Mushroom Market Analysis:

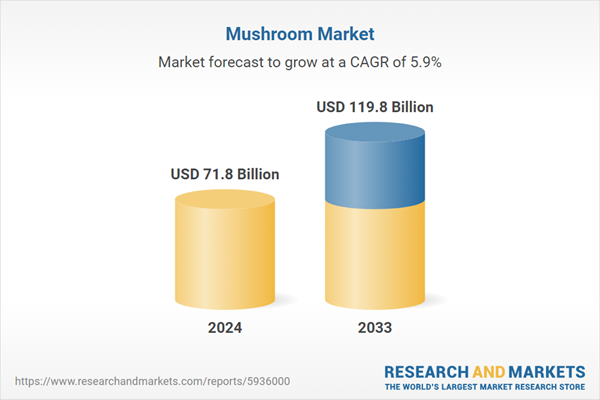

- Market Growth and Size: The global market is experiencing robust growth, driven by factors such as increasing consumer awareness of health benefits, culinary popularity, and expanding applications in pharmaceuticals and nutraceuticals.

- Major Market Drivers: Key drivers growing health consciousness among consumers, coupled with the nutritional benefits of mushrooms, fuels demand.

- Technological Advancements: Key players are investing in advanced cultivation methods and technology to ensure consistent quality, improve efficiency, and meet the rising demand for mushrooms.

- Industry Applications: The product is extensively used in the food processing industry, food service sector, and for direct consumption, showcasing their versatility across various applications.

- Key Market Trends: Sustainability and organic cultivation practices are prominent trends, aligning with consumer preferences for environmentally friendly products. Online stores are witnessing significant growth, reflecting changing consumer shopping habits.

- Geographical Trends: Europe holds the largest market share, driven by traditional culinary preferences and a well-established mushroom cultivation infrastructure.

- Competitive Landscape: Key players are diversifying product portfolios, focusing on sustainability, and engaging in strategic collaborations to strengthen their market positions.

- Challenges and Opportunities: Challenges include susceptibility to pests and diseases, requiring innovative pest management strategies. Opportunities lie in expanding markets, especially in regions with growing health consciousness and a demand for diverse culinary experiences.

- Future Outlook: The market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and the exploration of new applications. Strategic initiatives, including sustainable practices and market expansion, will likely define the industry's future trajectory.

Mushroom Market Trends:

Increasing consumer awareness of health benefits

As health consciousness becomes a pervasive trend, consumers are actively seeking nutritious and functional foods, with mushrooms gaining attention for their myriad health benefits. Mushrooms are a rich source of essential nutrients, including vitamins (such as B vitamins), minerals (like selenium), and dietary fiber. Moreover, certain mushroom varieties exhibit medicinal properties, contributing to immune system support and anti-inflammatory effects. The heightened awareness of these nutritional and health-enhancing qualities has led to a rise in mushroom consumption, positioning them as a staple in the diets of individuals focused on overall well-being.Growing culinary popularity and versatility

The culinary landscape is witnessing a product renaissance due to the fungi's exceptional versatility and ability to elevate flavors across a spectrum of cuisines. With an expanding interest in diverse and international culinary experiences, the product has become a cornerstone ingredient. From classic dishes to innovative recipes, they contribute a unique umami taste and a distinct texture. Their adaptability to various cooking methods and compatibility with both vegetarian and non-vegetarian dishes further solidify them as a culinary favorite, driving sustained demand from chefs, home cooks, and food enthusiasts alike.Expanding application in pharmaceutical and nutraceutical industries

Mushrooms are increasingly recognized for their bioactive compounds, particularly beta-glucans, and antioxidants, which hold promising health benefits. This recognition has led to the integration of them into pharmaceutical and nutraceutical products. Beta-glucans, found in certain product species, exhibit immune-modulating properties, making them valuable in pharmaceutical formulations. Additionally, its' antioxidant content contributes to their role in the nutraceutical sector, where they are incorporated into dietary supplements. Ongoing research exploring the medicinal potential of the product further fuels their demand in these industries, establishing them as essential components in the development of health-promoting products.Mushroom Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on mushroom type, form, distribution channel, and end-use.Breakup by Mushroom Type:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

Button mushroom accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the mushroom type. This includes button mushroom, shiitake mushroom, oyster mushroom, and others. According to the report, button mushroom represented the largest segment.The button mushroom segment stands as the largest in the market, characterized by its widespread cultivation and popularity. Known for its mild flavor and firm texture, the button mushroom appeals to a broad consumer base. This variety finds extensive use in salads, soups, and various culinary applications. Its versatility and relatively lower cost contribute to its dominance in both the commercial and household sectors, making it a staple in many kitchens worldwide.

On the other hand, shiitake mushrooms, with their robust and distinctive flavor profile, represent a premium segment in the market. Recognized for their culinary excellence and potential health benefits, shiitake mushrooms are often utilized in gourmet dishes and traditional Asian cuisine. The growing consumer interest in unique and exotic flavors has driven the demand for shiitake mushrooms, positioning them as a favored choice for chefs and consumers seeking a more adventurous culinary experience.

Furthermore, the oyster mushroom segment is gaining prominence owing to its delicate taste and tender texture. As a versatile culinary ingredient, oyster mushrooms are used in a variety of dishes, including stir-fries and vegetarian alternatives. Health-conscious consumers are drawn to the nutritional content of oyster mushrooms, contributing to the segment's growth. With an expanding market for plant-based and health-focused diets, oyster mushrooms continue to carve a niche for themselves in the market.

Breakup by Form:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

Fresh mushroom holds the largest share of the industry

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh mushroom, canned mushroom, dried mushroom, and others. According to the report, fresh mushroom accounted for the largest market share.The fresh mushroom segment commands the largest share of the market, driven by its immediate culinary appeal and widespread use in diverse recipes. With a high water content, fresh mushrooms offer a crisp texture and natural flavor, making them ideal for salads, sautés, and various dishes. This segment caters to the preferences of consumers who prioritize the sensory experience of cooking with freshly harvested mushrooms, and it remains a cornerstone in both retail and restaurant sectors, reflecting the demand for premium, unprocessed produce.

On the other hand, canned mushrooms represent a convenient and shelf-stable option in the market. This segment appeals to consumers seeking long-lasting storage, ease of use, and availability throughout the year. Canned mushrooms find applications in a range of dishes, from pasta sauces to casseroles, offering a quick and accessible way to incorporate mushrooms into meals. The canned mushroom segment addresses the need for preserved options without compromising the essential flavors and nutritional benefits associated with fresh mushrooms.

Furthermore, the dried mushroom segment is gaining traction as a versatile and concentrated form of this fungi. Drying mushrooms removes water content while intensifying flavors, resulting in a product with a longer shelf life and increased culinary versatility. Dried mushrooms are a popular choice for soups, stews, and sauces, providing a robust umami flavor. Additionally, they cater to the demand for portable and lightweight mushroom options, making them convenient for both home cooks and food manufacturers alike.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

Retail represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, grocery stores, online stores, and others. According to the report, retail represented the largest segment.The supermarkets and hypermarkets segment constitutes a substantial portion of the market, serving as the primary retail channel for consumers. These large-scale retail outlets provide a diverse range of fresh, canned, and dried mushroom varieties, offering consumers a one-stop shop for their culinary needs. The convenience of finding mushrooms alongside other groceries, coupled with the advantage of bulk purchases, contributes to the dominance of this distribution channel. Supermarkets and hypermarkets play a pivotal role in shaping consumer preferences through product visibility, attractive displays, and promotions.

On the other hand, grocery stores form another crucial segment in the market, catering to consumers seeking a more localized and community-oriented shopping experience. These stores, often smaller than hypermarkets, maintain a focus on providing fresh produce, including a variety of mushrooms. Grocery stores are valued for their accessibility and personalized service, allowing consumers to quickly procure fresh mushrooms and explore different varieties.

Furthermore, the online stores segment has witnessed significant growth in recent years, reflecting the evolving consumer landscape and preferences for e-commerce. Online platforms offer a wide array of fresh and packaged mushroom products, providing convenience through doorstep delivery. The online channel's growth is fueled by promotional offers, customer reviews, and the ability to explore and purchase mushroom products from the comfort of one's home, contributing to its increasing prominence in the market.

Breakup by End-Use:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

Direct consumption represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes food processing industry, food service sector, direct consumption, and others. According to the report, direct consumption represented the largest segment.The direct consumption segment stands out as the largest in the market, reflecting the enduring popularity of fresh mushrooms among consumers for home cooking. This segment includes households and individuals who purchase mushrooms for personal use in salads, stir-fries, pizzas, and various homemade dishes. The rising health consciousness and culinary experimentation at the individual level contribute to the sustained demand for fresh mushrooms. Direct consumption captures the essence of the mushroom market, emphasizing the appeal of this versatile ingredient in everyday cooking and consumers' preferences for incorporating fresh mushrooms into their home-cooked meals.

On the other hand, the food processing industry segment in the market is characterized by the integration of mushrooms into various processed food products. Processed mushrooms, including canned, frozen, and dehydrated forms, find applications in soups, sauces, ready meals, and snacks. The food processing industry benefits from the versatility of mushrooms, enhancing the flavor and nutritional profile of products. As consumer demand for convenient and time-saving food options continues to rise, the Food Processing Industry plays a pivotal role in shaping the market by incorporating mushrooms into a diverse range of processed foods.

Furthermore, the food service sector is a significant segment of the market, encompassing restaurants, hotels, and catering services. Mushrooms feature prominently on menus across various cuisines, adding depth and richness to dishes. The sector relies on both fresh and processed mushrooms to meet the demands of discerning consumers seeking diverse culinary experiences. The versatility of mushrooms allows chefs in the sector to craft innovative and appealing dishes, contributing to the growth of this segment as consumers increasingly explore unique flavors in dining out and food delivery experiences.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest mushroom market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.Europe leads the market as the largest segment, driven by a combination of traditional culinary preferences, a strong agricultural sector, and a growing focus on health and wellness. Mushrooms are integral to European cuisines, with varieties like button mushrooms, shiitake, and oyster mushrooms being staples in diverse recipes. The region's consumers appreciate the nutritional benefits of mushrooms, contributing to their prevalence in both traditional and modern European dishes. Additionally, the well-established infrastructure for mushroom cultivation and distribution further solidifies Europe's dominant position in the global mushroom market.

North America represents a significant segment of the market, with a strong consumer base seeking diverse and nutritious food options. The popularity of mushrooms in North America is fueled by a growing interest in plant-based diets, culinary innovation, and awareness of the health benefits associated with mushroom consumption. The region's diverse culinary landscape and the incorporation of mushrooms into various cuisines contribute to their prominence. The cultivation and distribution networks, coupled with a dynamic food culture, position North America as a key player in the global mushroom market.

The Asia Pacific segment is a major contributor to the market, reflecting the integral role of mushrooms in Asian cuisines and traditional medicine. Countries like China, Japan, and India have a rich history of using mushrooms in cooking and for their potential health benefits. The diverse array of mushroom varieties, including shiitake and enoki, adds to the region's culinary richness. As consumer awareness of health and wellness grows, mushrooms continue to be embraced in the Asia Pacific, both in households and as key ingredients in the food industry, contributing significantly to the overall market dynamics.

Latin America is emerging as a notable segment in the global market, driven by changing dietary preferences and an increasing focus on healthy eating. The region's culinary traditions incorporate various mushroom varieties, with a rising demand for both fresh and processed mushrooms. Latin American consumers are exploring the nutritional benefits of mushrooms, leading to their inclusion in a variety of dishes. The agricultural potential of the region also contributes to the growth of mushroom cultivation, positioning Latin America as a promising market within the global landscape.

The Middle East and Africa segment, while relatively smaller in comparison, is witnessing gradual growth in the market. As dietary habits evolve and health consciousness increases in the region, there is a growing interest in incorporating mushrooms into local cuisines. The Middle East, in particular, is experiencing a surge in culinary diversity, with mushrooms finding their way into various dishes. Agricultural initiatives and awareness campaigns further support the expansion of the mushroom market in the Middle East and Africa, contributing to a developing presence in the global marketplace.

Leading Key Players in the Mushroom Industry:

The key players in the market are actively engaged in strategic initiatives to capitalize on the growing demand and emerging trends. Many are focusing on expanding their product portfolios to offer a diverse range of mushroom varieties, addressing the preferences of health-conscious consumers and culinary enthusiasts. Additionally, there is a notable emphasis on sustainable and organic practices in cultivation, aligning with the increasing consumer preference for environmentally friendly and ethically sourced products. Companies are also investing in research and development to explore innovative ways of incorporating mushrooms into new food products and enhancing their functional properties. Market leaders are leveraging technological advancements in cultivation methods to ensure consistent quality and efficient production. Collaborations, mergers, and acquisitions are prevalent strategies among key players to strengthen their market presence, secure supply chains, and expand into new geographic regions, thereby maintaining a competitive edge in the dynamic and evolving mushroom market.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Agro Dutch Industries Ltd.

- Bonduelle Fresh Europe

- Drinkwater Mushrooms Ltd.

- Monaghan Mushrooms Inc.

- Monterey Mushrooms Inc.

- OKECHAMP S.A.

- Shanghai Finc Bio-Tech Inc.

- The Mushroom Company

Key Questions Answered in This Report

1. What was the size of the global mushroom market in 2024?2. What is the expected growth rate of the global mushroom market during 2025-2033?

3. What are the key factors driving the global mushroom market?

4. What has been the impact of COVID-19 on the global mushroom market?

5. What is the breakup of the global mushroom market based on the mushroom type?

6. What is the breakup of the global mushroom market based on the form?

7. What is the breakup of the global mushroom market based on the distribution channel?

8. What is the breakup of the global mushroom market based on the end-use?

9. What are the key regions in the global mushroom market?

10. Who are the key players/companies in the global mushroom market?

Table of Contents

Companies Mentioned

- Agro Dutch Industries Ltd.

- Bonduelle Fresh Europe

- Drinkwater Mushrooms Ltd.

- Monaghan Mushrooms Inc.

- Monterey Mushrooms Inc.

- OKECHAMP S.A.

- Shanghai Finc Bio-Tech Inc.

- The Mushroom Company.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 71.8 Billion |

| Forecasted Market Value ( USD | $ 119.8 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |