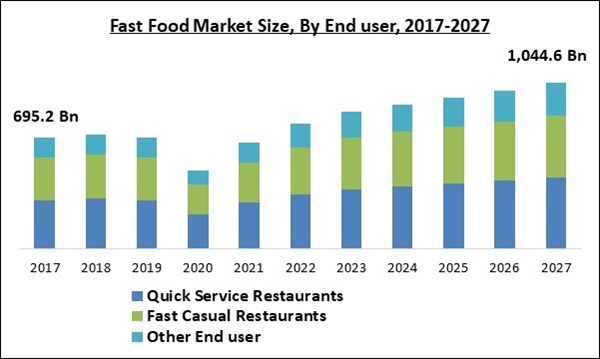

The Global Fast Food Market size is expected to reach $1,044.61 billion by 2027, rising at a market growth of 7.8% CAGR during the forecast period.

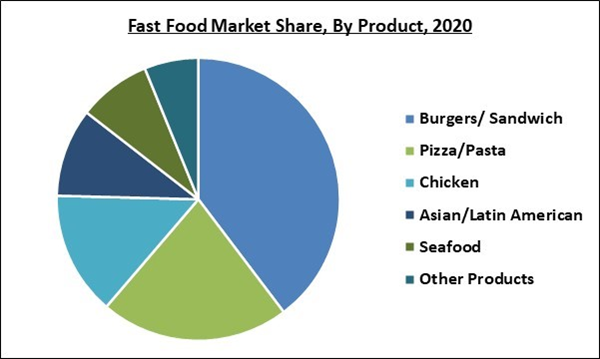

Fast food refers to the convenient food, which is made and served at quick-service restaurants as well as by street vendors. They are the popular substitute for homemade food. Such food types are widely consumed by customers across different sectors such as hotels, restaurants, and fast food centers. Fast food vendors offer a wide range of foods under the category of pizza/pasta, chicken & seafood, burgers/sandwiches, and Asian/Latin American food.

In the last few years, the fast food industry has witnessed various trends and product launches to cope up with the growing demand for fast food across the world. In addition, the high demand for fast food items in hotels, restaurants, and resorts is expected to accelerate the growth of the fast food market over the forecast period.

With the increasing women employment rate across the world, the demand for fast food has increased as such women find it difficult to invest time in cooking and thus, contributing to the growth of the fast food market. For example, in 2019, as per the United States Department of Labor, the women's employment rate was 46%. Additionally, in China, the women's employment rate was approximately 43.7% and South Africa has witnessed 45% of the women's employment rate. Due to this, the demand and growth of the fast food market is expected to witness a surge in the coming years.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has negatively impacted the fast food industry as the risk of virus spread is high in food delivery. Additionally, the imposition of lockdown across various nations and the disruption in the supply chain of various goods have affected the demand and growth of the overall fast food market. The travel ban and unavailability of a workforce in the industry have also restricted the demand and growth of the fast food market. In addition, the increasing health awareness among the people due to the pandemic has motivated consumers to eat healthy food items, which is expected to further hinder the growth of the fast food market in the coming years.

Though, during the post-pandemic situation, the fast food market is expected to regain its demand due to the reopening of fast food franchises and rising demand for online food deliveries. Also, the increasing snacking habits among people is expected to fuel the growth of the fast food market over the forecast period.

Market Growth Factors:

High demand for international cuisines

With the growing tourism sector and globalization, people are increasingly demanding international cuisines in their country. Several global hotels, restaurants, and food chains are expanding their presence across the world to serve the local customers with high quality and taste of international cuisines. Internet and social media platforms have opened doors for the customers to know about other countries’ or regions’ food and culture.

Rapid Globalization

With the rapid pace of globalization, the penetration of different cultures and food items in one economy has increased, which is expected to create lucrative opportunities for many companies to expand their business across different regions. Globalization refers to the widespread of various products, information, technology, and jobs across borders & cultures. This has resulted in various fashion and food trends across the world, nowadays, people are becoming more eager to try out new cuisines or food items.

Marketing Restraining Factor:

Health concerns of fast food

There is an increase in health awareness among consumers, which restricts them from the consumption of fast food as they are considered unhealthy. It is due to the usage of various ingredients that are unhealthy and can affect a person’s health condition like deep-fried items, which restrict people from its consumption and hence, hamper the growth of the fast food market. In addition, as consumers are becoming more aware of the importance of maintaining a healthy food habit and lifestyle, they is expected to shift from the consumption of fast food items to homemade food.

Product Outlook

The fast food market is segmented into Pizza/Pasta, Burgers/Sandwich, Chicken, Asian/Latin American, seafood, and others. Among these, the burgers/sandwich segment dominated the market with the highest revenue share due to the growing demand for these products. In addition, according to the U.S. Department of Agriculture (USDA), people consume approximately 50 billion burgers each year.

End-user Outlook

The fast food segment is fragmented into quick-service restaurants (QSRs), fast casual restaurants, and others. In 2020, the QSRs segment acquired the highest revenue share in the market and is anticipated to record the fastest growth rate over the forecast period. The COVID-19 pandemic has motivated numerous quick-service restaurants to expand their off-premise businesses.

Regional Outlook

North America emerged as the leading region in the fast food market with the highest revenue share. This growth is attributed to the factors like the accessibility of numerous cuisines and budget-friendly snacks & add-ons in different flavors. Further, the high consumer spending on fast food across this region is expected to also augment the regional growth.

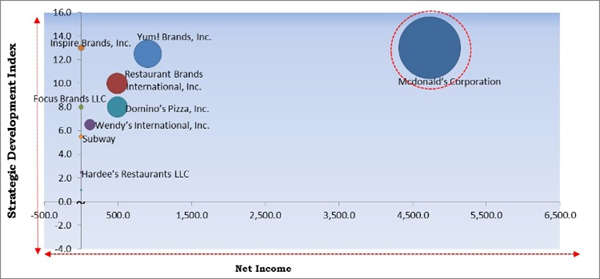

Cardinal Matrix - Fast Food Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Mcdonald’s Corporation is the major forerunners in the Fast Food Market. Companies such as Restaurant brands international, Inc., Yum! Brands, Inc., Inspire Brands, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Wendy’s International, Inc., Domino’s Pizza, Inc., Mcdonald’s Corporation, Restaurant brands international, Inc., Yum! Brands, Inc., Inspire Brands, Inc., Hardee's Restaurants LLC (CKE Restaurants Holdings, Inc.), Firehouse Restaurant Group, Inc., Focus Brands LLC (Roark Capital Group), and Subway (Doctor’s Associate, Inc.).

Recent Strategies Deployed in Fast Food Market

Partnerships, Collaborations and Agreements:

- Nov-2021: Focus brand’s restaurant chains Auntie Anne's and Cinnabon partnered with Fresh Dining Concepts. This partnership aimed to bring 10 co-branded Auntie Anne's and Cinnabon to five New York City boroughs in the next four years. In addition, the partnership is expected to also boost the ongoing efforts of the company to become more available to guests by adding locations outside the conventional mall setting, shared a statement.

- Nov-2021: McDonald’s entered into a partnership with ITC, a packaged consumer goods company. This partnership aimed to sell B Natural range of mixed fruit beverages to its popular Happy Meal.

- Nov-2021: McDonald’s Singapore extended its partnership with Grab, a technology company. This partnership aimed to enhance the quick-service restaurant (QSR) experience in Singapore. In this partnership, McDonald’s is expected to integrate the GrabExpress service into its online ordering channels like the McDelivery app and McDelivery website, to boost on-demand delivery capabilities.

- Nov-2021: Burger King partnered with Redberry Restaurants. This partnership aimed to open 50 new Burger King Restaurants in Quebec and 15 new restaurants in Saskatchewan over the next five years.

- Oct-2021: Wendy’s came into a partnership with Kellogg, an American multinational food manufacturing company. This partnership aimed to release Wendy’s Frosty Chocolatey Cereal. This cereal is expected to contain marshmallow pieces that is expected to intermingle with crispy, cocoa-coated round cereal bites.

- Oct-2021: Wendy's formed a partnership with Google Cloud, a suite of cloud computing services. This partnership aimed to improve Wendy's restaurant experience and attract new customers, restaurant, and employee experiences via data-driven insights. Through this partnership, Wendy's aimed to use Google Cloud's data analytics, machine learning (ML), artificial intelligence (AI), and hybrid cloud tools to develop new ways customers can order food in the drive-thru, on their mobile devices, and via other touch points.

- Oct-2021: McDonald’s formed a partnership with IBM, an American multinational technology corporation. Under this partnership, IBM is expected to acquire McDonald’s McD Tech Labs and establish the development and introduce its Automated Order Taking (AOT) technology.

- Oct-2021: Yum! Brands extended its partnership with NextGen Consortium, a multi-year consortium. In this partnership, Yum! and its KFC, Taco Bell, Pizza Hut, and The Habit Burger Grill brands collaborate with other companies to assist in advancing sustainable foodservice packaging solutions, which are recoverable across infrastructures.

- May-2021: Wendy’s entered into a partnership with Pringles, an American brand of stackable potato-based crisps. This partnership aimed to turn Wendy’sspicy chicken sandwich into a new limited-edition potato chip flavor.

- Apr-2021: Domino's Pizza partnered with Nuro, the leading self-driving delivery company. This partnership aimed to introduce autonomous pizza delivery in Houston.

- Feb-2021: Yum! Brands entered into a partnership with Beyond Meat, a Los Angeles-based producer of plant-based meat substitutes. This partnership aimed to develop and deliver crave able and innovative plant-based protein menu items, which could only be found at KFC, Pizza Hut and Taco Bell over the next few years.

- Jun-2020: Domino’s Pizza expanded its partnership with Dragontail Systems Limited, a software company. This partnership focused on improvements to DOM Pizza Checker, which is expected to make it a perfect tool for stores.

- Feb-2020: McDonald’s India came into a partnership with Swiggy for the North and East regions. This partnership aimed to expand the availability & accessibility of its products via McDelivery in the two regions.

- Jan-2020: McDonald’s India came into a partnership with Zomato, an Indian multinational restaurant aggregator and food delivery company. This partnership aimed to expand the availability and accessibility of its products via McDelivery in the North and East region.

Acquisitions and Mergers:

- Jun-2021: Yum! Brands came into an agreement to acquire Dragontail, the Quick Service Restaurant (QSR). This acquisition aimed to add Dragontail to Yum! Brands’ expanding technology portfolio to provide Yum! Brands the capability to scale Dragontail’s artificial intelligence (AI) kitchen order management and delivery technology globally.

- Mar-2021: Yum! Brands completed the acquisition of Tictuk Technologies, a leading Israeli omnichannel ordering and marketing platform company. This acquisition aimed to add Tictuk to Yum! Brands’ technology portfolio and provide the Company with the capability to deliver more ways for consumers globally to access and order its KFC, Taco Bell Pizza Hut, and The Habit Burger Grill brands via the world’s most popular social media and conversational platforms.

- Oct-2020: Inspire Brands took over Dunkin’ brand, an American restaurant holding company. Through this acquisition, Inspire Brands is expected to add Dunkin’ and Baskin-Robbins to expand its business across the world, in which Inspire is expected to establish approximately 32,000 restaurants in more than 60 countries.

Product Launches and Product Expansions:

- Jul-2021: Subway will roll out the biggest changes to its core menu in the company's history and introduce digital upgrades. The sandwich chain's Eat Fresh Refresh includes over 20 menu updates, including 11 new and improved ingredients, six all-new or returning sandwiches and four revamped signature sandwiches. The company is also introducing two fresh-baked breads, artisan Italian and hearty multigrain.

Geographical Expansions:

- Nov-2021: Subway expanded its geographical presence in India, Sri Lanka and Bangladesh by entering into an agreement with Everstone Group (Everstone), a South Asia focused leading private investment firm. This agreement is expected to upgrade its prevailing locations with the company's new, modern, and inviting "Fresh Forward" design and fulfill the requirement of consumer with comfortable guest indoor dining spaces along with various delivery and order ahead options, with a strong digital first strategy.

- Oct-2021: McDonald’s expanded its presence in Western and Southern India in the next 3-5 years. The company is expected to invest a huge amount in this expansion to open about 200 additional restaurants and revamp prevailing stores with improved digital capabilities like self-ordering kiosks and table services.

- Aug-2021: Wendy’s expanded its global presence across the United States, Canada, and the United Kingdom in partnership with Reef Technology. Under this expansion, the company intended to launch 700 delivery-only dark kitchens across these regions by 2025, wherein upcoming kitchens is expected to develop on a pilot test of eight dark kitchens in Canada in 2020, and 50 is expected to have opened throughout 2021.

- Jan-2021: Hardee’s expanded its global footprints by opening its 300th Carl's Jr. restaurant in Mexico. The company is planning to open additional 100 restaurants in the nation by 2024.

- Nov-2020: McDonald’s expanded its global presence by opening in-store cafés to 4,000 outlets on the Chinese mainland by the end of 2023. McCafés aimed to have their own counters and seating areas under larger McDonald’s stores, yet only about a third of McDonald’s 3,600 restaurants in China host a McCafé.

- Oct-2020: Arby’s, a brand of Inspire Brands, expanded its geographical footprint by opening its first restaurant in Mexico. This expansion is expected to help the company to serve customers across Latin America.

Scope of the Study

Market Segments Covered in the Report:

By Product

- Pizza/Pasta

- Burgers/Sandwich

- Chicken

- Asian/Latin American

- Seafood

- Others

By End User

- Quick-Service Restaurants (QSRs)

- Fast Casual Restaurants

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Wendy’s International, Inc.

- Domino’s Pizza, Inc.

- Mcdonald’s Corporation

- Restaurant brands international, Inc.

- Yum! Brands, Inc.

- Inspire Brands, Inc.

- Hardee's Restaurants LLC (CKE Restaurants Holdings, Inc.)

- Firehouse Restaurant Group, Inc.

- Focus Brands LLC (Roark Capital Group)

- Subway (Doctor’s Associate, Inc.)

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Wendy’s International, Inc.

- Domino’s Pizza, Inc.

- Mcdonald’s Corporation

- Restaurant brands international, Inc.

- Yum! Brands, Inc.

- Inspire Brands, Inc.

- Hardee's Restaurants LLC (CKE Restaurants Holdings, Inc.)

- Firehouse Restaurant Group, Inc.

- Focus Brands LLC (Roark Capital Group)

- Subway (Doctor’s Associate, Inc.)