The outbreak of the COVID-19 pandemic had a significant impact on the banking industry as a whole, and challenger banks in South America are no exception. With social distancing measures in place and people avoiding physical contact, there was a surge in demand for digital banking services. Challenger Banks, which typically offer digital-only banking solutions, were able to capitalize on this trend and attract more customers.

The pandemic caused a severe economic downturn across the globe, and South America was hit particularly hard. This led to increased financial uncertainty and made it more challenging for challenger banks to attract and retain customers. As the pandemic drove more customers towards digital banking, traditional banks also invested heavily in their digital offerings. This increased competition in the market and made it more challenging for challenger banks to differentiate themselves.

Digital banking is expanding across Latin America after getting a major foothold in 2013 in Brazil, home to regional pioneer Nubank. Digital lenders particularly target young, tech-savvy consumers with no qualms about switching between service providers. A central characteristic of these lenders is low entry barriers and low friction levels. Since then, other standalone digital banks, or challenger banks, have arrived on the scene, as well as neobanks - those that operate under the license of an existing player. And that's not to mention the myriad fintech nibbling away at different points on the traditional banking value chain while constantly seeking new sources of revenue and market opportunities.

Chile's prepaid card market is also growing due to the country-wise scenario of challenger banks or neo-banks in South America. Among the newcomers is the local unit of Peru-headquartered financial services giant Credicorp. A company known as B89 is looking to partner with a financial institution, as current regulations require a bank to have a physical presence.

South America Challenger Banks Market Trends

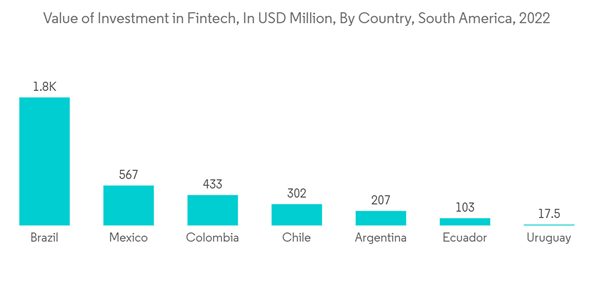

Rising Fintech Investments in South America Fueling the Growth

Challenger Banks are a relatively new phenomenon in South America but are gaining popularity quickly. These banks are primarily digital, providing their services through mobile applications and websites, and they often offer lower fees and better customer service than traditional banks. In recent years, there has been a rise in fintech investments in South America, which has fueled the growth of challenger banks. These investments have allowed these banks to expand their offerings and reach a wider audience. Some of South America's most popular challenger banks include Nubank, Banco Inter, Neon, and C6 Bank.Overall, Challenger Banks are becoming increasingly popular in South America, thanks in part to the rise in fintech investments in the region. These banks provide consumers with more options and better services than traditional banks and are likely to continue to grow in popularity in the coming years.

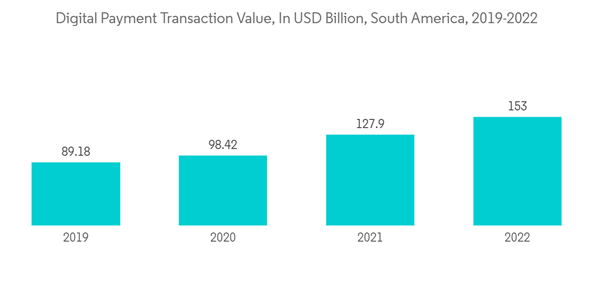

Increasing Demand for Digital Banking Services

Challenger banks in South America are experiencing increasing demand for their digital banking services as more consumers are turning to online banking solutions. This trend has been driven by several factors, including the convenience and accessibility of digital banking services, the lower fees offered by digital banks, and the COVID-19 pandemic, which has accelerated the shift towards online banking. Digital banks offer various financial services, including checking and savings accounts, credit cards, loans, and investment products, all of which can be accessed through mobile apps or websites. This makes it easier for consumers to manage their finances from the comfort of their own homes or on the go.In addition to the convenience factor, digital banks also tend to offer lower fees than traditional banks. This is because they have lower overhead costs, such as rent and salaries for bank tellers, and can pass these savings on to their customers.

Challenger banks in South America, such as Nubank, Banco Inter, Neon, and C6 Bank, are well-positioned to capitalize on this trend toward digital banking. These banks offer user-friendly mobile apps, competitive fees, and a range of financial products and services that appeal to many consumers. Overall, the increasing demand for digital banking services in South America is a positive trend for challenger banks, which will likely continue gaining market share in the coming years.

South America Challenger Banks Industry Overview

The Challenger Banks Market in South America is still relatively new and fragmented, with several digital banks competing for customers in different countries across the region. While there are a few established players, such as Nubank in Brazil and Banco Inter in Brazil, the market is still open for new entrants to gain market share.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.