Full-year 2021 capex likely to exceed target of $167B; outlook for 2022 data center spend remains strong but reliance on carrier-neutral facilities will grow

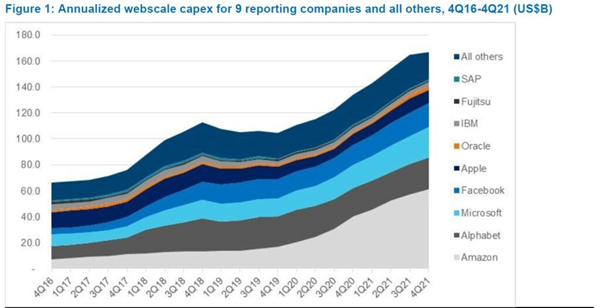

Preliminary fourth quarter earnings results from the webscale segment of network operators (WNOs) indicates a continued strong appetite for data center and cloud investment. Companies reporting to date include Alphabet (Google), Amazon, Apple, Meta (Facebook), Fujitsu, IBM, Microsoft, Oracle, and SAP. For these 9 webscalers, CY2021 capex totaled $146B, up an astounding 32% YoY. Capex in 4Q21 for the same group was up 20% YoY. Amazon and Microsoft, the leading cloud providers, drove growth in both 4Q21 and 2021 overall. These preliminary results for 4Q21 are consistent with the publisher’s forecast of $167.1B capex in 2021 for the webscale sector (up from $134.4B in 2020). Webscalers’ network spending outlook for 2022 is positive overall, driven by Meta (Facebook) and Alphabet (Google). Amazon’s total capex in 2022 is unlikely to rise but the network/IT component will be more prevalent. That’s due to Amazon’s continued expansion of its AWS regions to support the ongoing growth of this business, whose revenues grew 40% YoY in 4Q21 to $17.8 billion.

As cloud providers compete on footprint, and all webscalers deploy more complex functionality into their networks (video, gaming, AI, metaverse), webscale capex should remain strong. However, webscalers do have some financial pressures, and more important have an increasingly rich range of options for how they expand. The carrier-neutral segment (CNNO) of data center players is investing heavily in larger, more hyperscale-friendly and energy efficient facilities. Further, the sector is consolidating with help from private equity. the publisher expects webscalers to continue to lean heavily on these third-parties for expansion in 2022 and beyond. As a result, data center CNNOs like Digital Realty, Equinix and its JV partners, QTS/Blackstone, CyrusOne/KKR/GIP, American Tower/CoreSite, and GDS will become more attractive to vendors as they invest more in network technology of their own.

Table of Contents

- Summary

- Webscalers rising as telcos stagnate

- 4Q21 results: fear of webscale slowdown seem overblown

- 2022 outlook and rise of carrier-neutral providers

- About

Tables & Figures

Table 1: Capex results for 9 reporting webscalers, 4Q21 and CY2021

Figure 1: Annualized webscale capex for 9 reporting companies and all others, 4Q16-4Q21 (US$B)

Companies Mentioned

- Alibaba

- Alphabet (Google)

- Amazon (AWS)

- American Tower

- Apple

- Baidu

- Blackstone Inc.

- Brookfield Infrastructure

- ByteDance (TikTok)

- Carlyle Group

- Ciena

- CloudHQ (Cloud Capital)

- COPT

- CoreSite Realty Trust

- CyrusOne

- Digital 9 Infrastructure

- Digital Edge

- Digital Realty

- DigitalBridge

- Equinix

- Fujitsu

- Gaw Capital Partners

- GDS Data Centers

- GIP

- Hotwire

- Huawei

- I Squared Capital

- IBM

- Involtad

- IPI Partners

- KKR

- Macquarie Infrastructure

- Mapletree Investment Trust

- Meta (Facebook)

- Microsoft (Azure)

- Oracle

- Phoenix Tower

- Princeton Digital Group

- QTS

- Samsung

- SAP

- Tencent