The COVID-19 pandemic had a significant impact on all sectors, including the aviation industry. Due to restrictions on air travel, the overall passenger traffic declined by 60% to 65%. However, as the situation normalized in the fiscal year 2021-2022, the number of air passengers increased, leading to the unfreezing of standby orders of commercial aircraft and an increase in orders from airline companies. As of December 2022, the total traffic measured in revenue passenger kilometers (RPKs) rose by 39.9% compared to December 2021. Global traffic was then at 76.9% of the levels seen in December 2021.

In the Asia-Pacific region, the COVID-19 pandemic resulted in a decline in sales of aircraft in the commercial and general aviation segments in 2020. In the commercial sector, international passenger traffic continued to remain low in 2021. Nevertheless, domestic passenger traffic has been robustly growing in various countries since late 2020. A similar trend was witnessed in the general aviation sector in 2021 as the aircraft movement significantly increased compared to 2020. In Asia-Pacific, passenger and freight traffic rates are increasing, thus boosting the number of aircraft being handled by airports. This is propelling the demand for efficient and better ground handling systems and infrastructure at terminals. Due to the growing number of air passengers, several airports in the region need help with capacity management and other issues.

The airport infrastructure market in smaller cities in countries such as India and China is expected to witness growth, owing to the efforts taken by governments to promote air travel. As modern airports are being constructed with more terminal gates, longer runways, and advanced air traffic control systems, a rise in the demand for these infrastructure components is expected to propel the aviation infrastructure market in the Asia-Pacific region.

Asia-Pacific Aviation Infrastructure Market Trends

Commercial Airport Segment is Expected to Dominate the Market During the Forecast Period.

By airport type, the commercial airport segment is expected to dominate the market during the forecast period. Currently, commercial air passenger traffic is witnessing high growth in Asia-Pacific, and it is also expected to continue to grow significantly during the forecast period. Moreover, air freight transportation is expected to grow significantly during the forecast period. In this regard, airport authorities are investing in the development of the existing infrastructure by constructing new terminals or restructuring the existing ones. For instance, In June 2021, Varaha Infra Limited got a contract from the Airports Authority of India for the development of a new greenfield airport in Gujarat, India. According to the assessment by the Airports Council International in 2022, the Asia-Pacific region continues to be a geography with significant potential for aviation, as 57% of the 300 planned airports globally are coming up in this part of the world. Such developments are expected to augment the market prospects during the forecast period.China is Expected to Lead the Market During the Forecast Period.

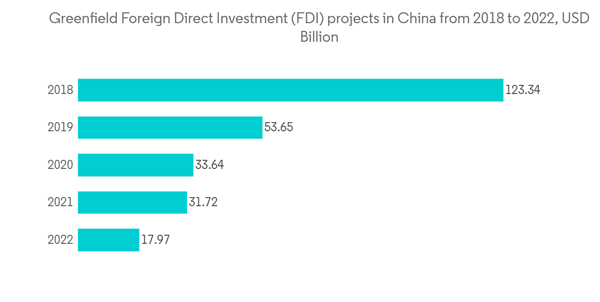

China held the highest shares in the market and continued its domination during the forecast period. The growth is attributed to the rising spending on the aviation sector, increasing demand for new aircraft, and growing airport construction projects across the country. Increasing air traffic and rising disposable income demand new aircraft, driving the market growth. China's major plane manufacturer, Commercial Aircraft Corporation of China (COMAC), predicted that China's aircraft fleet size will likely reach 9,957 by 2040, accounting for around 22 percent of the global passenger aircraft fleet, making China the world's largest single aviation market. The report stated that the country would take delivery of 9,084 passenger planes at or above the 50-seat class in the next two decades, valued at approximately USD 1.4 trillion.Furthermore, the Civil Aviation Administration of China (CAAC) aims to add another 215 airports to reach a target of 450 by 2035. China envisions constructing an average of 14 airports annually until 2035 to help transform the country's aviation industry into a strategic asset of its economy. The construction of new airports would facilitate the creation of new routes and the induction of a new aircraft fleet to address the additional passenger traffic. Such developments would bolster the adoption of sophisticated infrastructure to ensure operational efficiency in the country.

Asia-Pacific Aviation Infrastructure Industry Overview

Some of the prominent players in the Asia-Pacific aviation infrastructure market are GMR Group, GVK Industries Limited, JLL Inc., AECOM Limited, and Turner Construction Company. Major players are focusing on the constant development of the workforce to execute the on-time completion of infrastructure development projects. Aviation Infrastructure development companies have to work in close synergy with airport authorities to improve airport operations by understanding barriers and requirements, which may help them achieve growth during the forecast period. For instance, in May 2022, the aviation ministry extended the term of the Concession Agreement of GMR Infrastructure Limited (GIL) for operating the Rajiv Gandhi International Airport in Hyderabad till 2068. Such developments are expected to enhance the competitive nature of the market in the future.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.