Bakery products are food items that are produced and sold by bakeries, establishments specialized in baking and selling baked goods. These products encompass a wide range of items, usually made from flour, sugar, eggs, and other ingredients. Some of the bakery products include bread, cakes, pastries, cookies, muffins, bagels, and croissants. Bakery products are an integral part of various cultures worldwide and have a long history dating back centuries. They cater to diverse tastes and preferences, and their popularity continues to grow due to their delicious flavors and versatility.

The changing lifestyles and evolving dietary preferences are driving consumers toward convenient, ready-to-eat bakery products. In addition, the demand for healthier options, such as whole-grain bread and low-sugar pastries, has increased significantly. Additionally, the rise of urbanization and busy schedules have led to an increased demand for packaged and on-the-go bakery products, catering to the fast-paced lifestyle of consumers. Other than this, consumers are willing to pay more for high-quality and artisanal bakery products. The emphasis on craftsmanship and unique flavors has accelerated the sales of premium bakery items. Besides this, the growth of e-commerce platforms has facilitated the availability of bakery products to consumers, allowing them to order conveniently from their homes. In line with this, consumers’ exposure to different cultures and cuisines through travel and media has led to an increased interest in trying international bakery products, promoting globalization of the market. Furthermore, the rising awareness about health and wellness has spurred the demand for bakery products with natural, organic, and functional ingredients. Moreover, effective marketing strategies and strong branding play a vital role in influencing consumer choices and building brand loyalty in the competitive bakery market. Bakery companies are continually innovating to introduce new flavors, formats, and healthier ingredients. Product diversification helps attract a wider consumer base and keeps the market dynamic.

Bakery Products Market Trends/Drivers:

Shifting Consumer Preferences

Health-conscious consumers are increasingly seeking bakery items that align with their dietary choices and nutritional requirements. There is a growing demand for products made from whole grains, seeds, and other healthier ingredients, as they are perceived to offer better nutritional value. Additionally, there has been a rise in interest for bakery items with reduced sugar content and those catering to specific dietary needs, such as gluten-free, dairy-free, or vegan options.Rapid Urbanization and Busy Lifestyles

With more people living in cities and facing time constraints, there is a growing demand for convenient and easily accessible bakery items. Packaged snacks, grab-and-go products, and single-portion servings have gained popularity as they fit well into the busy routines of urban dwellers. Moreover, the rise of quick-service restaurants and cafes in urban areas has boosted the consumption of bakery products, creating opportunities for market research firms to assess market potential and consumption patterns in different urban centers.Innovation and Product Diversification

Product innovation is a critical factor driving consumer interest and brand loyalty. Companies are experimenting with unique flavors, textures, and shapes to attract and retain customers. Moreover, they are focusing on healthier alternatives that have led to the development of bakery products that incorporate natural ingredients, superfoods, and functional elements, such as probiotics and fortified nutrients.Bakery Products Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global bakery products market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on product type and distribution channel.Breakup by Product Type:

- Biscuits

- Cookies

- Cream Biscuits

- Glucose Biscuits

- Marie Biscuits

- Non-Salt Cracker Biscuits

- Salt Cracker Biscuits

- Milk Biscuits

- Others

- Bread and Rolls

- Artisanal Bakeries

- In-Store Bakeries

- Packaged

- Cakes and Pastries

- Artisanal Bakeries

- In-Store Bakeries

- Packaged

- Rusks

- Artisanal Bakeries

- In-Store Bakeries

- Packaged

Bread and rolls dominate the market

The report has provided a detailed breakup and analysis of the market based on the bread and rolls. This includes biscuits (cookies, cream biscuits, glucose biscuits, Marie biscuits, non-salt cracker biscuits, salt cracker biscuits, milk biscuits, and others), bread and rolls (artisanal bakeries, in-store bakeries, packaged), cakes and pastries (artisanal bakeries, in-store bakeries, and packages), and rusks (artisanal bakeries, in-store bakeries, and packaged). According to the report, bread and rolls represented the largest segment.Bread and rolls are staple food items consumed globally, making them a fundamental part of diets in various cultures. The widespread popularity of these products ensures a consistent and substantial demand, contributing to their dominant market position. Besides this, bread and rolls offer versatility, being suitable for various meal occasions. They can be consumed at breakfast, lunch, dinner, or as snacks, making them a versatile choice for consumers with diverse dietary habits and preferences. Additionally, bread and rolls are known for their convenience and long shelf life. Their extended freshness and ease of storage make them a preferred choice for consumers seeking products with extended usability. Moreover, the bakery industry's focus on product innovation and the introduction of healthier variants has also played a pivotal role in sustaining the popularity of bread and rolls. The availability of whole-grain, multigrain, and artisanal options has attracted health-conscious consumers, further driving the segment's growth. In line with this, the relatively affordable price range of bread and rolls compared to some other bakery products makes them accessible to a broader consumer base, contributing to their market dominance.

Breakup by Distribution Channel:

- Convenience Stores

- Supermarkets and Hypermarkets

- Independent Retailers

- Artisanal Bakeries

- Online Stores

- Others

Supermarkets and hypermarkets hold the largest share in the market

A detailed breakup and analysis of the market based on the supermarkets and hypermarkets has also been provided in the report. This includes convenience stores, supermarkets and hypermarkets, independent retailers, artisanal bakeries, online stores, others. According to the report, supermarkets and hypermarkets accounted for the largest market share.Supermarkets and hypermarkets offer a one-stop shopping experience for consumers, providing a wide assortment of products, including bakery items, under a single roof. This convenience attracts a significant number of shoppers seeking to fulfill their grocery and bakery needs in a single visit. Besides this, supermarkets and hypermarkets have extensive and well-established distribution networks. They often have multiple outlets, covering urban and suburban areas, which ensures widespread accessibility for consumers. Their large-scale operations and efficient supply chains enable them to reach a broader customer base, contributing to their dominant market position. Moreover, supermarkets and hypermarkets typically offer competitive pricing and promotions, making them attractive to cost-conscious consumers. Their ability to offer discounts and bundle deals enhances customer loyalty and fosters repeat business. Additionally, these retail formats invest in strategic marketing and merchandising to enhance product visibility and create a pleasant shopping experience. They use appealing displays and promotional activities to drive sales of bakery products and other items.

Breakup by Region:

- Asia-Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Europe exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, Europe was the largest market for bakery products.Bread has been a staple food in European diets for centuries, deeply ingrained in the culinary traditions of various European countries. This cultural preference for bread consumption has led to a consistent and substantial demand for bakery products across the region. Additionally, Europe boasts a diverse range of traditional bakery specialties, such as croissants from France, pastries from Austria, and pretzels from Germany. These unique and iconic bakery offerings have gained popularity not only within Europe but also internationally, further contributing to the region's dominant market position. Other than this, Europe's strong emphasis on quality and craftsmanship in bakery production has earned it a reputation for producing high-quality bakery products. The use of premium ingredients and artisanal techniques has attracted discerning consumers seeking authentic and delicious bakery experiences. In line with this, Europe's well-developed bakery industry is characterized by a competitive landscape with numerous established players and bakeries of all sizes, catering to various consumer segments. This vibrant and competitive market environment fosters continuous innovation and product diversification, keeping the bakery products market dynamic and responsive to evolving consumer preferences.

Competitive Landscape:

Leading bakery companies invest significantly in research and development to introduce new and innovative bakery products. They focus on meeting evolving consumer preferences, such as healthier options, gluten-free products, and organic ingredients. Product diversification helps them attract a broader consumer base and stay ahead of competitors. Additionally, key players understand the importance of effective branding and marketing to create a strong market presence. They invest in advertising campaigns, digital marketing, and social media promotions to enhance brand visibility and consumer engagement. Effective branding also helps build trust and loyalty among consumers. Besides this, global bakery giants often expand their market reach by entering new regions or acquiring local bakery businesses. This strategy enables them to leverage established distribution networks and gain a foothold in emerging markets. Other than this, various key players are increasingly adopting sustainable practices in their operations. They focus on reducing their carbon footprint, implementing eco-friendly packaging, and sourcing ingredients responsibly. Besides this, the growing awareness among consumers about environmental issues has made sustainability a key differentiator in the bakery market. Moreover, strategic collaborations with suppliers, retailers, and foodservice establishments help key players extend their product distribution and reach a wider audience. Partnerships with other food and beverage companies can lead to cross-promotional opportunities and product bundling.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Grupo Bimbo S.A.B de C.V.

- Yamazaki Baking Co., Ltd.

- JAB Holding Company

- ARYZTA AG

- Flowers Foods, Inc.

- Rich Products Corporation

- Dr. August Oetker Nahrungsmittel KG

- Gruma, S.A.B. de C.V.

- General Mills, Inc.

- Associated British Foods (ABF) Plc

Recent Developments:

Flowers Food Inc. made a significant announcement to introduce four new products under its popular brands, namely Nature's Own, Tastykake, and Wonder. The inclusion of these new bread and snacking options showcases their commitment to innovation and meeting the diverse preferences of consumers.Baked by Rich Products Incorporation and Nestlé Professional entered into a partnership, which resulted in the creation of three enticing candy-inspired cookie variants. This partnership showcases the innovation and creativity of both companies in the culinary domain, combining their expertise to deliver unique and delightful offerings to the market.

Gruma S.A.B., de C.V. launched Maseca Antojitos, a brand-new corn flour specially designed for crafting a diverse range of delectable Mexican snacks, including sopes, gorditas, quesadillas, tlacoyos, and huaraches. This innovative flour is a significant inclusion in Maseca's robust portfolio in Mexico, aligning perfectly with the ever-changing market dynamics, where consumers continuously seek new choices that cater to their unique preferences and lifestyles.

Key Questions Answered in This Report

1. How big is the bakery market?2. What is the expected growth rate of the market during 2025-2033?

3. What are the key factors driving the market?

4. What has been the impact of COVID-19 on the bakery products industry across the globe?

5. What is the breakup of the market based on the product type?

6. What is the breakup of the market based on the distribution channel?

7. What are the key regions in the global bakery products market?

8. Who are the key players/companies in the global bakery products industry?

Table of Contents

Companies Mentioned

- Grupo Bimbo S.A.B de C.V.

- Yamazaki Baking Co. Ltd.

- JAB Holding Company

- ARYZTA AG

- Flowers Foods Inc.

- Rich Products Corporation

- Dr. August Oetker Nahrungsmittel KG

- Gruma

- S.A.B. de C.V.

- General Mills Inc.

- Associated British Foods (ABF) Plc etc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | January 2025 |

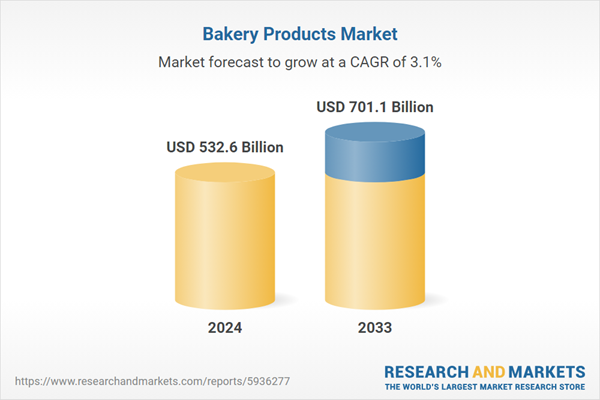

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 532.6 Billion |

| Forecasted Market Value ( USD | $ 701.1 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |