Also known as ortho-sulfobenzoic acid imide, saccharin is a synthetic compound that is used as a non-nutritive sweetening agent. It is soluble in water and nearly 200-700 times sweeter than table sugar. It also has a long shelf life and can be consumed after a long period of storage. Although it has a slightly bitter aftertaste, it offers no caloric value and does not get metabolized in the body. Apart from this, it is also considered better for oral health as compared to table sugar as it does not promote tooth decay. On account of these benefits, saccharin is widely utilized in China.

Owing to rapid urbanization, sedentary lifestyles and unhealthy diets, there is a rise in the prevalence of chronic conditions, such as obesity and diabetes, in China. This is resulting in the increasing utilization of low-calorie sugar substitutes like saccharin in the food and beverage (F&B) industry for preparing jams, candies, baked goods, chewing gum, canned fruits, dessert toppings and salad dressings. Apart from this, health-conscious individuals are replacing conventional sugar with saccharin in their diets to limit their calorie consumption. Furthermore, saccharin plays a vital role in the pharmaceutical industry for manufacturing syrup-based medicines.

It is also used as a coating on chewable tablets to provide a sweet taste. In line with this, the burgeoning pharmaceutical industry in the country is further contributing to the market growth. Besides this, the easy availability of raw materials, in confluence with low production costs, is anticipated to propel the market growth in the coming years.

Key Market Segmentation:

The research provides an analysis of the key trends in each segment of the China saccharin market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on product type and application.Breakup by Product Type:

- Sodium

- Insoluble

- Calcium

Breakup by Application:

- Food and Beverages

- Table Top Sweeteners

- Personal Care Products

- Pharmaceuticals

- Others

Competitive Landscape:

The competitive landscape of the market has been analyzed in the report, along with the detailed profiles of the major players operating in the industry. Some of these players are:

- Kaifeng Xinghua Fine Chemical Ltd.

- Shanghai Merry Yang Enterprise Co. Ltd.

- Tianjin North Food Co. Ltd.

- Hangzhou Focus Corporation

- Shaanxi Greenbo Biochem Co. Ltd.

Key Questions Answered in This Report:

- How has the China saccharin market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the China saccharin market?

- Which are the popular product types in the industry?

- What are the key application segments in the industry?

- What are the price trends of saccharin?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the industry and who are the key players?

- What is the degree of competition in the China saccharin market?

- How is saccharin manufactured?

- What are the various unit operations involved in a saccharin manufacturing plant?

- What is the total size of land required for setting up a saccharin manufacturing plant?

- What are the machinery requirements for setting up a saccharin manufacturing plant?

- What are the raw material requirements for setting up a saccharin manufacturing plant?

- What are the packaging requirements for saccharin?

- What are the transportation requirements for saccharin?

- What are the utility requirements for setting up a saccharin manufacturing plant?

- What are the manpower requirements for setting up a saccharin manufacturing plant?

Table of Contents

Companies Mentioned

- Kaifeng Xinghua Fine Chemical Ltd.

- Shanghai Merry Yang Enterprise Co. Ltd.

- Tianjin North Food Co. Ltd.

- Hangzhou Focus Corporation

- Shaanxi Greenbo Biochem Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 118 |

| Published | June 2025 |

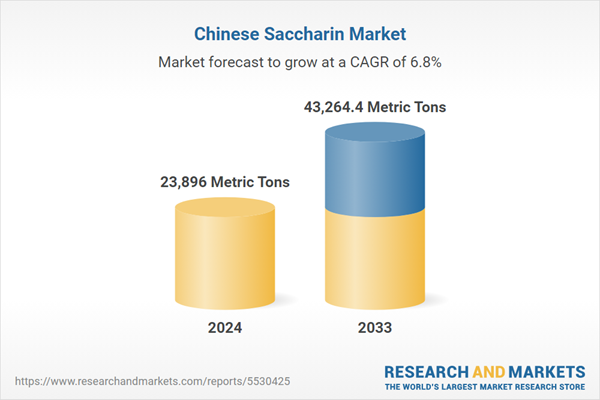

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 23896 Metric Tons |

| Forecasted Market Value by 2033 | 43264.4 Metric Tons |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | China |

| No. of Companies Mentioned | 5 |