Speak directly to the analyst to clarify any post sales queries you may have.

Increased Investment in Public Infrastructure Projects

- In 2022, the country's government unveiled a plan to allocate USD 708 billion towards economic recovery. This significant investment is set aside for the enhancement of public infrastructure and the advancement of digital technology.

- The Nihonbashi 1-Chome Central District Category 1 Urban Redevelopment Project is situated near the Nihonbashi Bridge and is one of the largest projects in the area. It is anticipated that the project will be completed in March 2026. The skyscraper is the tallest building in the Nihonbashi area, with a height of 284 m and 52 stories, and comprises three zones (A to C). Zone C, where the skyscraper building is located, is a large-scale complex facility with six uses: office, hotel, residential facility, retail facility, MICE*2, and business support facilities. The project is projected to strengthen the Japan construction equipment market growth.

- In 2022, the Japanese Ministry of Land, Infrastructure, Transport & Tourism planned flood control projects in Settsu City and the Kinki region of the country. Several dam reconstruction projects are progressing in the Gunma, Boso, and Toyogawa canals.

- The Japanese government has started several maintenance and renovation projects in 2022. It planned to renovate 24,458 bridges, 3,761 tunnels, and road renovation projects at 5,296 locations nationwide. Therefore, the increased road, bridge, and tunnel renovation and maintenance projects are expected to support the Japan construction equipment market.

- Additionally, In 2022, investments were planned for Tokyo's redevelopment and urban planning. Investments in redevelopment projects in western Japan's Kansai and Kinki areas are also planned. In 2022, the government announced a USD 407 billion stimulus package to offset the rise in fuel and grain prices caused by the Ukraine-Russia war.

KEY HIGHLIGHTS

- Earthmoving equipment accounted for the largest market share of the Japan construction equipment market in 2023. Excavators in the earthmoving segment accounted for the largest share in 2023. Rising investment in housing, port expansion, and public infrastructure projects is expected to drive the demand for excavators in the Japan construction equipment market.

- The construction project for the cable-stayed bridge is advancing as an integral part of the Kawasaki Port Higashi-Ogishima-Mizue-cho Area Port Road Improvement Project. The objective is to establish logistical pathways, providing an alternative transportation route for emergency relief supplies during disasters and serving as an evacuation route for island workers. The bridge, designed as a cable-stayed structure, features a central span of 525 meters to accommodate the 400-meter width of the Keihin Canal.

- In September 2023, the East Japan Railway Company (JR-EAST) unveiled the specifics of their extensive redevelopment plans for a 9.5-hectare site situated on the western side of the new station along Tokyo's JR Yamanote Line, positioned between Shinagawa and Tamachi Stations.

- The 2025 Osaka Kansai Expo project involves the creation of an exhibition center on a 390-hectare area in Yumeshima, Osaka. Construction work began in the second quarter of 2023 and is slated for completion in the first quarter of 2025.

- Mitsubishi Estate, a real estate developer, started the Tokyo Torch project in Tokyo, which consists of the construction of four new tall towers (Torch Tower, Electrical Substation Building, Waterworks, and Sewerage Bureau Building) in the Tokiwabashi district; the project is projected to support the Japan construction equipment market growth.

SEGMENTATION ANALYSIS

Segmentation by Type

- Earthmoving Equipment

- Excavator

- Backhoe Loaders

- Wheeled Loaders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers)

- Road Construction Equipment

- Road Rollers

- Asphalt Pavers

- Material Handling Equipment

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

- Other Construction Equipment

- Dumper

- Tipper

- Concrete Mixer

- Concrete Pump Truck

- End Users

- Construction

- Mining

- Manufacturing

- Others (Power Generation, Utilities Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management)

MARKET TRENDS & DRIVERS

Japan’s Investment in Hydrogen Fuel to Promote the Nation’s Target to Achieve Net Zero Emissions

- In June 2023, the Japanese government approved a revision to the country's strategy for incorporating hydrogen as a fuel source in its carbon emissions reduction efforts.

- This revised plan aims to substantially boost the annual hydrogen supply, increasing it sixfold from the current level to 12 million tons by 2040.

- Additionally, the government has committed to providing the equivalent of USD 107 billion in funding, drawing from private and public sources, to develop hydrogen-related supply chains over the next 15 years.

Investment in Smart City Projects and Integration of Building Information Technology (BIM) Technology

In recent years, the Japanese construction sector has been experiencing significant transformations due to the extensive adoption of Building Information Modeling (BIM) technology. Situated in Fukushima Prefecture, the New Sukagawa City Hall illustrates a BIM implementation project carried out by a local government. AXS Satow Inc. emerged as the winner of the design competition, and the Sukagawa City authorities requested that the engineers engaged in the project employ the BIM methodology.Country’s Aging Infrastructure and the Upcoming EXPO 2025 to Propel the Japan Construction Equipment Market

The nation currently has approximately 720,000 road bridges. By 2023, it is anticipated that this number will decrease to about 290,000 bridges, and by 2033, the count is projected to rise to 450,000 bridges, all of which will have been standing for over half a century since their construction. Therefore, Japan intends to make huge investments in renovating and repairing old infrastructure, thereby supporting the Japan construction equipment market. Further, in 2023, numerous construction projects are currently in progress in preparation for the upcoming international event, Expo 2025. This event strategically aims to boost the Japanese economy following the Tokyo Olympics. The government has allocated more than USD 2.6 billion for these construction initiatives related to Expo 2025.High Investments Towards Decarbonizing the Country Are Supporting the Renewable Energy Sector

- Tokyo Electric Power Co. Holdings plans to invest USD 7 billion in renewable energy projects by fiscal 2030 to construct 6 to 7 gigawatts of additional capacity.

- Yotsuya Capital, a Japan-based solar plant developer, received investment from Octopus Energy in April 2023. Proceedings will be used to establish 250MW of solar farms nationwide in the next five years.

- In May 2023, Actis introduced Nizomi Energy, a recently established renewable energy platform focusing on achieving 1.1 gigawatts of onshore wind and solar power generation in Japan by 2027. A USD 500 million investment backs this ambitious initiative.

Robust Growth in the Logistics and Warehousing Industry to Boost the Sales of Material Handling Equipment in the Japan Construction Equipment Market

The e-commerce industry surge drove warehouse expansion investments throughout Japan in 2022. For instance, Nippon Logistech Corporation finalized the construction of its inaugural cold storage warehouse in Atsugi-Shi, Kanagawa Prefecture. ESR Kawanishi Distribution Center also allocated USD 1.5 billion towards establishing a multi-phase logistics park in the Osaka region during the same year. Furthermore, in June 2023, Amazon Japan announced that it would launch two new distribution hubs within the country, which is expected to generate more than 3,000 job opportunities.INDUSTRY RESTRAINTS

Rapid Aging Population and Labour Scarcity Will Hamper Construction Activities

According to a study conducted in Mar 2023, Japan could confront a deficit of over 11 million workers by 2040, highlighting the economic difficulties the country will encounter due to its rapidly aging population. Furthermore, the worker population is anticipated to experience a sharp decline starting in 2027. By 2040, the labor supply is projected to contract by approximately 12% compared to 2022, while the demand for labor remains constant. Moreover, in response to the acute shortage, in 2021, YKK Group, the largest zipper manufacturer globally, eliminated the retirement age restriction for its employees. Electronic retail chain Nojima also adopted a similar policy in 2020, allowing workers to continue their employment until they reach the age of 80.Power Crises in Japan Delay and Restrict New Project Tenders

The intense heatwave experienced in Tokyo in 2022 was an alert call for Japan, highlighting its reliance on domestic energy production, which covers just 12% of its energy demands. Moreover, with millions of air conditioners running at full capacity, the available power generation capacity came dangerously close to the threshold that could have triggered a citywide blackout. In reaction, the government promptly called upon businesses and households to curtail their electricity usage, resulting in project delays and further impacting the Japan construction equipment market.Mortgage Rates on Rise to Impede the Growth of Residential Sector

Anticipated higher mortgage rates are likely to persist in Japan, resulting in heightened demand for housing, even though concerns about purchasing power are still present. These elevated mortgage rates are expected to continue because of the limited supply of pre-owned homes, ultimately expanding the industry size for home builders. Further, the shortage of iron is another major factor hampering the housing market, as the high price of iron affects the prices of building materials and housing equipment. In addition, Japan entirely depends on the import of iron ore. The yen depreciation is worsening the situation as it makes imports costly. The price of iron ore, a major input cost for steel, witnessed growth of 32% in March 2022.VENDOR LANDSCAPE

- Caterpillar, Komatsu, Volvo CE, Hitachi Construction Machinery, Kubota, and Kobelco are leaders in the Japan construction equipment market. These companies have a strong market share and offer diverse sets of equipment.

- Komatsu recently introduced the new FH-2 Series Diesel Forklift. The Komatsu FH-2 SERIES diesel forklift is designed to be highly efficient, reducing business operating costs.

- Zoomlion, Tadano, DEVELON, Haulotte, Mitsubishi Forklift Trucks, Yanmar, and Takeuchi are niche players in the Japan construction equipment market. These companies offer low product diversification and have a strong presence in Japan’s local market.

Key Vendors

- Caterpillar

- Hitachi Construction Machinery

- Komatsu

- Liebherr

- Volvo Construction Equipment

- Kobelco

- Kubota

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- SANY

- Hyundai Construction Equipment

- SAKAI

Other Prominent Vendors

- Yanmar

- Tadano

- Takeuchi

- Manitou

- SUMITOMO CONSTRUCTION MACHINERY CO., LTD.

- Toyota Material Handling

- AUSA

- AIRMAN

- Aichi Corporation

- KATO WORKS CO., LTD.

- Develon

- Hydrema

- Haulotte

- Merlo S.p.A.

- Mitsubishi Forklift Trucks

Distributor Profiles

- Nippon Cat

- Akiyama Construction Machinery

- Daiichi Toyo Co., Ltd

- Yamazaki Machinery Co., Ltd.

- WWB KENKI

- KATY MACHINERY CO., LTD.

KEY QUESTIONS ANSWERED:

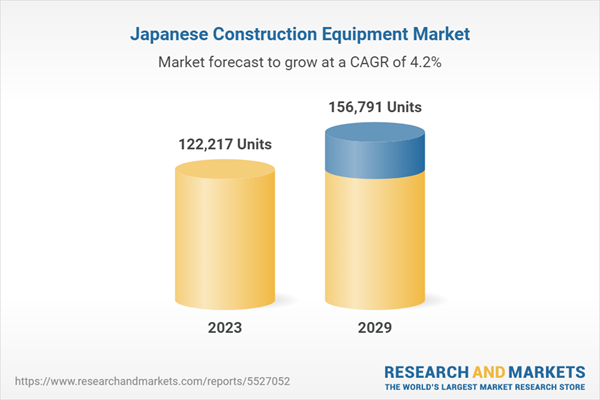

1. How big is the Japan construction equipment market?2. What is the growth rate of the Japan construction equipment market?

3. Who are the key players in the Japan construction equipment market?

4. What are the trends in the Japan construction equipment market?

5. Which are the major distributor companies in the Japan construction equipment market?

Table of Contents

Companies Mentioned

- Caterpillar

- Hitachi Construction Machinery

- Komatsu

- Liebherr

- Volvo Construction Equipment

- Kobelco

- Kubota

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- SANY

- Hyundai Construction Equipment

- SAKAI

- Yanmar

- Tadano

- Takeuchi

- Manitou

- SUMITOMO CONSTRUCTION MACHINERY CO., LTD.

- Toyota Material Handling

- AUSA

- AIRMAN

- Aichi Corporation

- KATO WORKS CO., LTD.

- Develon

- Hydrema

- Haulotte

- Merlo S.p.A.

- Mitsubishi Forklift Trucks

- Nippon Cat

- Akiyama Construction Machinery

- Daiichi Toyo Co., Ltd

- Yamazaki Machinery Co., Ltd.

- WWB KENKI

- KATY MACHINERY CO., LTD.

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value in 2023 | 122217 Units |

| Forecasted Market Value by 2029 | 156791 Units |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Japan |

| No. of Companies Mentioned | 32 |