Batter and Breader Premixes Market Analysis:

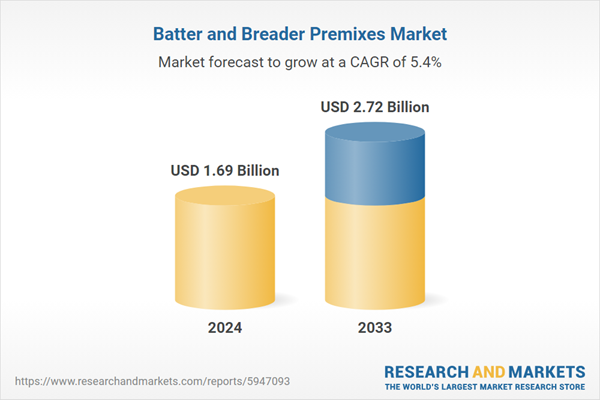

- Market Growth and Size: The market is witnessing stable growth, driven by the rising product demand in the processed food sector and quick-service restaurants (QSRs), and the increasing consumer preferences for convenience foods and diverse culinary experiences.

- Major Market Drivers: Key drivers influencing the market growth include increasing product utilization in the processed food industry, product innovation and diversification, popularity of quick-service restaurants (QSRs), rapid technological advancements in food processing, and the ongoing shift towards healthier eating habits.

- Key Market Trends: The key market trends involve the ongoing shift towards the incorporation of healthier, organic, and gluten-free options in batter and breader premixes. Additionally, the rising demand for ethnic and exotic flavors, as manufacturers constantly innovate to meet diverse taste preferences, is bolstering the market growth.

- Geographical Trends: North America leads the market due to its strong fast-food culture and high consumption of processed foods. Other regions are also showing significant growth, fueled by changing lifestyle patterns and the integration of Western and traditional Asian cuisines.

- Competitive Landscape: The market is characterized by the active involvement of key players who are engaged in strategic expansions, research and development (R&D), and mergers and acquisitions to enhance market presence and cater to regional tastes. Furthermore, companies are focusing on sustainable practices and cleaner production processes, aligning with consumer demand for environmentally responsible products.

- Challenges and Opportunities: The market faces various challenges, such as meeting diverse regional taste preferences, adhering to health and safety regulations, and managing the environmental impact of production. However, rapid innovations in health-oriented product lines and rising technological advancements to improve product quality and production efficiency are creating new opportunities for the market growth.

Batter and Breader Premixes Market Trends:

Growing product demand in the processed food industry

The rising demand for batter and breader premixes in the processed food industry is providing a thrust to the market growth. Additionally, the increasing consumer preference for convenience foods, including ready-to-cook (RTC) and ready-to-eat (RTE) products, owing to changing consumer lifestyles, is strengthening the market growth. Moreover, the rising utilization of batter and breader premixes as an essential component in the preparation of many convenient foods due to their desirable textures and flavors is acting as a growth-inducing factor. In line with this, the widespread product application in coating and preparing fried foods, such as chicken, fish, vegetables, and seafood, is positively impacting the market growth. Furthermore, the evolving consumer taste preferences towards exotic and varied flavors in processed foods, driving innovation and variety in batter and breader premixes, are contributing to the market growth.Rapid innovation and product diversification

The rising innovation and diversification of products as manufacturers experiment with new ingredients and combinations to enhance flavor, texture, and nutritional value is anticipated to drive the market growth. In line with this, the introduction of gluten-free, multigrain, and fortified premixes that cater to the growing health-conscious consumer base is propelling the market growth. Additionally, the widespread incorporation of spices, herbs, and other flavor enhancers in the premixes to meet the demand for ethnic and exotic tastes is bolstering the market growth. Along with this, the rising focus on customization and regional taste preferences in terms of flavor, texture, color, and nutritional content is offering remunerative growth opportunities for the market.Rising popularity of quick service restaurants (QSRs)

The rising proliferation of quick-service restaurants (QSRs) across the globe that extensively utilize batter and breader premixes for a variety of menu items is creating a positive outlook for the market growth. In confluence with this, the increasing demand for consistent quality and taste in premixes to maintain brand standards is providing a thrust to the market growth. Besides this, the rapid expansion of international and local QSR chains, leading to the heightened consumption of premixes, is driving the market growth. Along with this, the introduction of new flavors and dishes in restaurants, leading to the demand for innovative batter and breader premixes, is bolstering the market growth. Furthermore, the increasing competitive nature of the QSR industry, necessitating the need for constant menu innovation, is supporting the market growth. In line with this, the heightened collaborations between premix manufacturers and restaurant chains to develop unique and proprietary products are fueling the market growth.

Growing technological advancements in food processing

The introduction of modern processing technologies that allow for longer shelf life, consistent quality, and ease of use of batter and breader premixes is favoring the market growth. Moreover, the development of advanced packaging solutions that preserve the freshness and quality of premixes is contributing to the market growth. In addition to this, the rising incorporation of automation in food processing, leading to increased efficiency and scale of production for premixed products, is fostering the market growth. Along with this, rapid innovations in mixing and coating technologies that ensure a more uniform application of premixes, leading to better texture and flavor consistency in the final product, are catalyzing the market growth. Additionally, the increasing advancements in food science, enabling the reduction of harmful ingredients like trans fats are supporting the market growth.Ongoing shift towards healthier eating habits

The sudden shift towards healthier eating habits, as consumers become aware of the nutritional content of their food, is providing an impetus to the market growth. Moreover, the rising production of batter and breader premixes with low-fat, low-carb, high-fiber, and organic variants is positively impacting the market growth. In addition to this, the widespread integration of whole grains, multigrain, and other nutrient-rich ingredients into the premixes is broadening the market growth. Besides this, the rising product innovation in line with nutritional guidelines and dietary recommendations that include reduced sodium content, utilization of natural or organic ingredients, and incorporation of superfoods for added health benefits is catalyzing the market growth. Furthermore, the growing focus on transparency and clean labeling, encouraging manufacturers to reformulate existing products and be more transparent about their production processes and supply chains, is fueling the market growth.Batter and Breader Premixes Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on batter type, breader type, and application.Breakup by Batter Type:

- Adhesion Batters

- Coating Batters

- Others

Adhesion batters account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the batter type. This includes adhesion batters, coating batters, and others. According to the report, adhesion batters represented the largest segment.Adhesion batters hold the largest market share as they are designed to adhere to the crumbs or breading of the product, creating a binding layer that ensures the coating stays intact during cooking. They contain various ingredients like starches, flours, and gums, which enhance their stickiness and binding properties. Moreover, the widespread utilization of adhesion batters in various food products, such as meats, seafood, vegetables, and cheese, is boosting the market growth. Along with this, the versatility of adhesion batters, as they can be customized with different flavors, spices, and nutritional enhancements to meet diverse consumer preferences, is contributing to the market growth.

Coating batters are more viscous and applied as the outermost layer in the coating process. They include light, crispy, thick, and crunchy variations, depending on their composition and the desired end-product texture. Furthermore, coating batters contain ingredients like flour, cornstarch, and seasonings and can be customized with various flavors and spices.

Breakup by Breader Type:

- American-Style Bread Crumbs

- Panko

- Flour Breaders

- Others

American-style bread crumbs holds the largest share in the industry

A detailed breakup and analysis of the market based on the breader type have also been provided in the report. This includes American-style bread crumbs, panko, flour breaders, and others. According to the report, American-style bread crumbs accounted for the largest market share.American-style bread crumbs represent the largest share of the market, underlining their widespread use in various culinary applications. They are characterized by their fine texture and consistent quality and are employed in various applications, such as coating fried foods like chicken, fish, and vegetables. Moreover, the widespread product popularity due to their ability to provide a uniform, golden-brown finish, and a satisfying crunchy texture is bolstering the market growth. Along with this, the widespread versatility of American-style bread crumbs, as they can be seasoned with various herbs and spices to complement different dishes, is fostering the market growth.

Panko is known for its light, airy, and flaky texture, which provides a crispier and crunchier coating than traditional bread crumbs. It is utilized in dishes where a delicate and crisp texture is desired, such as tempura or breaded seafood. Moreover, the rising popularity of Asian cuisine across the globe, coupled with the growing interest in culinary diversity, is providing an impetus to the market growth.

Flour breaders are utilized due to their binding properties and subtle texturing capabilities. They are made from finely ground flour and are used as a base coat before applying heavier coatings. Flour breaders are essential in achieving an even and adherent coating, especially in deep-fried food items. Moreover, they are preferred for their simplicity and ability to blend well with various seasonings and spices.

Breakup by Application:

- Meat

- Fish and Seafood

- Poultry

- Vegetables

Meat represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes meat, fish and seafood, poultry, and vegetables. According to the report, meat represented the largest segment.Meat represents the largest segment due to the changing consumption patterns across the globe that favor meat as a primary source of protein. Batter and breader premixes are extensively used in preparing various meat dishes, including beef, pork, and lamb, to enhance flavor, texture, and appearance. Moreover, the increasing versatility of the premixes that allow for a range of culinary techniques, such as frying and baking, is boosting the market growth. Additionally, rapid innovations in meat batter and breader premixes that focus on enhancing the sensory attributes of meat products, such as introducing gluten-free or low-carb options, are providing a thrust to the market growth.

Fish and seafood utilize batter and breader premixes to provide unique textures and flavor enhancements to aquatic products. Batters and breaders are critical in preparing popular dishes like fish fillets, shrimp, and calamari, to offer a crispy exterior while preserving the delicate, moist interior of the seafood. Moreover, the versatility of batter and breader types, which allowed for customization according to the type of seafood and desired culinary style, is favoring the market growth.

Poultry includes chicken, turkey, and other birds. Batters and breaders are essential in creating popular dishes like fried chicken, chicken nuggets, and breaded turkey cutlets. Moreover, the increasing need to achieve the perfect balance of a crispy exterior with a juicy interior, prompting the adoption of premixes, is supporting the market growth.

The increasing preference for plant-based diets and vegetarian options is boosting the market growth. Batter and breader premixes are utilized to enhance the appeal of vegetables, making them more palatable, especially as snacks or appetizers. Moreover, they are employed in breaded and fried vegetables like zucchini, mushrooms, and cauliflower.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest batter and breader premixes market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America represents the largest market share due to the region's strong fast-food culture and high consumption of processed and convenience foods. Moreover, the vast network of quick-service restaurants (QSRs) and high demand for meat and poultry products, which extensively use batter and breader premixes, is bolstering the market growth. Additionally, rapid innovation in food products, including the development of healthier and more diverse premix options to cater to the growing health-conscious and multicultural population, is stimulating the market growth. Along with this, the presence of major food processing companies and a robust retail sector is catalyzing the market growth.

The Asia Pacific region's market for batter and breader premixes is growing, driven by changing lifestyle patterns, urbanization, and the increasing popularity of Western-style fast food alongside traditional Asian cuisines. Moreover, the rising demand for batter and breader premixes in the preparation of seafood and vegetable-based dishes is favoring the market growth. Additionally, the escalating middle-class population and burgeoning disposable income in the region are also strengthening the market growth.

Europe has shown significant growth in the market due to its diverse culinary landscape and a strong focus on quality and tradition in food preparation. Besides this, the rising preference for gourmet and artisanal food products, which extends to the use of high-quality batter and breader premixes in various cuisines, is strengthening the market growth.

The Latin American market for batter and breader premixes is evolving, influenced by the region's rich culinary heritage and the increasing influence of global food trends. Moreover, the increasing preference for bold and spicy flavors, boosting the demand for batter and breader premixes used in local cuisines, is propelling the market growth.

The Middle East and Africa (MEA) region is growing due to changing dietary patterns and increasing urbanization. Additionally, the growing preference for meat and poultry products, which are often prepared with unique regional flavors and spices in batter and breader premixes, is propelling the market growth.

Leading Key Players in the Batter and Breader Premixes Industry:

The major leaders in the market are engaging in multiple strategic initiatives to strengthen their market position and cater to evolving consumer preferences. They are investing in research and development (R&D) to innovate and diversify their product portfolios, introducing healthier, more versatile, and region-specific options. Moreover, some companies are focusing on the development of gluten-free, organic, and reduced-sodium premixes in response to the rising health consciousness among consumers. In addition to this, the major players are expanding their global footprint through various partnerships, mergers, and acquisitions with local companies to reach a wider audience.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Archer-Daniels-Midland Company

- Blendex Company

- Bowmans Milling Limited (Solina Group SAS)

- Breading & Coating Ltd

- Bunge North America Inc. (Bunge Limited)

- House-Autry Mills Inc.

- Ingredion Incorporated

- Kerry Group plc

- Newly Weds Foods Inc.

- Prima Limited

- Pt. Sriboga Raturaya

- Showa Sangyo Co. Ltd.

- Thai Nisshin Technomic Co. Ltd.

Key Questions Answered in This Report

1. What was the size of the global batter and breader premixes market in 2024?2. What is the expected growth rate of the global batter and breader premixes market during 2025-2033?

3. What are the key factors driving the global batter and breader premixes market?

4. What has been the impact of COVID-19 on the global batter and breader premixes market?

5. What is the breakup of the global batter and breader premixes market based on the batter type?

6. What is the breakup of the global batter and breader premixes market based on the breader type?

7. What is the breakup of the global batter and breader premixes market based on the application?

8. What are the key regions in the global batter and breader premixes market?

9. Who are the key players/companies in the global batter and breader premixes market?

Table of Contents

Companies Mentioned

- Archer-Daniels-Midland Company

- Blendex Company

- Bowmans Milling Limited (Solina Group SAS)

- Breading & Coating Ltd

- Bunge North America Inc. (Bunge Limited)

- House-Autry Mills Inc.

- Ingredion Incorporated

- Kerry Group plc

- Newly Weds Foods Inc.

- Prima Limited

- Pt. Sriboga Raturaya

- Showa Sangyo Co. Ltd.

- Thai Nisshin Technomic Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.69 Billion |

| Forecasted Market Value ( USD | $ 2.72 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |