High treatment expenses, inadequate insurance, and lack of know-how may also prevent sufferers’ capacity to get hold of better oncology treatments in China. China is a number one among many pharmaceutical agencies because of its large population, changing demographics, rapid financial improvement, and evolving healthcare machine. According to the PRC State Food and Drugs Administration (SFDA), China’s pharmaceutical enterprise has improved more than 20 percent annually in the ultimate 5 years, and the trend is expected to keep growing.

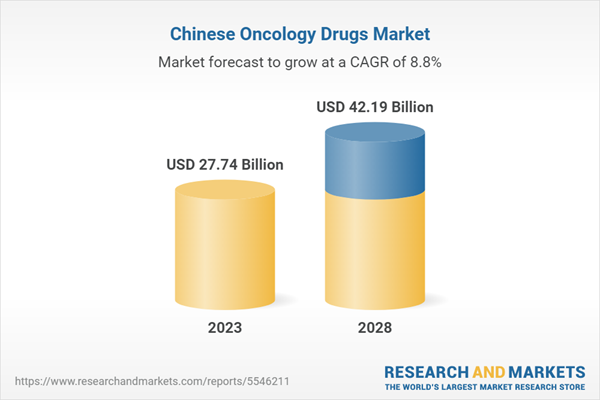

China Oncology Drugs Market is increasing at a CAGR of 8.75% for the duration of 2022-2028

Notably, colorectal, prostate and breast cancers are on the rise. Lung cancer, largely attributed to smoking, is now the leading cause of cancer-related fatalities. The Chinese government has implemented various strategies to combat cancer and its risk factors, achieving significant milestones while grappling with ongoing challenges. The ambitious Health China 2030 initiative presents a promising outlook for cancer control in the country, emphasizing the need for collaborative efforts across sectors to reduce the cancer burden through primary and secondary prevention measures.In 2022, there were about 4,820,000 new oncology instances and 3,210,000 Oncology deaths in China. Oncology is the second leading motive of demise globally, claiming the lives of 9.6 million human beings yearly. Each year, approx. 2.3 Million Oncology deaths are pronounced in China, making Oncology liable for approximately 1 of 5th of all-purpose deaths within the China.

China the world’s second most populous country has made strides in fitness promotion in the last few decades. With the increasing older populace, the burden of cancers continues to develop in China. Changes in hazard components for cancers, especially eating regimen, obesity, diabetes, and air pollutants, increase the chances of cancer transition in China. The rising number of colorectal, prostate, and breast cancers is also significant. Lung cancer became the pinnacle cause of cancers-related deaths, and smoking was the important contributor to cancers deaths.

The Chinese authorities have taken numerous procedures to manipulate cancers and cancer-associated hazard factors. Many achievements were made, however some challenges stay. Health China 2030 is ambitious and depicts a vibrant vision of the future for cancer management in China. Decreased cancers burden in China would require cross-sector collaboration and coordinated primary and secondary prevention efforts through governments, public health industries, and individuals.

A collection of country wide guidelines launched by means of the Chinese government in the next years, which include 'Healthy China 2030' in 2016, 'China Medium-and-Long Term Plan for Prevention and Control of Chronic Diseases (2017-2025)' in 2017, and 'Healthy China Act (2019-2030)' in 2019, promoted Oncology prevention and manipulate, reduction in Oncology mortality rate, and improvement of five-year Oncology survival charges as vital dreams for unique durations. After 2025 can be an essential year for relevant evaluation of the plans. As a result, China Oncology Drugs Market turned into worth US$ 27.74 Billion in 2023.

According to drugs class type, the centered remedy segment occupies the biggest Oncology drugs market in China

By Therapy, China Oncology Drugs Market is divided into Chemotherapy, Targeted Therapy, Immunotherapy (Biologic Therapy) and Hormonal Therapy. China Oncology drugs market has visible centered therapy upward push to dominance, in the main because of its precision in focused on oncology-precise molecular or genetic abnormalities. This technique minimizes harm to wholesome cells, enhancing effectiveness and lowering facet effects. China healthcare providers and patients have eagerly followed those improvements, spurring demand. China's huge populace and growing Oncology cases amplify the demand for powerful remedies, making precision medicine the desired amongst oncologists. Moreover, collaborative efforts between pharmaceutical agencies and educational establishments, coupled with ongoing research and improvement, have fueled the growth of this drugs segment.Breast Oncology leads China Drugs Market Growth

By Indication, China Oncology Drugs Market is split into Blood Oncology, Breast Oncology, Gastrointestinal Oncology, Prostate Oncology, Lung Oncology, Skin Oncology, Ovarian Oncology, Cervical Oncology, Kidney Oncology and Other Oncology. Breast oncology is the hastily growing segment in the China's Oncology drugs market. This growth can be attributed to several elements which include converting existence and environmental elements, leading to improved demand for powerful treatment.Moreover improvements in research and diagnostics have raised recognition and pushed demand for breast oncology capsules and pharmaceutical companies are bringing innovative cures tailored to breast oncology, enhancing outcomes and lowering facet effects, similarly boosting market growth. Besides, due to improved healthcare infrastructure breast oncology treatments are more broadly available, contributing notably to this segment's rapid growth.

NSAIDs related treatment is becoming necessary in management of cancer patients in China

By Drugss, China Oncology Drugs Market is split into ESAs (Erythropoiesis Stimulating Agents), G-CSFs (Granulocyte-colony Stimulating Factors), Anti-emetics, Bisphosphonates, Opioids and NSAIDs & Others. NSAIDs (Nonsteroidal Anti-Inflammatory Drugss) and other rising remedies are poised to dominate ChinaOncology drugs market, securing the highest market proportion. This trend can be attributed to their potential for bothOncology prevention and symptom management.NSAIDs, traditionally known for ache remedy and infection control, are being explored for his or her anti oncology properties. Additionally, novel treatments like immunotherapy and targeted capsules are gaining momentum, providing more personalized and powerful remedy options. This shift signifies a dynamic panorama in China Oncology drugs market, reflecting a growing attention on revolutionary procedures and a broader commitment to preventing oncology comprehensively.

Key Players

Bristol Myers Squibb, Merck, Eli Lilly, Sino BioPharma, F Hoffmann-La Roche AG, Johnson & Johnson, AbbVie Inc., AstraZeneca p.C are the main company running in China Oncology Drugs Industry.In March 2023, AstraZeneca blood oncology drugs, Calquence, secured provisional clearance in China. The National Medical Products Administration (NMPA) granted conditional approval for treating mantle cell lymphoma (MCL) in adults who previously underwent remedy. Calquence, a present day selective Bruton's tyrosine kinase (BTK) inhibitor, marked its debut in China below AstraZeneca's banner. The pharmaceutical giant referred to that in addition approval can also rely on the outcomes of ongoing randomized controlled trials.

In March 2023, the Chinese National Medical Products Administration (NMPA) granted approval for Nubeqa (darolutamide), an oral androgen receptor inhibitor (ARi), to be used in mixture with docetaxel for treating sufferers with metastatic hormone-touchy prostate Oncology. Nubeqa become previously authorized in China for non-metastatic castration-resistant prostate Oncology patients at high danger of growing metastatic disorder.

The report titled “China Oncology Drugss Market, by Therapy (Chemotherapy, Targeted Therapy, Immunotherapy (Biologic Therapy) and Hormonal Therapy), Indication (Blood Oncology, Breast Oncology, Gastrointestinal Oncology, Prostate Oncology, Lung Oncology, Skin Oncology, Ovarian Oncology, Cervical Oncology, Kidney Oncology and Other Oncology), Drugss (ESAs (Erythropoiesis Stimulating Agents), G-CSFs (Granulocyte-colony Stimulating Factors), Anti-emetics, Bisphosphonates, Opioids and NSAIDs & Others. NSAIDs (Nonsteroidal Anti-Inflammatory Drugss) and other), Companies (Bristol Myers Squibb, Merck, Eli Lilly, Sino BioPharma, F Hoffmann-La Roche AG, Johnson & Johnson, AbbVie Inc., AstraZeneca plc)” provides a complete analysis of China Oncology Drugs Market.

Therapy - Market have been covered from 4 viewpoints:

1. Chemotherapy2. Targeted Therapy

3. Immunotherapy (Biologic Therapy)

4. Hormonal Therapy

Indication - Market have been covered from 10 viewpoints:

1. Blood Oncology2. Breast Oncology

3. Gastrointestinal Oncology

4. Prostate Oncology

5. Lung Oncology

6. Skin Oncology

7. Ovarian Oncology

8. Cervical Oncology

9. Kidney Oncology

10. Other Oncology

Drugs - Market have been covered from 6 viewpoints:

1. ESAs (Erythropoiesis Stimulating Agents)2. G-CSFs (Granulocyte-colony Stimulating Factors)

3. Anti-emetics

4. Bisphosphonates

5. Opioids

6. NSAIDs & Others

Company Insights:

- Overview

- Recent Development

- Revenue

Company Analysis:

1. Bristol Myers Squibb2. Merck

3. Eli Lilly

4. Sino BioPharma

5. F Hoffmann-La Roche AG

6. Johnson & Johnson

7. AbbVie Inc.

8. AstraZeneca plc

Table of Contents

Companies Mentioned

- Bristol Myers Squibb

- Merck

- Eli Lilly

- Sino BioPharma

- F Hoffmann-La Roche AG

- Johnson & Johnson

- AbbVie Inc.

- AstraZeneca plc

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 27.74 Billion |

| Forecasted Market Value ( USD | $ 42.19 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | China |

| No. of Companies Mentioned | 8 |