Bio-based epoxy resins are created from plant-based carbon instead of petroleum-based carbon. Bio-based epoxy resins utilize green chemistry methods that need a smaller amount of energy and generate fewer hazardous bi-products, thus lowering the greenhouse gas emission from manufacture of resins by 50%. The bio-based epoxy resins market is increasing drastically due to the factors, such as increasing awareness regarding carbon emissions, rising initiatives by government and non-government agencies, expanding application of bio-based epoxy resins.

Flexible epoxy resins are utilized in making adhesives, coatings, sealants, composites, as well as flooring products, which are significant parts of the building and construction industry. The epoxy resin-based adhesives are used for creation of laminated woods for decks, walls, roofs and other building applications. The rising usage and preference rates boost the growth rate of the market.

The varying cost of raw material is restricting the growth of the bio-based epoxy resins market. Several economies focus on import and exports for the raw materials, and the unstandardized process limits the growth rate of the market to a limited extent.

Growth Influencers:

Government Regulations to curb the carbon emissions

Governments across the world are focused on imposing restrictions and regulations to streamline the increasing gas emissions. For instance, in December 2018, the US Environmental Protection Agency (EPA) proposed new greenhouse gas emissions (GHG) regulations for modified and reconstructed power plants. The recommended rule would replace EPA’s 2015 carbon pollution standard for new power plants, which established New Performance Source Performance Standards (NSPS) to restrict the carbon dioxide emissions from fossil fuel-fueled power plants. Thus, such regulations promise the environmental sustainability and push the demand for bio-based epoxy resins, thus raising the growth rate of the market.

Increased Applications of Bio-based Epoxy Resins

The bio-based epoxy resins have many applications in several industries, including building industry. These resins are used as sealant covers, floor covers, building materials, and adhesives. Moreover, bio-based epoxy resins are used at a significant rate in the manufacturing industry for glass fiber materials, marine crafts, rainwater tanks, electrical circuit boards, and water repelling materials, among others. For instance, in March 2020, Bitrez Ltd, one of Europe’s foremost manufacturers of specialist polymers and chemicals, launched a new set of regulatory compliant bio-based resins for the composites industry. This new family of bio-based resins, including bio-epoxy systems and Polyfurfuryl Alcohol (PFA), are specifically designed for composite applications and are Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) compliant. Such wide applications bio-based epoxy resins aid in the growth of the market during the forecast period.

Segments Overview:

The global bio-based epoxy resins market is segmented into type, ingredient, form, application, and end user.

By Type

- Bio-based Carbon Content: 28-50%

- Bio-based Carbon Content: ≥50%

The bio-based carbon content 28-50% segment is anticipated to hold the largest market share. The bio-based carbon content: ≥50% is estimated to be the fastest growing segment during the forecast period and is anticipated to grow at a CAGR of 4.8%.

By Ingredient

- Glycerol

- Hemp

- Vegetable

- Plant Oil

- Soybean Oil

- Linseed Oil

- Canola Oil

- Karanja Oil

- Others

The plant oil segment seized the largest market share of more than 35%. The vegetable segment held a CAGR of 4.7% and is expected to grow significantly over the forecast period owing to the increasing use of this ingredient in bio-based epoxy resins. Based on plant oil, the canola oil market volume is estimated to cross 1,102.9 tons by 2027.

By Form

- Liquid & Solution

- Solid

The liquid & solution segment is anticipated to grow at the largest share owing to the rising demand of this design in the bio-based epoxy resins market.

By Application

- Diglycidyl Ethers of Isosorbide (DGEI)

- Epoxidized Cardanol (Coatings)

- Epoxidized Linseed Oil

- Furan diepoxy of 2,5-bis (hydroxymethyl)-furan (BHMF)

- Liquid epoxidized natural rubber (LENR)

- Terpene-maleic estertype epoxy (TME)

The Diglycidyl Ethers of Isosorbide (DGEI) segment is anticipated to hold the largest market share owing to the rising applications of DGEI, whereas the Epoxidized Cardanol (Coatings) is likely to grow at the fastest growth rate over the forecast period. The BHMF segment volume is projected to hit 700 tons by 2027.

By End-User

- Aerospace

- Building & Construction

- Consumer Goods (Market Volume Size will cross 10,000 tons in 2026)

- Electrical & Electronics

- Marine

- Wind Power

- Others

The electrical and electronics sub-segment held a market share of nearly 11% owing to the rise in the usage and reliance of bio-based epoxy resins in several electronics appliances across the world. The consumer goods segment volume is anticipated to cross 10,000 tons in 2026.

Regional Overview

By region, the global bio-based epoxy resins market is divided into Europe, North America, Asia Pacific, Middle East & Africa, and South America.

The North American region is expected to hold the largest market share of around 36% owing to the presence of established infrastructure and manufacturing capabilities in countries, such as US and Canada. Furthermore, Asia Pacific is one of the regions expected to hold the fastest rowing rate of 5.1% owing to the increasing applications and usage of bio-based epoxy resins in countries, such as Japan, India, and China.

The European region is anticipated to grow substantially owing to the rising awareness and increasing demand. The Latin American region is also anticipated to grow at a considerable rate.

Competitive Landscape

Key players operating in the global bio-based epoxy resins market include ALPAS, Bitrez Ltd., Chang Chun Group, COOE (Change Climate), EcoPoxy, Entropy Resins, Gougeon Brothers, Greenpoxy, Huntsman Corporation, Kukdo Chemical, Nagase ChemteX Corporation, Resin Research Bio Epoxy, Resoltech, Sicomin Epoxy Systems, among others.

The top 6 players in the market hold approximately 54% of the market share. These market players are investing in research, agreements, product launches, mergers & acquisitions, and joint ventures to lure customers towards their products. For instance, in January 2020, Bitrez Ltd, Europe’s leading manufacture of specialist polymers and chemicals, launched a new family of regulatory compliant bio-based resins for the composites industry.

The global bio-based epoxy resins market report provides insights on the below pointers:

- Market Penetration: Provides comprehensive information on the market offered by the prominent players

- Market Development: The report offers detailed information about lucrative emerging markets and analyzes penetration across mature segments of the markets

- Market Diversification: Provides in-depth information about untapped geographies, recent developments, and investments

- Competitive Landscape Assessment: Mergers & acquisitions, certifications, product launches in the global Bio-Based Epoxy Resins market have been provided in this research report. In addition, the report also emphasizes the SWOT analysis of the leading players.

- Product Development & Innovation: The report provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

- Pricing Analysis: Pricing analysis of various metals and other components used in the manufacturing of bio-based epoxy resins

- Manufacturing Cost Analysis: Cost-share of various components in bio-based epoxy resins, cost analysis of bio-based epoxy resins

The global Bio-Based Epoxy Resins market report answers questions such as:

- What is the market size and forecast of the global bio-based epoxy resins market?

- What are the inhibiting factors and impact of COVID-19 on the global bio-based epoxy resins market during the assessment period?

- Which are the products/segments/applications/areas to invest in over the assessment period in the global bio-based epoxy resins market?

- What is the competitive strategic window for opportunities in the global bio-based epoxy resins market?

- What are the technology trends and regulatory frameworks in the global bio-based epoxy resins market?

- What is the market share of the leading players in the global bio-based epoxy resins market?

- What modes and strategic moves are considered favorable for entering the global bio-based epoxy resins market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALPAS

- Bitrez Ltd.

- Chang Chun Group

- COOE (Change Climate)

- EcoPoxy

- Entropy Resins

- Gougeon Brothers

- Greenpoxy

- Huntsman Corporation

- Kukdo Chemical

- Nagase ChemteX Corporation

- Resin Research Bio Epoxy

- Resoltech

- Sicomin Epoxy Systems

Table Information

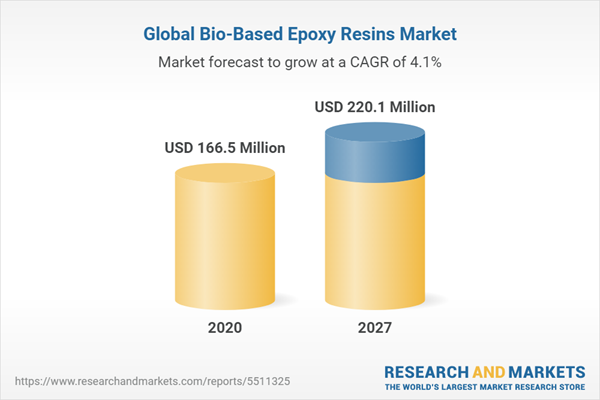

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | October 2021 |

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 166.5 Million |

| Forecasted Market Value ( USD | $ 220.1 million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |