The development of the business ecosystem, rise in disposable income of people, investment in the tourism sector, etc. are propelling the demand for commercial and general aviation aircraft in the European region. The aforementioned factor is subsequently driving the market growth for aircraft lighting.

The innovations and introduction of new technologies, such as LED mood lighting, human-centric lighting, and other innovative cabin lighting products are significantly fueling the demand for aircraft lighting systems in Europe. A wide range of lighting options in several different colors is helping airlines and aircraft manufacturers to enhance customers' moods and experiences during air travel and lessen jetlag.

The success of LCCs is high in this region. Major airline companies in the region such as Air France, British Airways, and Lufthansa, are focusing on improving the overall passenger experience in the commercial aircraft market. This is expected to play a vital role in aiding the demand for aircraft lighting systems in the region.

Europe Aircraft Lighting Market Trends

Commercial Aircraft Segment to Witness the Highest Growth During the Forecast Period

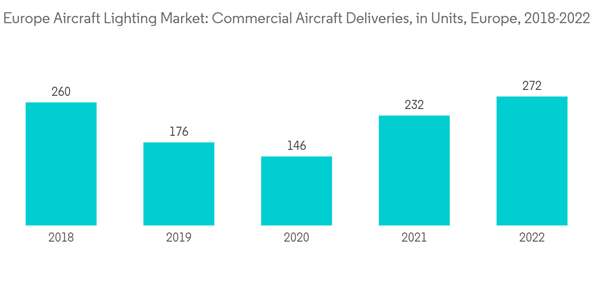

The rise in air passenger traffic, especially in southern and eastern Europe is propelling the demand for new commercial aircraft. Several countries are investing in the development of their respective national aviation infrastructure by building new regional airports to cater to the air travel needs of people. With the construction of new airports, airline operators in the region are expanding their fleet to serve new destination pairs and this has driven the demand for new aircraft, thereby also creating a simultaneous demand for aircraft lighting systems, both interior and exterior.The region’s airlines are also transitioning to high-quality LED lighting, as it eliminates many of the shortcomings of the current interior cabin lighting in terms of performance, dependability, durability, and weight. The widespread implementation of LED Ambient Lighting (LED) on next-generation aircraft has helped to keep cabin modernization activities ongoing while maintaining a consistent level of service quality.

It is anticipated that the huge number of aircraft orders placed by various airlines will drive the market as most airlines are opting for innovative cabin lighting to enhance passengers experience. Major airlines such as Rostec, Ryanair, Wizz Air, Air France, Lufthansa, and Turkish Airlines, have ordered large numbers of aircraft. For instance, in October 2023, easyJet reportedly ordered 257 aircraft from Airbus valued at nearly USD 20 billion. The LCC airline also plans to increase the average number of seats per flight from 179 to the low 200s by 2034. Such aircraft orders such as these are expected to boost the demand for aircraft lighting during the forecast period.

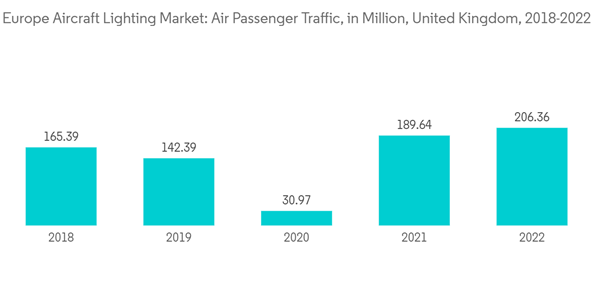

United Kingdom is Expected to Account for a Major Market Share

The UK is one of the most attractive markets for airlines operating in Europe and is also a gateway to many European destinations, which is evident from the high air passenger traffic volumes at the UK airports. In 2022, Heathrow Airport was the busiest airport in the country with a passenger traffic of nearly 61.6 million. The increasing air passenger traffic has encouraged airlines to initiate fleet modernization and expansion programs to effectively serve a growing clientele and operate on new routes. On this note, as of July 2022, British Airways is expecting the deliveries of its new aircraft Boeing B777X between 2026 and 2028. The airline has made significant improvements to the amenities inside the cabin, which include more than 16 million variations of ambient lighting, designed to complement the time of day and the level of light outside, to help the passengers combat the effects of jet lag.Additionally, new product development in the field of aircraft lighting is also driving the growth prospects of the market. For instance, in June 2023, UK-based STG Aerospace announced the launch of the curve, a new flexible cabin lighting product from STG Aerospace's universal lighting family intended for installation onboard the business jets.

Europe Aircraft Lighting Industry Overview

The Europe aircraft lighting market is semi-consolidated in nature. Some prominent players in the market include STG Aerospace Limited, Oxley Group, Safran SA, Honeywell International Inc., Diehl Stiftung & Co. KG. The market is witnessing a high rate of innovations through technology and design development to cater to the comfort needs of air passengers. Players are working with airlines and aircraft manufacturers to develop cost-effective and power-efficient lights that are also lightweight, which will complement and enhance the mood and flying experience of passengers, thereby helping the growth of the players during the forecast period.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.