COVID-19 had affected the overall healthcare industry. As per the article published in 2021 under the title 'Clinical impact of blood pressure variability in patients with COVID-19 and hypertension', High blood pressure variability (BPV) was substantially related to in-hospital mortality in COVID-19 patients with hypertension. High blood pressure variability was inversely correlated with advanced age and systemic inflammation. Patients with COVID-19 who have high blood pressure and hypertension require additional care since the infection caused frequent fluctuations in blood pressure. Moreover, the report published in 2021 under the title 'The challenges of measuring blood pressure during COVID-19', stated that the availability of face-to-face care in family practice has changed because of COVID-19. The adverse impact on normal care for managing chronic diseases was found to be a concern during the pandemic. As per the aforementioned factors, COVID-19 had a significant impact on the blood pressure monitoring devices market.

The market currently is experiencing tremendous growth due to the rising burden of cardiovascular disorders, growing geriatric and obsess population, and increasing unhealthy lifestyle habits. As per the World Health Organization (WHO) in 2021, an estimated 1.28 billion adults aged 30-79 years worldwide have hypertension, with most (two-thirds) living in low- and middle-income countries. It is estimated that this trend will continue to rise even in the forecast period and the demand for monitoring blood pressure devices experience substantial growth in the future. This surge in rising of the geriatric population is expected to continue in all the other parts of the globe as well giving rise to the number of cardiovascular disorders as the aged population is more prone to diseases and subsequently booming the market. For instance, according to data from World Population Prospects: the 2019 Revision, by 2050, one in six people in the world is anticipated to be over age 65. By 2050, one in four persons living in Europe and Northern America could be aged 65 or over. Technological advancements pertaining to hypertension monitoring are also increasing. For instance, in February 2022, InBody introduced the new BP 170 automatic blood pressure monitor, which provides individuals with the option to self-record and track key health metrics at home. In addition, the rising adoption of home healthhealth monitoring coupled with awareness about the importance of early diagnosis of hypertension & cardiac diseases is further expected to boost the market growth

As per the points mentioned above, the blood pressure monitoring devices market is anticipated to grow over the forecast period. However, the excessive cost of technological developments and the lack of trained physicians are the factors that can hamper the market growth over the forecast period.

Blood Pressure Monitoring Devices Market Trends

Automated/Digital Blood Pressure Monitor is Expected to Witness a Growth Over the Forecast Period

Automated blood pressure readings are more accurate than typical manual readings among patients with hypertension. The ease of usage and accuracy lead the digital BP monitors to have more acceptance compared to others. There are studies conducted reviewing the benefit of self-monitoring and explaining the need for BP monitor for each household as heart issues are more prevalent. As per the article published in 2021 under the title 'Self-Measured Blood Pressure Monitoring at Home: A Joint Policy Statement From the American Heart Association and American Medical Association', self-measured BP monitoring is used to confirm the diagnosis of hypertension and to help those with the condition better control their blood pressure. Therefore, there was likely to be an investment in creating and supporting the infrastructure for expanding self-measured BP monitoring and increasing coverage for the patient- and provider-related costs. Technological advancements along with new product launches are expected to further fuel the demand for digital BP monitors globally. For instance, in January 2022, OMRON Healthcare, Inc., introduced its new remote patient monitoring services at the 2022 Consumer Electronics Show (CES) along with its connected blood pressure monitors and an advanced mobile app that is designed to support consumers.As per the factors mentioned above, digital/automated blood pressure monitors are expected to witness growth over the forecast period.

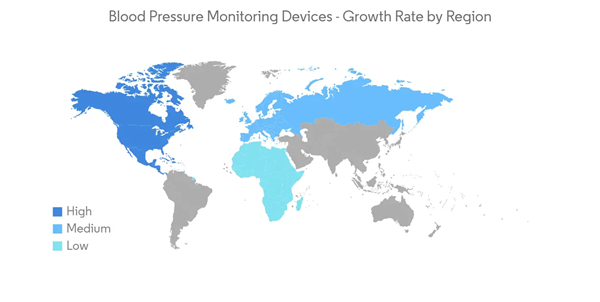

North America is Expected to Hold the Largest Market Share Over the Study Period

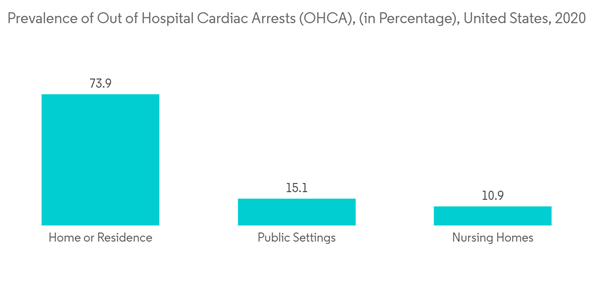

Globally, North America dominates the global blood pressure monitoring devices market owing to the high demand for blood pressure monitors due to the increased burden of hypertensive patients in this region. As per CDC, heart disease is the leading cause of death for men, women, and people of most racial and ethnic groups in the United States. One person dies every 34 seconds in the United States from cardiovascular disease. About 697,000 people in the United States died from heart disease in 2020.Initiatives taken by the government in this region such as the public blood pressure (BP) monitoring program to create awareness amongst people and maintain the database created by remotely operational BP monitors are expected to propel further growth during the forecast period. For instance, Million Hearts is a national initiative co-led by the Centers for Disease Control and Prevention (CDC), and the Centers for Medicare & Medicaid Services (CMS). They have forecasted their priorities for 2027 are building healthy communities and optimizing care through a committed focus on specific populations experiencing inequities.

Hence as per the factors mentioned above, North America is expected to witness a growth for the studied market over the forecast period.

Blood Pressure Monitoring Devices Industry Overview

The blood pressure monitoring devices market is fragmented and competitive due to the presence of a large number of players. The major players are currently aiming their attention to expanding their businesses in order to strengthen their position in the market. Innovation and technology advancement seems to be one of their top strategy to uphold in the market space. GE Healthcare, A&D Medical Inc., Incorporated, Omron Healthcare Inc., and Philips Healthcare are some of the key players currently dominating the blood pressure monitoring devices market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.