Key Highlights

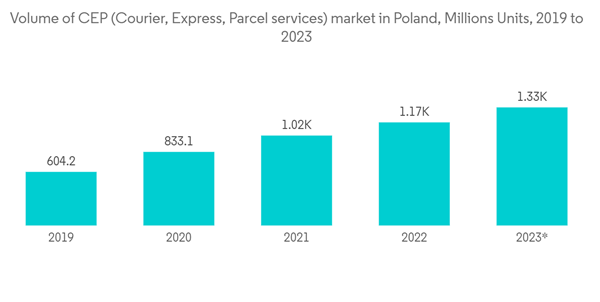

- COVID-19 has impacted all Polish sectors except the CEP segment in the e-commerce sector. When lockdowns eased in 2021, the CEP market grew strongly across all sectors. The market is primarily driven by the growing e-commerce industry in the country and the cross-border deliveries across the European Union. The Polish business market consists of more than 20,000 online stores that belong to various industries and offers home deliveries across Poland and the majority of locations across the region.

- The CEP sector is one of the fastest-growing service industries in Poland right now, largely because of the rising trend of logistics outsourcing, changes in the retail sales structure (particularly the growth of e-commerce), the demand for faster delivery times, and the need to reduce stocks.

- The majority of European CEP operators and all major global corporations are present in the Polish market. In Poland, CEP entities also include the national postal service, which has enhanced its competitiveness in the market over the past few years. Some businesses with Polish roots provide services outside of Poland. Local service brokers and couriers are also prevalent.

- The same-day deliveries have helped the market expand exponentially, primarily led by the deliveries of clothing, books, small consumer electronics, footwear, cosmetics, etc. The growing e-commerce industry is driving the express delivery market due to the rising demand from the B2C business segment.

- The way CEP operators think and behave has evolved and is continuing to change as a result of e-commerce. E-commerce has influenced the development of service features such as afternoon or evening deliveries, specialised IT tools to support Interactive Delivery Management, or IDM, and specialised product offerings such as pre-paid services and "out of house" delivery.

- The large middle class and young population group in Poland are anticipated to drive the demand for quick deliveries, focusing more on perishable goods that require express delivery. The pricing strategies of the key players are projected to drive the market with an increasing number of small players entering the market.

- The domestic players are also focusing on mergers and partnerships with other players to expand their customer base and total addressable market.

Poland CEP Key Market Trends

Growing Express Delivery Segment is Driving the Market's Growth

The highly secure and efficient delivery processes witnessed significant growth in the Polish CEP market and held a major market share despite the high cost of express logistics than the standard deliveries.The rising number of players operating in the market over the years and consumer preference for fast delivery positively impacted the market. Healthy competition in the market has led to high penetration of diversified services with the introduction of better services. Though there was a significant fall in the number of letters posted through express delivery, the number of couriers and parcels sent through express delivery has increased substantially.

The main express logistics in the country are handled by the country's major airports, including Warsaw, Krakow, Gdansk, and Poznan. One of Europe's biggest cargo terminals is located in Warsaw.

Some online retailers use Poland as their hub for delivering goods to the Baltic and surrounding Eastern European nations. The process is quicker and more effective when air freight is used to deliver goods to these nations.

Due to cheaper ground logistics costs, ground express in the country saw a lower revenue market share than air express. Ground express is employed by express logistics providers when a package can be delivered to a location by the appointed time.

The country's express logistics industry has primarily benefited from the international courier. Express delivery for international shipments has become more popular in the nation due to the development of a well-planned road infrastructure and air transportation network and solid connectivity with European, North American, and Asian countries through road and air routes. On the other hand, the country's high internet penetration rate and the e-commerce sector's expansion have boosted the domestic express delivery services market.

Domestic Deliveries Anticipated to Hold More Market Share

Domestic courier services contributed a major share of the total market revenues during the study period. They are anticipated to continue this trend during the forecast period. The well-developed road and air infrastructure boosted the growth of the market segment. The increased demand for express and one-day deliveries also boosted the domestic segment of the market.Efficient tracking solutions offered by the market players have ensured package safety and helped gain customer confidence. The high internet penetration rate and the growing awareness about various products may help the international and domestic segments increase their market revenues.

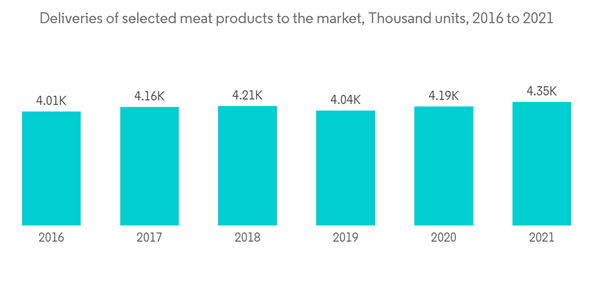

In 2021, domestic meat deliveries (including hog, beef, veal, and poultry meat) totaled 4348 thousand ton, up by 3.7% from the previous year. Both chicken meat and raw meat from animals for slaughter saw an increase in delivery, 1.3% and 5.4%, respectively.

Deliveries of frozen sea fish, chocolate (including white chocolate and chocolate goods), vodkas, liqueurs, and other spirit drinks, including pure vodka, increased significantly in 2021 compared to the previous year. Raw meat from animals for slaughter, meat and various meat products from animals for slaughter, and wine and mead, including grape wine, also saw a considerable rise in deliveries during the same period. However, deliveries of different meat products from chicken, margarine, reduced-fat spreads, and rye flour were significantly lower in 2021 than in 2020.

Poland CEP Market Competitive Landscape

Poland’s courier, express, and parcel (CEP) market is relatively consolidated, with the top three companies occupying a major market share. With the growing demand for CEP services in the country, companies are becoming more competitive to capture this huge opportunity.The international players are making strategic investments to establish a regional logistics network, such as opening new distribution centers, smart warehouses, etc. Local companies are facing high competition with multinational companies with comparatively well-developed infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- DHL

- DPD Group

- Polish Post (Poczta Polska)

- FedEx

- UPS

- General Logistics Systems BV (GLS)

- Inpost

- Geis