Total premium growth throughout the third quarter of 2021 hit a substantial 9.5 percent, which was 7.3 points higher than the corresponding timeframe in 2020. Commercial lines grew more significantly than personal lines at 9.8 percent and 4.8 percent, respectively. Commercial and personal auto and workers’ compensations regained traction and rebounded significantly, which impacted the overall premium level.

US property and casualty (P&C) insurers have weathered uncertainty relatively well in recent years. From 2017 through 2021, their average annual total shareholder return (TSR) was approximately 11%, compared with 7% for insurers across all regions and sectors.

State Farm Insurance was the largest property and casualty insurance company by revenue in 2021. It also topped the list of leading P/C insurers regarding the value of direct premiums written. State Farm is a group of mutual insurance companies with headquarters in Bloomington, Illinois. However, Nationwide overtook State Farm in 2021 to become the country's most profitable mutual property and casualty insurer.

US Property & Casualty Insurance Market Trends

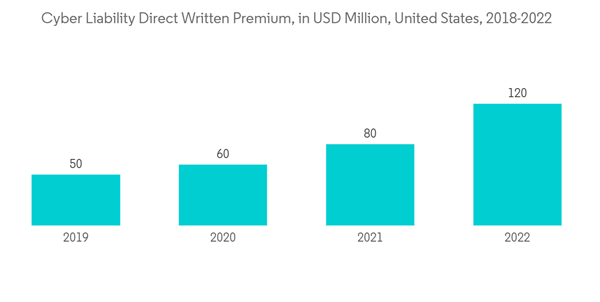

Cyber Insurance is the Fastest Growing Line in United States

Premiums for stand-alone cybersecurity insurance policies soared in 2021, as reported on supplementary schedules in U.S. P&C insurers' annual statutory statements, and they are poised for significant expansion again in 2022.Factors such as the increased importance of remote information technology capabilities in the pandemic era, high-profile ransomware and distributed denial-of-service attacks on large corporations and critical infrastructure, and fears about potential retaliatory attacks by state-sponsored actors have led to a surge in demand for coverage at a time many in the industry have been reluctant to materially boost capacity.

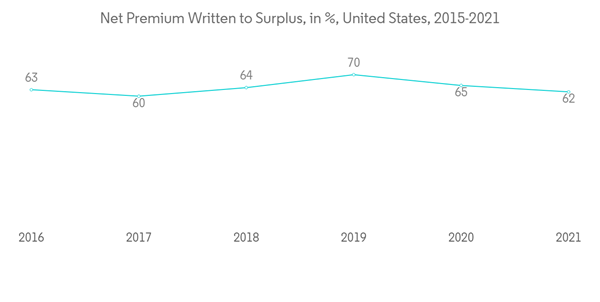

Increase in Net Premiums Written in the P&C Sector is Driving the Market

Net income grew 8.0 % in the first three quarters of 2021 to USD 43.5 billion compared to USD 35.5 billion in 2020 and policyholder surplus grew 10.1 percent. As a result, the net premium written to surplus ratio improved to 73.0 percent. The total expense ratio, including underwriting, loss adjusting, and investment, remained at 38.4 percent, unchanged from 2020. Companies with a solid surplus may look to deploy excess growth and capital through product expansion and new investments in technology in the future.Direct loss ratios for most lines of business in 2021 had lower loss ratios throughout the first three quarters of the year compared to 2020. Personal lines suffered a big upswing in loss ratios with home & farm insurance losses going up 3.8 points and auto losses going up more than 10.0 points. These increased ratios are the result of elevated catastrophe activity linked to wildfires, hurricanes, tornadoes, and supply chain challenges coupled with inflation.

US Property & Casualty Insurance Market Competitor Analysis

The report covers the major players operating in the property and casualty insurance market in the United States. The market is fragmented. The property and casualty markets continue to present "soft rates" (i.e., lower insurance premiums), and despite the recent increase in the federal fund rate, interest rates remain near historically low levels. The foregoing factors have adversely impacted revenue and profitability of P&C insurers, which may encourage consolidation among larger property and casualty insurers, due to diminished opportunities for organic growth. Its major players are Berkshire Hathaway Inc., American International Group Inc., Liberty Mutual Holding Company Inc., The Progressive Corporation and The Travelers Companies Inc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Berkshire Hathaway Inc.

- American International Group Inc.

- Liberty Mutual Holding Company Inc.

- The Progressive Corporation

- The Travelers Companies Inc.

- United Services Automobile Association

- Farmers Group Inc.

- American Family Mutual Insurance Company S.I.

- W. R. Berkley Corporation

- American Financial Group Inc.