Tires & Rubber in China industry profile provides top-line qualitative and quantitative summary information including: market size (value 2017-22, and forecast to 2027). The profile also contains descriptions of the leading players including key financial metrics and analysis of competitive pressures within the market.

Key Highlights

- The tires and rubber market consists of the manufacturers revenues generated through the sales of both original equipment manufacturer (OEM) and aftermarket tires for passenger cars (Cars), commercial vehicles (Trucks) and motorcycles. The volume represents the number of tires produced for passenger cars, commercial vehicles and motorcycles. The volumes contained herein make a number of assumptions on the rate of tire wear. It is assumed that OEM vehicles receive one full set of tires upon completion, while aftermarket cars, motorcycles and trucks receive a new set approximately every four years, two years, and 15 months respectively.

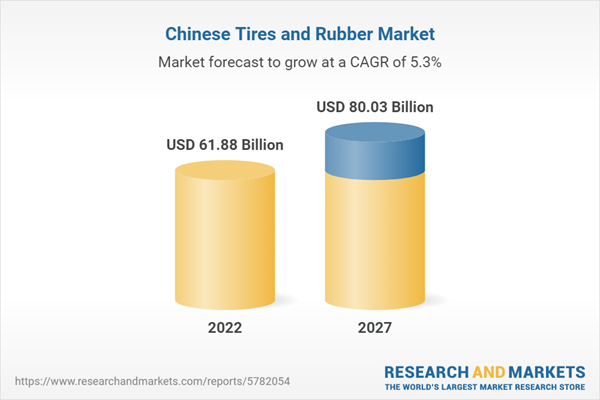

- The Chinese tires & rubber market had total revenues of $61.9 billion in 2022, representing a compound annual growth rate (CAGR) of 1.5% between 2017 and 2022.

- Market consumption volume increased with a CAGR of 4.8% between 2017 and 2022, to reach a total of 700.7 million tires in 2022.

- Increasing vehicle ownership supported by the rising disposable income of the Chinese population has facilitated market growth during the historical period.

Scope

- Save time carrying out entry-level research by identifying the size, growth, and leading players in the tires & rubber market in China

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the tires & rubber market in China

- Leading company profiles reveal details of key tires & rubber market players’ global operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the China tires & rubber market with five year forecasts

Reasons to Buy

- What was the size of the China tires & rubber market by value in 2022?

- What will be the size of the China tires & rubber market in 2027?

- What factors are affecting the strength of competition in the China tires & rubber market?

- How has the market performed over the last five years?

- How large is China’s tires & rubber market in relation to its regional counterparts?

Table of Contents

1 Executive Summary

2 Market Overview

3 Market Data

4 Market Segmentation

5 Market Outlook

6 Five Forces Analysis

7 Competitive Landscape

8 Company Profiles

9 Macroeconomic Indicators

10 Appendix

List of Tables

List of Figures

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Shandong Linglong Tire Co Ltd

- Giti Tire Pte. Ltd.

- Guizhou Guihang Automotive Components Co Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 40 |

| Published | March 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 61.88 Billion |

| Forecasted Market Value ( USD | $ 80.03 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | China |