Penetration Rate of Smartphone

4.2.4. Types of Smartphones

4.2.4.1. Entry-Level Smartphones

4.2.4.2. Performance Smartphones

4.2.4.3. Media-Centric Smartphones

4.2.4.3.1. Music smartphones

4.2.4.3.2. Navigation smartphones

4.2.4.3.3. Gaming smartphones

4.2.4.3.4. Camera smartphones

4.2.5. Role of Telecom Operators

4.2.6. Aftermarket services (repair & maintenance)

4.2.7. Smartphone Insurance

4.3. PESTLE Analysis

4.4. Porter's Five Forces Analysis

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Power of Buyers

4.4.3. Threat of Substitutes

4.4.4. Threat of New Entrants

4.4.5. Degree of Competition

4.5. Market Dynamics and Trends

4.5.1. Growth Drivers

4.5.2. Restraints

4.5.3. Challenges

4.5.4. Key Trends

4.6. Covid-19 Impact Assessment on Market Growth Trend

4.7. Market Growth and Outlook

4.7.1. Market Revenue Estimates and Forecast (US$ Bn), 2017 - 2030

4.7.2. Market Volume Estimates and Forecast (Mn Units), 2017 - 2030

4.7.3. Pricing Analysis

4.8. EXIM Landscape

4.8.1. Top importing countries for Smartphones

4.8.2. Top exporting countries for Smartphones

4.9. Technology Lifecycle

4.9.1. Key Technology Development Milestone

4.9.1.1. Electro-Magnetic Resonance and Magnetic Resonance Technologies

4.10. Competition Dashboard

4.10.1. Market Concentration Rate

4.10.2. Company Market Share Analysis (Value %), 2020

4.10.3. Competitor Mapping

4.10.4. Strategical Overview

4.10.4.1. Marketing Innovation Key Success Factor

4.10.4.2. Collaboration with EMS

4.10.4.3. Low-price Market Competition

4.10.4.4. Mergers and Acquisitions

4.10.4.5. Expansion in Mass Markets

Chapter 5. Smartphone Market - Consumer Behavior Analysis

5.1. Average Replacement Rates

5.2. Consumer Buying Preferences: Smartphone Selection Scenario

5.2.1. Brand

5.2.2. Price

5.2.3. Operating System

5.2.4. Screen Size

5.2.5. RAM

5.2.6. Processor

5.2.7. Camera

5.2.8. Battery Life

5.2.9. Design

5.2.10. Brand Endorsements

5.2.11. Others

5.3. Consumer Demographics

5.3.1. By Age

5.3.2. By Gender

5.3.3. By Income Group

5.3.4. By Lifestyle

Chapter 6. Smartphone Component Market Analysis

6.1. Hardware

6.1.1. Battery

6.1.2. Display Technology

6.1.2.1. LCD

6.1.2.2. LED

6.1.2.3. OLED

6.1.3. System-on-a-chip (SoC)

6.1.4. CPU

6.1.5. Graphics Processing Unit

6.1.6. Memory Management Unit

6.1.7. Connectivity

6.1.8. Modems

6.1.9. Camera

6.1.10. Sensors

6.1.10.1. Accelerometer

6.1.10.2. Gyroscope

6.1.10.3. Digital Compass

6.1.10.4. Ambient Light Sensor

6.1.10.5. Proximity Sensor

6.2. Software

6.2.1. Kernel

6.2.2. Middleware

6.2.3. Application Execution Environment (AEE)

6.2.4. User Interface Framework

6.2.5. Application Suite

Chapter 7. Smartphone Market Analysis, By Brand

7.1. Key Insights

7.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

7.2.1. Apple

7.2.2. Samsung

7.2.3. Xiaomi

7.2.4. Oppo

7.2.5. Huawei

7.2.6. Others

Chapter 8. Smartphone Market Analysis, By Operating System

8.1. Key Insights

8.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

8.2.1. Android

8.2.2. Windows

8.2.3. iOS

8.2.4. Palm OS

8.2.5. Other (Sailfish, Tizen and Blackberry OS)

Chapter 9. Smartphone Market Analysis, By RAM Size

9.1. Key Insights

9.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

9.2.1. Below 2GB

9.2.2. 2GB-4GB

9.2.3. 4GB-8GB

9.2.4. More than 8GB

Chapter 10. Smartphone Market Analysis, By Generation

10.1. Key Insights

10.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

10.2.1. 3G

10.2.2. 4G

10.2.3. 5G

Chapter 11. Smartphone Market Analysis, By Screen Size

11.1. Key Insights

11.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

11.2.1. below 4.0"

11.2.2. 0"-5.0"

11.2.3. Up to 6.0”

Chapter 12. Smartphone Market Analysis, By Price Range

12.1. Key Insights

12.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

12.2.1. < US$ 100

12.2.2. US$ 101 - US$ 200

12.2.3. US$ 201 - US$ 500

12.2.4. > US$ 501

Chapter 13. Smartphone Market Analysis, By Distribution Channel

13.1. Key Insights

13.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

13.2.1. Online

13.2.1.1. Brand Website

13.2.1.2. E-marketplaces

13.2.2. Offline

13.2.2.1. Multi Brand Store

13.2.2.2. Brand Store

Chapter 14. Smartphone Market Analysis, By Region/ Country

14.1. Key Insights

14.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

14.2.1. North America

14.2.1.1. The U.S.

14.2.1.2. Canada

14.2.1.3. Mexico

14.2.2. Europe

14.2.2.1. Western Europe

14.2.2.1.1. The UK

14.2.2.1.2. Germany

14.2.2.1.3. France

14.2.2.1.4. Italy

14.2.2.1.5. Spain

14.2.2.1.6. Rest of Western Europe

14.2.2.2. Eastern Europe

14.2.2.2.1. Poland

14.2.2.2.2. Russia

14.2.2.2.3. Rest of Eastern Europe

14.2.3. Asia Pacific

14.2.3.1. China

14.2.3.2. India

14.2.3.3. Japan

14.2.3.4. Australia & New Zealand

14.2.3.5. ASEAN

14.2.3.6. Rest of Asia Pacific

14.2.4. Middle East & Africa (MEA)

14.2.4.1. UAE

14.2.4.2. Saudi Arabia

14.2.4.3. South Africa

14.2.4.4. Rest of MEA

14.2.5. South America

14.2.5.1. Argentina

14.2.5.2. Brazil

14.2.5.3. Rest of South America

Chapter 15. The US Smartphone Market Analysis

15.1. Key Insights

15.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

15.2.1. By Operating System

15.2.2. By Ram Size

15.2.3. By Distribution Channel

15.2.4. By Price Range

15.2.5. By Generation

Chapter 16. Canada Smartphone Market Analysis

16.1. Key Insights

16.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

16.2.1. By Operating System

16.2.2. By Ram Size

16.2.3. By Distribution Channel

16.2.4. By Price Range

16.2.5. By Generation

Chapter 17. Mexico Smartphone Market Analysis

17.1. Key Insights

17.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

17.2.1. By Operating System

17.2.2. By Ram Size

17.2.3. By Distribution Channel

17.2.4. By Price Range

17.2.5. By Generation

Chapter 18. The U.K. Smartphone Market Analysis

18.1. Key Insights

18.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

18.2.1. By Operating System

18.2.2. By Ram Size

18.2.3. By Distribution Channel

18.2.4. By Price Range

18.2.5. By Generation

Chapter 19. Germany Smartphone Market Analysis

19.1. Key Insights

19.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

19.2.1. By Operating System

19.2.2. By Ram Size

19.2.3. By Distribution Channel

19.2.4. By Price Range

19.2.5. By Generation

Chapter 20. France Smartphone Market Analysis

20.1. Key Insights

20.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

20.2.1. By Operating System

20.2.2. By Ram Size

20.2.3. By Distribution Channel

20.2.4. By Price Range

20.2.5. By Generation

Chapter 21. Italy Smartphone Market Analysis

21.1. Key Insights

21.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

21.2.1. By Operating System

21.2.2. By Ram Size

21.2.3. By Distribution Channel

21.2.4. By Price Range

21.2.5. By Generation

Chapter 22. Spain Smartphone Market Analysis

22.1. Key Insights

22.2 Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

22.2.1. By Operating System

22.2.2. By Ram Size

22.2.3. By Distribution Channel

22.2.4. By Price Range

22.2.5. By Generation

Chapter 23. Poland Smartphone Market Analysis

23.1. Key Insights

23.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

23.2.1. By Operating System

23.2.2. By Ram Size

23.2.3. By Distribution Channel

23.2.4. By Price Range

23.2.5. By Generation

Chapter 24. Russia Smartphone Market Analysis

24.1. Key Insights

24.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

24.2.1. By Operating System

24.2.2. By Ram Size

24.2.3. By Distribution Channel

24.2.4. By Price Range

24.2.5. By Generation

Chapter 25. China Smartphone Market Analysis

25.1. Key Insights

25.2 Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

25.2.1. By Operating System

25.2.2. By Ram Size

25.2.3. By Distribution Channel

25.2.4. By Price Range

25.2.5. By Generation

Chapter 26. India Smartphone Market Analysis

26.1. Key Insights

26.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

26.2.1. By Operating System

26.2.2. By Ram Size

26.2.3. By Distribution Channel

26.2.4. By Price Range

26.2.5. By Generation

Chapter 27. Japan Smartphone Market Analysis

27.1. Key Insights

27.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

27.2.1. By Operating System

27.2.2. By Ram Size

27.2.3. By Distribution Channel

27.2.4. By Price Range

27.2.5. By Generation

Chapter 28. Australia & New Zealand Smartphone Market Analysis

28.1. Key Insights

28.2 Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

28.2.1. By Operating System

28.2.2. By Ram Size

28.2.3. By Distribution Channel

28.2.4. By Price Range

28.2.5. By Generation

Chapter 29. ASEAN Smartphone Market Analysis

29.1. Key Insights

29.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

29.2.1. By Operating System

29.2.2. By Ram Size

29.2.3. By Distribution Channel

29.2.4. By Price Range

29.2.5. By Generation

Chapter 30. UAE Smartphone Market Analysis

30.1. Key Insights

30.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

30.2.1. By Operating System

30.2.2. By Ram Size

30.2.3. By Distribution Channel

30.2.4. By Price Range

30.2.5. By Generation

Chapter 31. Saudi Arabia Smartphone Market Analysis

31.1. Key Insights

31.2 Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

31.2.1. By Operating System

31.2.2. By Ram Size

31.2.3. By Distribution Channel

31.2.4. By Price Range

31.2.5. By Generation

Chapter 32. South Africa Smartphone Market Analysis

32.1. Key Insights

32.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

32.2.1. By Operating System

32.2.2. By Ram Size

32.2.3. By Distribution Channel

32.2.4. By Price Range

32.2.5. By Generation

Chapter 33. Argentina Smartphone Market Analysis

33.1. Key Insights

33.2. Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

33.2.1. By Operating System

33.2.2. By Ram Size

33.2.3. By Distribution Channel

33.2.4. By Price Range

33.2.5. By Generation

Chapter 34. Brazil Smartphone Market Analysis

34.1. Key Insights

34.2 Market Size and Forecast, 2017 - 2030 (US$ Bn and Mn Units)

34.2.1. By Operating System

34.2.2. By Ram Size

34.2.3. By Distribution Channel

34.2.4. By Price Range

34.2.5. By Generation

Chapter 35. Company Profile (Company Overview, Financial Matrix, Key Product landscape, Key Personnel, Key Competitors, Contact Address, and Business Strategy Outlook)

35.1. Sony Corp.

35.2. ZTE Corp.

35.3. Samsung Electronics Apple

35.4. Huawei Technologies Co., Ltd.

35.5. Apple Inc.

35.6. Vivo Communication Technology Co. Ltd.

35.7. Xiaomi Corporation

35.8. Guangdong OPPO Mobile Telecommunications Corp., Ltd.

35.9. Nokia Corporation

35.10. AsusTek Computer Inc.

35.11. Sony Corporation

35.12. Huawei

35.13. Micromax Informatics Ltd.

35.14. Realme

35.15. Panasonic Corp

35.16. Motorola, Inc.

35.17. HTC Corporation

35.18. Lenovo Group Limited

35.19. BBK Electronics Corp. Ltd.

35.20. Mobicel

35.21. Transsion Group

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Sony Corp.

- ZTE Corp.

- Samsung Electronics Apple

- Huawei Technologies Co., Ltd.

- Apple Inc.

- Vivo Communication Technology Co. Ltd.

- Xiaomi Corporation

- Guangdong OPPO Mobile Telecommunications Corp., Ltd.

- Nokia Corporation

- AsusTek Computer Inc.

- Sony Corporation

- Huawei

- Micromax Informatics Ltd.

- Realme

- Panasonic Corp

- Motorola, Inc.

- HTC Corporation

- Lenovo Group Limited

- BBK Electronics Corp. Ltd.

- Mobicel

- Transsion Group

Table Information

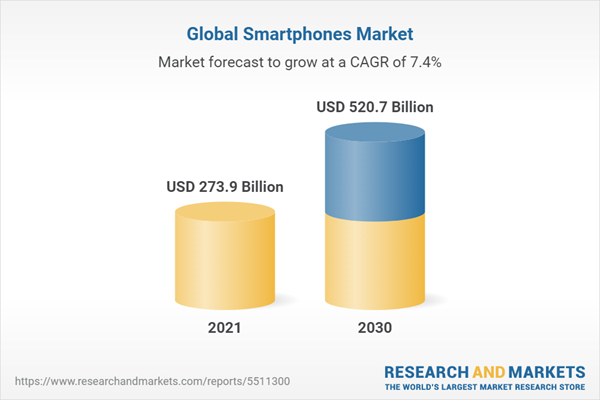

| Report Attribute | Details |

|---|---|

| No. of Pages | 617 |

| Published | October 2021 |

| Forecast Period | 2021 - 2030 |

| Estimated Market Value ( USD | $ 273.9 Billion |

| Forecasted Market Value ( USD | $ 520.7 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |