Spirits, in the context of beverages, refer to a category of alcoholic drinks that have been distilled to achieve a high alcohol content, typically exceeding 20%. This distillation process involves the fermentation of grain, fruit, or vegetable matter followed by the purification of the resulting liquid through heating and cooling. This results in a potent drink, with the essence of the initial ingredients often distilled into a purer form. In addition, spirits are often used as a base in cocktail recipes.

It's crucial to note that while they offer unique flavors and textures, their high alcohol content requires they be consumed responsibly. Please note, this explanation is strictly related to spirits in the context of alcoholic beverages, the term 'spirits' can have different meanings in other contexts. Some of the commonly consumed spirits include vodka, gin, rum, tequila, whiskey, and brandy, each varying in their base ingredients and aging process.

Tanzania's thriving tourism sector is another influential driver for the spirits industry. The country's rich natural heritage, wildlife, and coastal areas attract millions of tourists each year. This influx of international visitors has led to the growth of the hospitality sector, including hotels, resorts, and restaurants, which, in turn, has fueled demand for various types of spirits. Along with this, the development of the hospitality sector has created a sustainable market for both local and international spirits, offering a promising avenue for further growth and diversification within the industry.

In addition, the rapid growth of online sales platforms and home delivery services has made it easier for consumers to access a wide variety of spirits without needing to visit physical stores. The convenience of online shopping and the ability to explore a vast array of products from the comfort of home has contributed to a rise in demand for spirits.

Apart from this, new technologies in manufacturing, packaging, and distribution allowing businesses to optimize their operations, improve the quality of their products, and reach a wider consumer base are contributing to the market. Moreover, advancements in packaging technology enabling companies to preserve and present their products more attractively is creating a positive market outlook.

Tanzania Spirits Market Trends/Drivers:

Rising Middle-Class Population and Disposable Income

In Tanzania, the expanding middle class has led to an increase in disposable income. This trend is fostering a change in consumption patterns, particularly among younger generations, who are now more inclined to explore new and diverse alcoholic beverages, including spirits. As the economic landscape continues to grow, so does the demand for higher-quality spirits, which were previously considered luxury item.Along with this, the purchasing power of the middle class has made international brands more accessible, and local manufacturers have responded by upgrading their offerings to meet this new standard. The overall increase in spending capacity has had a substantial impact on the spirits industry, encouraging innovation, increasing competition, and broadening the market's reach.

Evolving Urban Lifestyle and Cultural Influence

The urbanization of Tanzania is another major driver for the spirits industry. As cities and urban areas grow, there is a natural blending of cultures, with international influences becoming more prominent. This has led to a broadening of tastes and preferences, with city dwellers showing a greater interest in trying different types of spirits, both locally produced and imported. Nightlife culture, bars, and restaurants have also grown, creating new opportunities for the spirits industry. In confluence with this, the integration of spirits into social gatherings, celebrations, and leisure activities is shaping consumer behavior, making it a driving force in the industry's growth.Tanzania Spirits Industry Segmentation:

The research provides an analysis of the key trends in each segment of the Tanzania spirits market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on product type and distribution channel.Breakup by Product Type:

- Whiskey

- Vodka

- Gin

- Brandy

- Rum

- Other.

Whiskey represents the most widely used type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes whiskey, vodka, gin, brandy, rum, and others. According to the report, whiskey represented the largest segment.The Tanzania spirits industry, particularly the whiskey segment, is largely influenced by several market drivers. A key catalyst for growth is the increasing adult population with a growing middle class, who are adopting Western drinking habits and are willing to experiment with premium spirits. In addition, the rising trend of cocktail culture in urban areas largely involves vodka as a base spirit. This, coupled with the rise in nightlife and entertainment venues, has heightened the demand for whiskey. Moreover, improvements in distribution channels, including the rise of online platforms and home delivery services, have made access to a diverse range of whiskey brands easier, thus contributing to its popularity.

On the other hand, the gin segment within Tanzania's spirits industry is experiencing a growth influenced by the expanding consumer preference for diverse and unique flavor profiles, and gin, with its various botanical infusions. Along with this, the rising cocktail culture, particularly in urban cities, also contributes significantly to gin's popularity, as it is often a key ingredient in many mixed drinks. In confluence with this, the growing segment of health-conscious consumers is favoring gin due to its relatively low-calorie content compared to other spirits. Additionally, advancements in distribution networks, through digital platforms, have increased the accessibility of a wide variety of gin brands, thus stimulating demand.

Breakup by Distribution Channel:

- On-Trade

- Off-Trade

- Specialty Retailers

- Supermarkets and Hypermarkets

- Online

- Other.

On-trade represents the most widely used distribution channel

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes on-trade and off-trade (specialty retailers, supermarkets and hypermarkets, online and others). According to the report, the commercial segment accounted for the largest market share.On-trade distribution channels in the Tanzania spirits industry, which involve direct sales to customers in bars, restaurants, and other hospitality venues, are driven by multiple market factors. A primary driver is the increasing consumer propensity towards socializing and dining out, coupled with the growth of urbanization and a vibrant nightlife scene.

In addition, the rising trend of experiential consumption where customers enjoy tastings and cocktail mixology sessions is stimulating on-trade spirit sales. The hospitality industry's strategic promotional activities, such as happy hours and themed events, also play a crucial role in enhancing customer engagement and driving sales. Moreover, the improved economic conditions and increasing disposable incomes have allowed consumers to spend more on premium spirits in on-trade establishments.

On the contrary, the off-trade distribution channels in the Tanzania spirits industry, which include supermarkets, hypermarkets, and liquor stores, are driven by the growing demand for at-home consumption of spirits, a trend further boosted by health crises that limit outdoor social activities. Additionally, the rise in digital platforms and e-commerce websites providing home delivery services has widened customer access to a broad spectrum of brands and products, fueling off-trade sales. Another factor is the increase in consumer purchasing power, leading to a higher demand for premium and imported spirits available in off-trade outlets. Also, the strategic pricing and discount offers by off-trade retailers play an essential role in attracting cost-conscious consumers.

Competitive Landscape:

The key players in the market are diversifying their product portfolios to cater to different consumer preferences. This included offering a wide range of spirits such as vodka, whiskey, rum, gin, and liqueurs. To stand out in a competitive market, companies were investing in marketing and branding efforts, such as advertising campaigns, social media promotions, and sponsorships of events and activities. Along with this, the implementation of stringent quality control measures to maintain consumer trust and meet regulatory standards is also positively influencing the market.In addition, manufacturers are continuously working to improve logistics and partnerships with retailers and wholesalers, which is acting as another growth-inducing factor. Apart from this, the widespread adoption of locally-sourced ingredients to produce their spirits, emphasizing sustainability and supporting local communities is contributing to the market. Furthermore, key players are investing in market research and consumer insights to understand trends, preferences, and demand patterns, creating a positive market outlook.

The report has provided a comprehensive analysis of the competitive landscape in the Tanzania spirits market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Anheuser-Busch InBev

- East Africa Spirits (T) Limited (EASTL)

- Edward Snell & Co. Ltd.

- HEINEKEN Beverages

- La Martiniquaise

- Pernod Ricard

- Serengeti Breweries Limited (East African Breweries Limited)

- William Grant & Son.

Key Questions Answered in This Report:

- How has the Tanzania spirits market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the Tanzania spirits market?

- What is the impact of each driver, restraint, and opportunity on the Tanzania spirits market?

- What is the breakup of the market based on the category?

- Which is the most attractive category in the Tanzania spirits market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the Tanzania spirits market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the Tanzania spirits market?

- What is the breakup of the market based on imports and domestic manufacturing?

- What is the competitive structure of the Tanzania spirits market?

- Who are the key players/companies in the Tanzania spirits market?

Table of Contents

Companies Mentioned

- Anheuser-Busch InBev

- East Africa Spirits (T) Limited (EASTL)

- Edward Snell & Co. Ltd.

- HEINEKEN Beverages

- La Martiniquaise

- Pernod Ricard

- Serengeti Breweries Limited (East African Breweries Limited)

- William Grant & Sons

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | June 2025 |

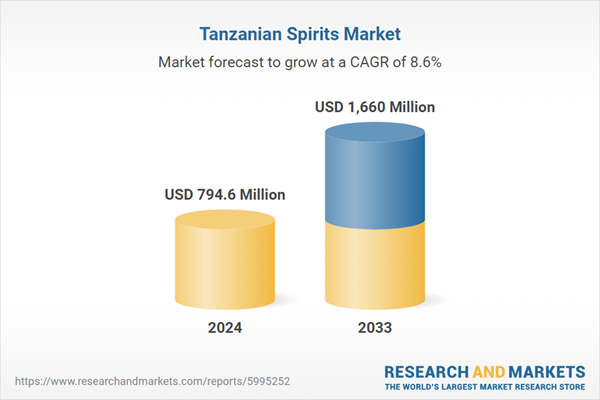

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 794.6 Million |

| Forecasted Market Value ( USD | $ 1660 Million |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Tanzania |

| No. of Companies Mentioned | 8 |