Key Highlights

- The market is primarily driven by factors, such as the growing fleet of aircraft, to cater to the rise in the demand for air travel and the increasing need to avoid baggage handling and passenger handling delays to increase the operational efficiency of airports. Passenger traffic across the European airport network witnessed a 98% YoY growth in 2022, however, it was 21% below the pre-pandemic air passenger traffic in 2019.

- The increasing investments in airport infrastructure to increase the passenger and aircraft handling capacities through the expansion of existing airports and construction of new airports are anticipated to increase the flight frequency at airports, thereby, accelerating the growth of the market.

- The introduction of new eco-friendly ground handling systems may attract contracts from ground handling service providers to support the green airport initiatives of airport authorities.

Europe Airport Ground Handling Systems Market Trends

The Aircraft Handling Segment is Anticipated to Record the Highest CAGR During the Forecast Period

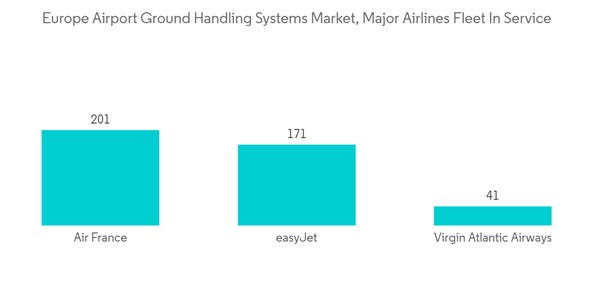

The aircraft handling segment is expected to have the highest growth in the European airport ground handling systems market during the forecast period. This is mainly due to the growing fleet of major airlines in the region, which has led to an increase in flight movements at various airports in the region. For managing the increasing aircraft operations, the need for advanced aircraft handling systems has increased. Major players are investing heavily in the research and development of products to provide advanced aircraft handling products in accordance with safety norms. For instance, in October 2018, Fraport and Lufthansa co-tested a remote-controlled aircraft tug at Frankfurt Airport. The e-vehicle is smaller than many conventional tugs, and it can be stationed and charged in a fixed parking position. So, it is available for use at all times and avoids long travel distances between individual positions. It can manage between 30 and 50 pushback procedures without having to be charged, helping to limit emissions. Also, in December 2022, the International Air Transport Association (IATA) called for a transition to enhanced ground support equipment (Enhanced GSE) to improve safety and contain the cost of ground damage involving GSE. Enhanced GSE uses anti-collision and inching technology, improves vehicle control, and increases docking accuracy, all of which minimizes the risk of personnel injuries and damaging aircraft. The incorporation of such advanced technology solutions for aircraft handling may propel the growth of the segment in the coming years.United Kingdom is expected to hold the highest market share

The United Kingdom accounted for the largest share in the market. According to UK Civil Aviation Authority, about 63 million passengers flew in and out of the UK, between April and June 2022 on 477,559 flights. Heathrow Airport and Gatwick Airport were the busiest airports in the United Kingdom in 2022, with cumulative passenger traffic of more than 94.4 million passengers. With the growth in air traffic, the UK government has planned to increase the capacity of all the major airports in the country by 2030. Also, airports, like Manchester Airport, are testing zero-emission ground handling equipment, like belt loaders, pushback tugs, and multi-purpose cargo tractors. Such introduction of eco-friendly equipment and the stricter new emissions norms of the UK government, along with the aging ground handling equipment infrastructure, may accelerate the demand for new airport ground handling systems during the forecast period.Europe Airport Ground Handling Systems Industry Overview

The European airport ground handling market is fragmented, with several players accounting for significant amounts of shares in the market. Some of the prominent companies in the market are Cavotec SA, Beumer Group, JBT, Adelte Group SL, and Textron Inc. These players are investing heavily in the research and development of future technologies to reduce the efforts of ground support staff. Ground handling service providers are focusing on the expansion opportunities in the region, as the demand for new equipment is increasing. For instance, after receiving a five-year contract at Birmingham airport for Flybe, World Flight Services is investing in the procurement of new management control systems and new ground support equipment to ensure the efficiency of its Birmingham operation. Such expansions of service providers into new airports, as well as the growing demand for zero-emission GSE, are anticipated to help manufacturers increase their sales in the coming years.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.