COVID-19 outbreak had a significant impact on the growth of the market during the pandemic period. The demand for influenza vaccine was notable during the pandemic as the SARS-CoV-2 affects the infected patient’s respiratory system. Such circumstances significantly impacted the market's growth, giving rise to the demand for influenza vaccines during the pandemic. For instance, the BW article published in November 2021, mentioned that Apollo hospitals and Fortis Healthcare were also witnessing higher demand for flu shots, including Abbott's imported vaccine, influvasc, the private hospital operators. Such a surge in demand for influenza vaccines during the pandemic period notably impacted the market growth. In addition, the demand for the influenza vaccine is expected to remain intact during the post-pandemic period, thereby contributing to the market's growth over the forecast period.

The increasing number of influenza cases worldwide is expected to drive the demand for influenza vaccines, thereby contributing to the market's growth. For instance, the Global Flu data published in February 2022 mentioned that an estimated 1 billion people worldwide are infected by seasonal influenza every year. The report also said that out of those 1 billion, about 3 to 5 million people have a severe case of flu every year. Additionally, according to the data published by WHO in December 2022, 5%-15% of the population is affected by influenza in the European region every year. Likewise, the Plos One Journal article published in July 2021 mentioned that approximately 5%-10% and 20%-30% of new cases of influenza infections occur among adults and children, respectively, annually. Such a high prevalence of influenza is expected to contribute to the market's growth over the forecast period.

The growing number of government investments to increase production capabilities for the influenza vaccine has been the key market driver for influenza vaccines. For instance, in March 2022, the Australian government invested more than 100 USD million in the seasonal influenza vaccine to protect people at risk. Moreover, major healthcare companies are investing vast amounts of capital and time in developing advanced therapy in the form of vaccines. For instance, in August 2021, Seqirus invested in Next-generation influenza vaccine technology, self-amplifying mRNA. The company targeted the commencement of clinical trials for both seasonal and pandemic influenza vaccines.

However, the huge cost involved in R&D and the extended timeline required for introducing a new vaccine may hinder the market growth for influenza vaccines.

Influenza Vaccine Market Trends

The Quadrivalent Segment is Expected to Hold a Major Share in the Market over the Forecast Period

Quadrivalent influenza vaccine is designed to protect against four different flu viruses, including two influenza A verses and two influenza B viruses. The quadrivalent segment is expected to hold a significant share of the influenza vaccine market due to its cost-effectiveness, efficacy against viral infections, and easy availability in hospitals and clinics. The product approvals for the quadrivalent type of vaccine are also expected to drive the market's growth. For instance, in July 2022, the United States FDA approved the request of GlaxoSmithKline for the influenza vaccine, Fluarix, a quadrivalent vaccine. The Fluarix quadrivalent is a vaccine indicated for active immunization to prevent disease caused by the influenza A subtype virus and type B virus contained in the vaccine.The increasing preference for quadrivalent vaccines by healthcare professionals to treat influenza is expected to drive the market's growth. For instance, in June 2022, a healthcare survey conducted by Sanofi reported that physicians and pharmacists would recommend CDC to provide vaccines like Fluzone high-dose quadrivalent (influenza vaccine) for people 65 and older for the treatment of influenza.

Also, the increasing product launches are expected to drive the growth of the studied segment during the forecast period. In April 2021, Sanofi invested over EUR 600 million to build a new vaccine facility in Toronto to increase its supply of influenza vaccines in Canada, the United States, and Europe. The new facility is expected to develop quadrivalent influenza vaccines and serve its customers with effective vaccinations.

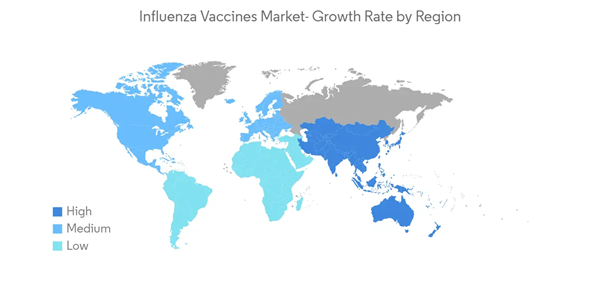

North America is Expected to Hold Notable Share in the Market Over the Forecast Period

North America is expected to hold a significant market share in the forecast period. This is due to the rising awareness regarding influenza infections and their available therapies, the government spending on spreading awareness, and the technological advancements in developing new vaccines. The market's growth is also attributed to the presence of major market players in the region, and their high expenditure on R&D. In North America; there is an increased prevalence of influenza, which has led to market growth. According to the CDC data in December 2022, nearly 150,865 influenza-positive cases, among which 149,704 cases were influenza A and 1,61 influenza B virus types. Additionally, the Public Health Agency of Canada in December 2022 mentioned that nearly 34,413 influenza cases were reported in Canada from August 2022 to December 2022. Such a high burden of influenza cases among the North American population is expected to drive the demand for influenza vaccines, thereby fueling the market growth in this region.The growing number of government initiatives to increase awareness about the medications and prevention of influenza has been the key market driver for influenza vaccines. For instance, in September 2021, the CDC participated in a broad inter-agency partnership coordinated by the Biomedical Advanced Research and Development Authority (BARDA) that supports the advanced development of new and better influenza vaccines.

Additionally, the increasing product developments by various organizations in this region are also expected to contribute to the growth of the market. For instance, in June 2021, NIH launched the clinical trials of FluMos-v1, a vaccine candidate in the United States. This vaccine is expected to stimulate antibodies against multiple influenza virus strains by displaying part of the influenza virus proteins.

Thus the above-mentioned factors are expected to drive the market's growth in this region during the forecast period.

Influenza Vaccine Market Competitor Analysis

The Influenza Vaccine Market is moderately competitive, with many key players dominating the market. The presence of major market players, such as Abbott Laboratories, GlaxoSmithKline PLC, Pfizer Inc., AstraZeneca PLC, and CSL Limited, is intensifying the competition.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AstraZeneca PLC

- CSL Limited

- Abbott Laboratories

- Emergent BioSolutions

- GlaxoSmithKline PLC

- Gamma Vaccines Pvt. Ltd

- Merck & Co. Inc.

- Pfizer Inc.

- Sanofi

- Sinovac Biotech Ltd

- Viatris Inc. (Mylan)

- BIKEN