Key Highlights

- The midstream segment is expected to witness significant growth in the Chinese oil and gas market during the forecast period.

- China targets to boost domestic production of unconventional sources like shale gas. It is also estimated that China's shale gas production may reach around 280 billion cubic meters (bcm) by 2035. Thus, the plans to boost its shale gas production are expected to create an opportunity in the coming years.

- The rising oil and gas investments, especially in the upstream and midstream sectors, are expected to drive the nation’s oil and gas market during the forecast period.

Key Market Trends

Midstream Sector to Witness Significant Growth

- China's oil and gas midstream consists of oil and gas pipelines and storage facilities. As of 2021, the country has nearly 110,000 kilometers of natural gas pipeline, while the oil pipeline of nearly 27,441 kilometers.

- In April 2020, China’s Sinopec started building storage tanks in the second phase of its Tianjin terminal project to receive liquefied natural gas (LNG). The plan for the second phase is to have five LNG tanks with a storage capacity of 220,000 cubic meters each and a new berth for LNG vessels.

- In July 2020, PipeChina agreed to buy pipelines and storage facilities valued at USD 55.9 billion. Under the deal, PipeChina, known formally as China Oil and Gas Pipeline Network, will take over oil and gas pipelines and storage facilities from state-owned energy giants PetroChina and Sinopec in return for cash and equity in the pipeline company.

- Moreover, China has nearly 287 storage facilities with approximately 1.06 billion barrels of total storage capacity (crude oil: 74 facilities with 706.1 million barrels of capacity; refined products: 213 facilities with 357 million barrels of capacity).

- In October 2021, China Petroleum & Chemical Corp (Sinopec) commenced operations on a 10 billion cubic meter Wei 11 gas storage facility in Northern China. The Wei 11 gas storage facility built in the Zhongyuan oilfield region has completed its first gas injection. The storage mainly covers the region of the middle and lower reaches of the Yellow River - Henan Province and East China's Shandong Province.

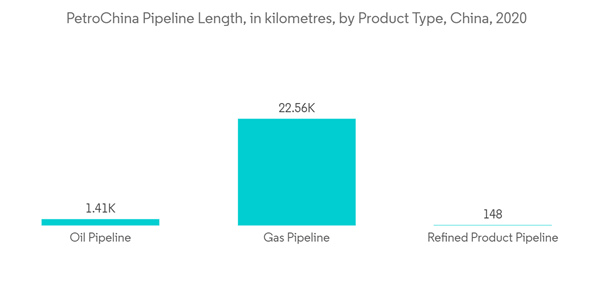

- PetroChina's domestic crude oil pipelines had a total length of about 7,190 kilometers in 2020, while gas pipelines had a total length of about 22,555 kilometers. Overall, pipeline length decreased in 2020 compared to the previous year.

- With rising demand for natural gas, the country is planning to build 23 gas storage facilities by 2030, with an investment of around USD 8.5 billion. The completion of the storage facilities, along with the upcoming gas pipelines in the country, is expected to boost the midstream sector in the near future.

- Therefore, based on the above-mentioned factors, the midstream segment is expected to witness significant growth in the Chinese oil and gas market during the forecast period.

Rising Oil and Gas Investments Driving the Market Demand

- China is the world’s second-largest consumer of oil and gas and the sixth-largest producer of oil and gas globally. The Chinese energy market is dominated by state-owned oil and gas companies by developing the country’s domestic reserves, building and operating pipelines, managing, and filling its strategic petroleum reserves (SPR).

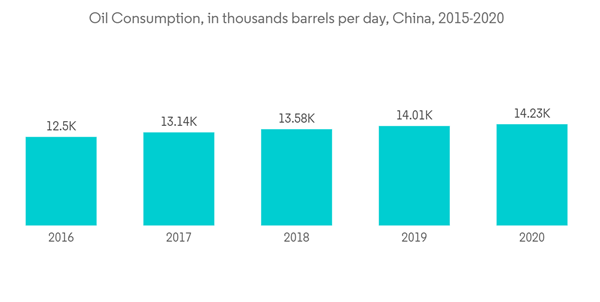

- China's oil consumption has seen significant growth with rising demand from the increasing automotive fleet across the country. Oil consumption increased to 14,225 thousand barrels per day in 2020, as compared to 14,005 thousand barrels per day in 2019. This is expected to attract major investments to meet the demand.

- Furthermore, to meet the county's oil and gas demand and boost domestic energy supplies, in 2020, China's Ministry of Natural Resources announced the opening of foreign direct investments in the oil and gas industry. It aims to allow foreign companies to explore for and produce oil and gas in the country.

- In February 2021, CNOOC announced a total capital expenditure of USD 15.46 billion, with targeted net production of 545-555 million barrels of oil equivalent (Mboe).

- Further, in March 2021, Sinopec anticipates spending CNY 66.8 billion on upstream exploration, focusing on shale gas development in southwest China and the construction of liquefied natural gas (LNG) terminals in coastal areas.

- In November 2021, ExxonMobil announced the final investment decision (FID) to build a multi-billion dollar petrochemical complex in south China's Guangdong province. The Dayawan plant will produce performance polymers used in packaging, automotive, agricultural, and consumer products for hygiene and personal care.

- Hence, making some of the major investments with the help of domestic and foreign firms is expected to drive the Chinese oil and gas market during the forecast period.

Competitive Landscape

The Chinese oil and gas market is moderately consolidated. The key players in the market include China National Petroleum Corporation, China Petroleum & Chemical Corporation (Sinopec), China National Offshore Oil Corporation (CNOOC), ExxonMobil Corporation, and Chevron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation (Sinopec)

- China National Offshore Oil Corporation (CNOOC)

- ExxonMobil Corporation

- Chevron Corporation

- BP PLC

- Shell PLC

- Yanchang Petroleum International Limited

- Shaanxi Yanchang Petroleum Group

- Sinochem Corporation